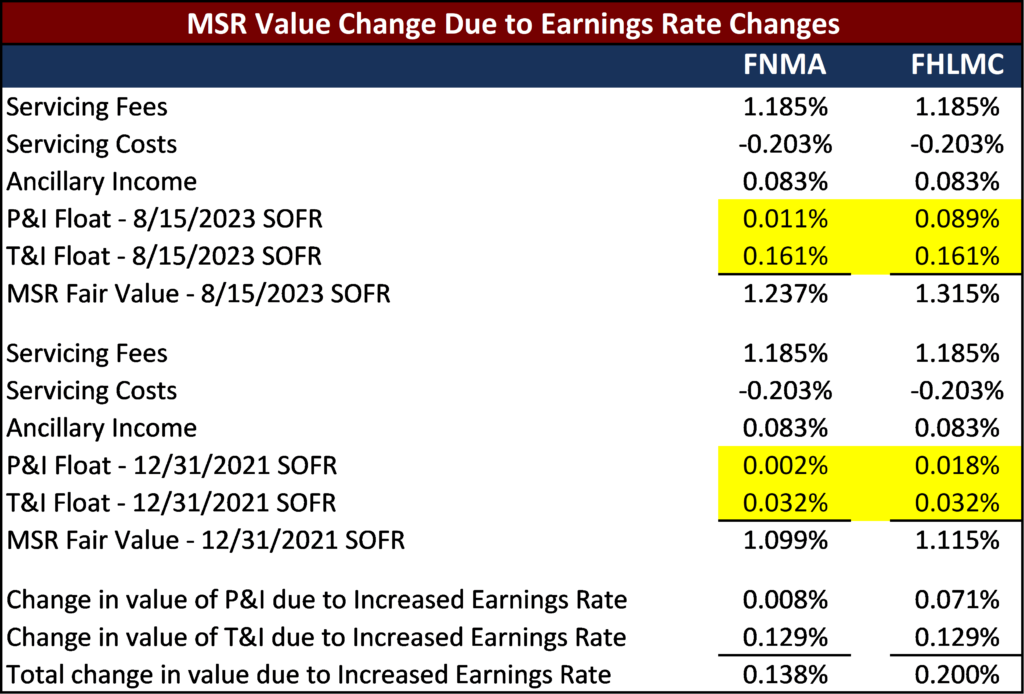

The increase in mortgage rates that occurred in 2022 led to a significant increase in the value of mortgage servicing rights (“MSRs”). The decline in assumed prepayment speeds drove most of the increase in MSR value, but a lesser-known driver of increased MSR value relates to earnings from float income due to substantially higher earnings rates. Interest income from float arises from two sources. The larger component comes from loans that are escrowed (impounded) for property taxes and hazard insurance. The servicer collects the escrow payment monthly, disburses the insurance annually, and disburses the property taxes quarterly, semi-annually, or annually depending on the jurisdiction. A minor source of float comes from the principal and interest payments. Most payments come in before or near the first-of-the-month due date. Under certain investor programs, the servicer remits these payments later. Wilary Winn uses the forward SOFR curve as the float earnings rate for principal and interest payments and escrow payments. The forward SOFR curve on December 31, 2021, ranged from a low of 0.053% to a high of 1.484%, while the forward SOFR curve on August 31, 2023, ranged from a low of 3.637% to a high of 5.435%. The table below shows the change in value related to float earnings. We used a 30-year fixed rate $200,000 loan that escrows for tax and insurance with a 6.75% interest rate. The values were determined by holding all input assumptions static except for the SOFR curve.

The 20.0 basis point increase in the Freddie Mac loan is higher than the 13.8 basis point increase in the Fannie Mae loan due to the above discussed difference in remittance methodology between the two institutions. We have assumed actual / actual remittance with 1 day of float for both P&I payments and prepayments for the FNMA loan, compared to scheduled / actual remittance with 12 days of float P&I payments and 5 days of float on prepayments for the FHLMC loan. In the current environment we are seeing very little decrease in assumed prepayment speeds should interest rates continue to rise. If the rising interest rate environment continues, the main driver of MSR fair values moving forward will be the increased value generated from float earnings. At the same time, we must also consider the increased risks associated with higher interest rates, including higher required yields for mortgage servicing rights, or an economic recession which could lead to potential defaults or delinquencies. Either would adversely impact MSR values.