CECL Results

With all the ado being made about the CECL implementation – the two most important questions remain:

- How will it actually affect my existing allowance; and

- How can I use the information generated to produce the calculation to better manage my institution?

We have performed more than 50 complete and comprehensive CECL calculations since the final standard was issued in June of 2016. We found that approximately half of the institutions were under-reserved, fifteen percent were adequately reserved, and approximately one-third were over-reserved. We found that when institutions were under-reserved, they were under by approximately 50 percent. The average required CECL amount for all of the institutions we analyzed was 97 basis points compared with an average existing ALLL of 85 basis points. Our CECL loss estimates by institution ranged from 29 to 267 basis points.

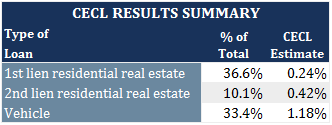

The table below shows the results for selected loan categories.

Nearly half of the loans we analyzed were secured by residential real estate loans and we believe this fact affected the results. Our lifetime credit loss estimate for 1st lien residential real estate loans was 24 basis points. For second lien loans, our estimate was 42 basis points. Our highest loss estimate was for vehicles which in the aggregate totaled 118 basis points. We note the range (not shown) was 56 basis points for new direct to 216 basis points for used indirect.

We believe that the actual results contradict much of the speculation about how CECL will affect financial institutions.

- First and foremost, we found that not all institutions were under-reserved.

- Second, we found that given the recent tight underwriting, low unemployment rate, and forecasted housing appreciation, the reserves necessary for residential real estate loans are lower than those for other loan types despite their longer average lives. Much of the concern over CECL is centered on loans with long lives. This is because the industry recognized that the probable requirement used for calculation of the ALLL today limits the estimate to approximately one year while CECL requires a life-of-loan loss calculation. Many were thus multiplying loss rates by average life to gage the effect CECL would have on their institution. Our actual results perfectly illustrate why this approach does not work and the reasons we use discounted cash models based on current and projected loan and credit attributes at the valuation date versus an incurred loss or vintage analysis.

- Third, we found the loss rates for vehicle loans can vary significantly based on origination channel.

- Fourth, we note that while the ALLL totaled 97 basis points in the CECL base case scenario, we also ran two stress case scenarios based on the performance data we have for the most recent complete business cycle. If the unemployment rate were to return to its late 2009 peak and housing prices downturned similarly to the late 2011 trough, the required ALLL would be 195 basis points. If a repeat of the results were only half as bad, the required ALLL would be 135 basis points. We note that the loan categories most affected by our stress test are below prime residential real estate loans with higher LTVs and subprime vehicle loans. We believe the information we provide to our clients in these scenarios, and other economic scenarios expressly tailored to our clients’ requests, can provide significant insights into potential credit risks and their effect on capital. Using this knowledge, our clients can offer more informed pricing and establish sophisticated concentration risk limits.

- Fifth, we found the calculation varied significantly by institution and forecasted macroeconomic conditions confirming our belief that there is nothing like actually doing the calculation to know how CECL will affect your institution.

For more information regarding how we can help you, please contact us.