Investment Securities

As part of the changes required by Dodd-Frank, effective January 1, financial institutions can no longer rely solely on the rating agencies to assess the risk of the investment securities they own.

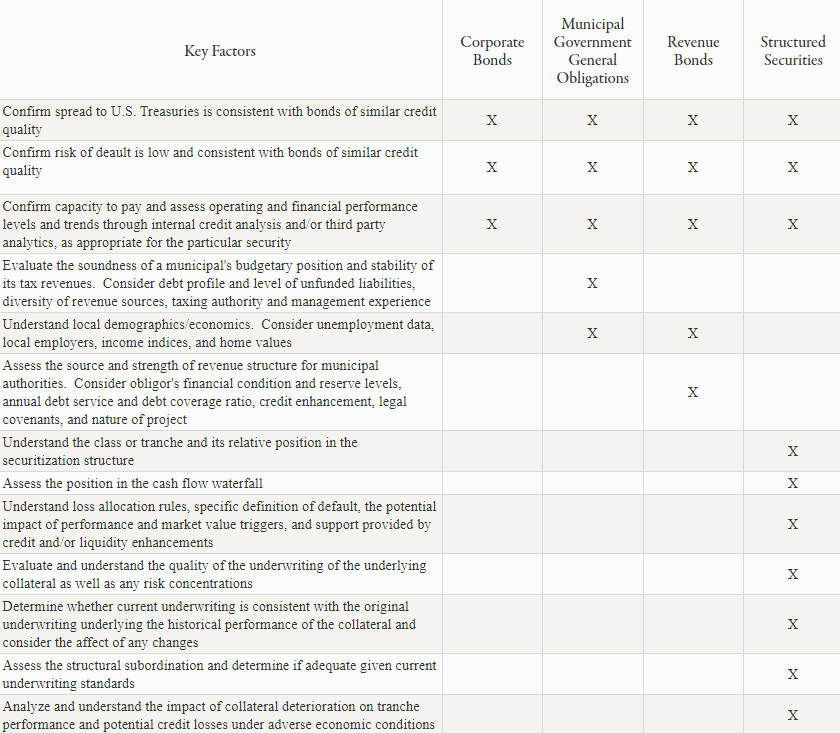

The rating must be supplemented by additional due diligence and analysis, including independent third party reviews. Fortunately, the new regulations provide for a carve out for Type I securities. Type I securities include U.S. Treasuries, U.S. Agencies, and municipal general obligation bonds. For well capitalized institutions, the carve out includes municipal revenue bonds. The table below provides a summary of the key factors to consider for the securities which have to be evaluated. More details can be found in the FDIC’s FIL 48-2012 and 34-2012. OCC guidance is contained in the Federal Register, volume 77, number 114 dated June 13, 2012 on pages 35259-35263. The NCUA adopted similar rules in its Board Meeting of December 6, 2012.

Sources

Federal Register/Vol. 77, No. 114