Mitigating Layered Credit Risk in Auto Lending

Demand for vehicle loans has been increasing as the recovery gains ground.

Vehicle lending trends over the last couple years include an increase in sub-prime lending, higher LTVs at origination, and longer average loan terms. We recommend that lenders consider the interaction between FICO, LTV, and loan term in order to mitigate credit risk.

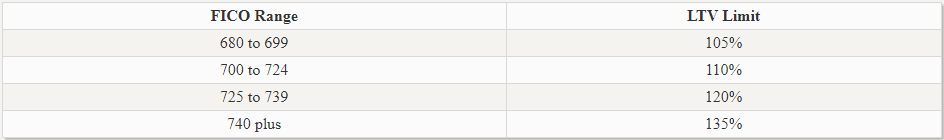

We believe there is a strong correlation between FICO score, LTV and loan performance. To mitigate risk layering, Wilary Winn advises that institutions limit the LTV as FICOs decrease. A recent response by 16 of the largest auto lenders to a proposed regulatory change provides insight. The lenders proposed the following matrix of FICO and LTV for loans to be “qualifying” under the regulatory guidance.

However, based on Experian’s 4th quarter 2012 publication[2], we believe the opposite is occurring in the marketplace. The average LTV on loans with a FICO above 740 was 102%, whereas the LTV on loans with FICOs below 550 was 126%. The LTVs on used vehicle loans in the same FICO ranges were higher still at 121% and 150%, respectively.

Wilary Winn further believes that longer loan terms also increase credit risk. We note that per the same Experian report, the current average term for new vehicle loans is 65 months and for used vehicle loans is 60 months. Furthermore, the loan term segment of 73 to 84 months had the highest year over year growth, with new financing in this segment increasing 19.4% and used financing increasing 11.5%. The average loan term increased in all credit quality categories from 4th quarter 2011 to 4th quarter 2012, and loan terms over 72 months are becoming more common. While vehicle life and dependability have recently increased, loans with initial high LTVs and long terms increase the time period when the borrower has negative equity. According to Standard and Poor’s, the average loss rate on a pool of auto loans with “C” credit quality with a term of 72 months was more than 3 times the loss rate of a pool of loans with the same credit quality and a loan term limit of 60 months[3].

Recent auto loan demand has in part been spurred by the affordability created by longer term loans and relaxed underwriting. We advise lenders to be cautious when weighing the benefit of increased lending with the likelihood of increased future losses. We recommend that lenders consider implementing underwriting standards that mitigate layered credit risk by limiting LTVs and loan terms based on FICO score.

Sources

[1] https://www.sec.gov/comments/s7-14-11/s71411-287.pdf, August 1, 2011

[2] Experian, State of the Automotive Finance Market Fourth Quarter 2012

[3] Standard & Poor’s, Criteria, Structured Finance, ABS: General Methodology And Assumptions for Rating U.S. Auto Loan Securitizations, January 11, 2011