Mortgage Rates Fuel Rise in Mortgage Servicing Right (MSR) Values

The rise in mortgage rates that occurred in 2022 has led to a significant increase in the value of mortgage servicing rights (“MSRs”). However, the increases are not spread evenly across all vintages. The biggest increases were in the very low interest rate loans originated in 2020 and 2021.

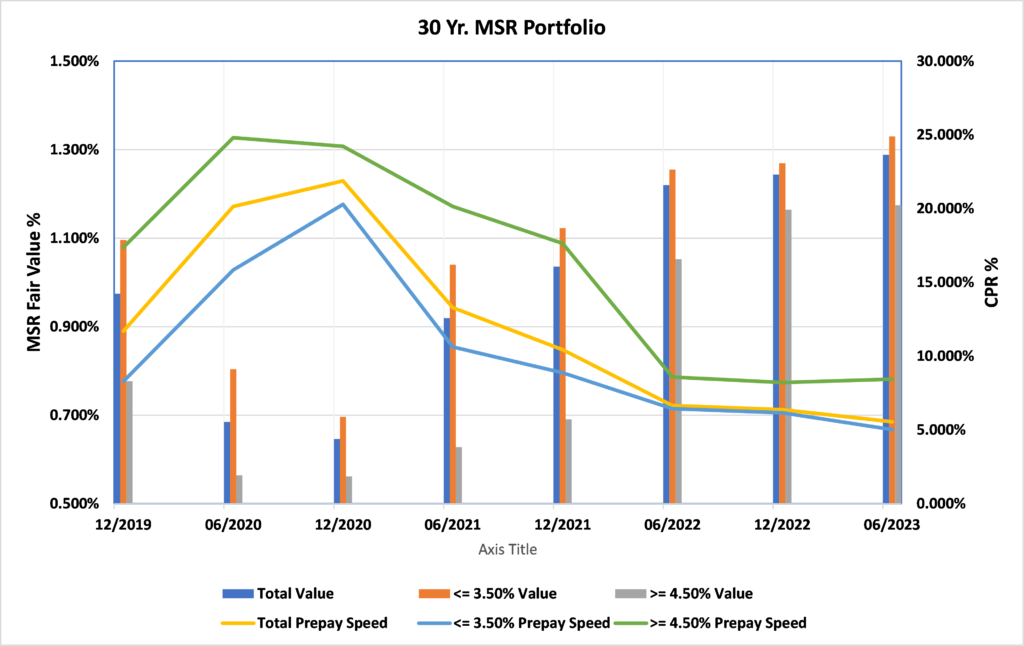

The chart below details the MSR fair values and prepayment speeds for a portfolio of 30-year fixed-rate, conforming conventional residential loans with interest rates less than or equal to 3.50% compared to loans with interest rates greater than or equal to 4.50%. The overall MSR fair values were at their lowest near the end of 2020 and began increasing in the first half of 2021. The change took place first in the 3.50% coupons which continued to rise in value through 2022 and into 2023, increasing from a low of 0.696% in the fourth quarter of 2020 to a high of 1.330% at the end of June 2023.

As interest rates increased in 2022, we saw new originations recommence with rates greater than or equal to 4.50%. These coupons also increased in value but at much more modest levels, rising from 1.053% at the end of June 2022 to 1.174% and the end of June 2023.

The increases in value were driven by the significant decreases in expected prepayments caused by rising interest rates. Although prepayments will never reach zero, 30-year mortgage offering rates are currently above 6.00%. As a result, expected prepayments in lower coupon mortgage loans are extremely low by historical standards. In fact, our interest shock analyses show little decline in prepayment speeds even when we model mortgage rates to rise because the expectations for prepayments are essentially at their floor.

Despite the significant decrease in expected prepayments and the corresponding increases in value of the 2020 and 2021 vintages, we caution institutions against being too aggressive when recording the fair value of MSRs of new loan originations in the current rate environment. These loans are at a much higher risk of prepayment, which could lead to write-downs or impairment if and when mortgage rates decline.