Accounting & Regulatory Reporting for Mortgage Servicing Rights [White Paper]

Key Takeaway

Wilary Winn provides valuations of mortgage servicing rights and turnkey advice on how to properly account for them.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released January 2012

Introduction

Mortgage banking involves relatively sophisticated financial activities, including the creation of derivatives, hedging, and the intricacies of mortgage servicing. As a result, the accounting for these activities is relatively complex. The accounting relates to:

- Interest rate lock commitments

- Forward mortgage loan sales commitments

- Closed loans held for sale

- Mortgage servicing rights

This white paper addresses the accounting and regulatory reporting requirements for mortgage servicing rights. Our companion paper, Accounting & Regulatory Reporting for Mortgage Banking Derivatives, addresses the requirements related to interest rate lock commitments, forward mortgage loans sales commitments and closed loans held for sale.

Mortgage Servicing Rights

The proper accounting and reporting for mortgage servicing assets is set forth in FASB ASC 860-50. FASB ASC paragraph 860-50-25-1 (Transfers and Servicing – Servicing Assets and Liabilities) provides that an entity shall recognize a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in any of the following situations:

- A servicer’s transfer of any of the following, if that meets the requirements for sale accounting – an entire financial asset, a group of entire financial assets, or a participating interest in an entire financial asset, in which circumstance the transferor shall recognize a servicing asset or a servicing liability only related to the participating interest sold.

- An acquisition or assumption of a servicing obligation that does not relate to financial assets of the servicer or its consolidated affiliates.

The institution as loan servicer receives the benefits of the servicing, including the contractually specified servicing fees, a portion of the interest from the financial assets, late charges, and ancillary income, and incurs the costs of servicing the assets.

The benefits of servicing are expected to exceed “adequate compensation”. If they do not, an institution has a servicing liability. Servicing assets and liabilities must be reported separately. The previously issued FASB 140 implementation guide states that, “adequate compensation is determined by the marketplace and is based on the specified servicing fees and other benefits demanded in the marketplace to perform the servicing.

Wilary Winn believes that the fair value of servicing is based in Level 2 inputs. According to FASB ASC paragraph 820-10-35-48 “Level 2″ inputs include the following:

- Quoted prices for similar assets or liabilities in active markets

- Quoted prices for identical assets or liabilities in markets that are not active

- Inputs other than quoted prices that are observable for the asset or liability (for example interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks and default rates)

- Market-corroborated inputs

We believe that the inputs used to value servicing rights are either observable (prepayment speeds, servicing costs, forward curves, default rates, and loss severities) or can be corroborated (discount rates).

The servicing asset is to be initially reported at its fair value. The servicing is to be subsequently measured using one of the following two methods:

- Amortization method: Amortize the servicing asset in proportion to and over the period of estimated net servicing income (level yield method) and assess servicing assets for impairment based on fair value at each reporting date.

- Fair value measurement method: Measure the servicing asset at fair value at each reporting date and report changes in fair value of servicing assets in earnings in the period in which the changes occur.

For more details, see FASB ASC paragraph 860-50-35-1.

While the fair value method is the method preferred by FASB, Wilary Winn recommends that institutions that do not financially hedge their portfolios remain on the amortization method in order to minimize earnings volatility. We note that different elections can be made for different classes of servicing and that an institution may make an irrevocable decision to subsequently measure a class of servicing assets at fair value at the beginning of any fiscal year1.

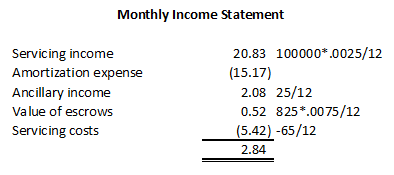

A simplified monthly income statement for the $100,000 loan the month after it is sold follows. The servicing fee is 25 basis points, the ancillary income is $25.00 per year, the value of the float is estimated to be $2.06 (average escrow balance of $825 at .75 percent interest), and the servicing costs are $65 per loan. The servicing asset is being amortized on the level yield methodology.

FASB ASC paragraph 860-50-50- 2 sets forth increased required disclosures for servicing assets and liabilities.

Regardless of the method selected institutions must disclose:

- Management’s basis for determining the classes of servicing assets and liabilities.

- A description of the risks inherent in the servicing assets and liabilities, and if applicable, the instruments used to mitigate the income statement effect of changes in fair value of the servicing assets and liabilities.

- The amount of contractually specified servicing fees, late fees, and ancillary fees earned for each period for which results are presented, including a description of where each item is reported in the statement of income.

- Quantitative and qualitative information about the assumptions used to estimate fair value (for example, discount rates, anticipated credit losses, and prepayment speeds).

Amortization Method

FASB ASC paragraph 860-50-35-9 requires that MSRs be stratified and reported by one or more predominant risk characteristics which include “interest rate, type of loan, loan size, date of origination, term and geographic location”. Institutions should be deliberate in their selection of stratification bands, as a gain in one band cannot be used to offset an impairment loss in another. Moreover, making changes to the bands once they are established is strongly discouraged.

Impairment is best measured at the loan level and is reported at the predominant risk characteristic stratum. There is a difference between temporary impairment, which is accounted for through an allowance, and “other than temporary” and permanent impairment, which require a direct write off. We note that the temporary impairment reserve can be reduced to a floor of zero if market interest rates subsequently increase and the value of the MSRs thus increases as well.

The disclosures required when institutions elect the amortization method are as follows:

- For each class of servicing assets and liabilities, the activity in the balance of the servicing assets and the activity in the balance of the servicing liabilities (including a description of where changes in the carrying amount are reported in the statement of income for each period for which results of operations are presented) including, but not limited to, the following:

- The beginning and ending balances

- Additions (through purchases of servicing assets, assumptions of servicing obligations, and servicing obligations that result from transfers of financial assets)

- Disposals

- Amortization

- Application of valuation allowance to adjust carrying value of servicing assets

- Other-than-temporary impairments

- Other changes that affect the balance and a description of those changes

- For each class of servicing assets and liabilities, the fair value of recognized servicing assets and liabilities at the beginning and end of the period.

- The risk characteristics of the underlying financial assets used to stratify recognized servicing assets for purposes of measuring impairment in accordance with FASB ASC paragraph 860-50-35-9.

- The activity by class in any valuation allowance for impairment of servicing assets – including beginning and ending balances, aggregate additions charged and recoveries credited to operations, and aggregate write-downs charged against the allowance – for each period for which results of operations are presented.

Fair Value Measurement Method

Alternatively, institutions may elect to subsequently measure the servicing asset using the fair value method. Using this method, an institution measures the servicing asset at fair value at each reporting date and reports the changes in the fair value of servicing assets in earnings in the period in which the changes occur.

The disclosures required when institutions elect the fair value method are as follows:

- For each class of servicing assets and liabilities, the activity in the balance of the servicing assets and the activity in the balance of the servicing liabilities (including a description of where changes in the fair value are reported in the statement of income for each period for which results of operations are presented) including, but not limited to, the following:

- The beginning and ending balances

- Additions (through purchases of servicing assets, assumptions of servicing obligations, and servicing obligations that result from transfers of financial assets)

- Disposals

- Changes in fair value during the period resulting from:

- Changes in valuation inputs or assumptions used in the valuation model

- Other changes in fair value and a description of those changes

- Other changes that affect the balance and a description of those changes

Loan Servicing Regulatory Requirements

The banking agencies expect institutions involved in the mortgage-servicing operations to use market-based assumptions that are reasonable and supportable in estimating the fair value of servicing assets2. Financial institutions should compare their estimates of fair value to bulk, flow and daily servicing released prices to ensure that their valuation assumptions are reasonable and consistent with those used in the marketplace.

The Interagency Advisory on Mortgage Banking also indicates that financial institutions should ensure that the following items are addressed.

The advisory requires comprehensive documentation standards for all aspects of mortgage banking, including mortgage-servicing assets. Financial institutions should substantiate and validate the initial carrying amounts assigned to mortgage servicing rights and the underlying valuation assumptions. The validation process should compare actual to predicted performance.

Valuation Models should be based on realistic estimates of adequate compensation, future revenues, prepayment speeds, market servicing costs, mortgage default rates, and discount rates. Fair values should be based upon market prices and market-based valuation assumptions. The agencies encourage institutions to obtain periodic third-party valuations by qualified market professionals to support the fair values of their mortgage servicing rights and to update internal models.

Institutions should compare the actual gross monthly cash flows to modeled cash flows in order to better understand the economic value of their servicing rights.

Changes in valuation assumptions should be reviewed and approved by management and, where appropriate, by the board of directors.

Institutions should ensure that financial models used throughout the company for mortgage servicing including valuation, hedging, and pricing be compared and that differences between the values obtained be identified, supported and reconciled.

There are two more modeling recommendations for financial institutions remaining on the amortization method. Financial Institutions should ensure that:

- Amortization of the cost basis is based on the estimated remaining net servicing income period as adjusted for prepayments; and

- Impairment is recognized timely.

There are also requirements for mortgage banking hedging activities, management information systems, and internal audit.

Regulatory Reporting Requirements

In addition, there are three FFIEC Call Report reporting requirements associated with MSRs:

- The outstanding principal balance of loans sold is to be reported on Schedule RC-S, item 11A, and RC-S, Memoranda, item 2a

- The book value of the retained servicing is reported in RC-M, Memoranda, item 2a

- The estimated fair value of the retained servicing is reported in RC-M, Memoranda, item 2a(1).

The amount of servicing assets that can be included in Tier 1 capital is limited to the lesser of 100 percent of the amount of servicing assets reported, 100 percent of Tier 1 capital or 90 percent of the servicing’s fair value. The amount of “disallowed servicing” is reported on RC-R 9a.

The requirements for the NCUA 5300 are as follows:

- The servicing fees are included in Non-Interest Income – page 5 line 12.

- Loan servicing expenses are included in Non-Interest Expense – page 5 line 24.

- The total amount of first mortgage loans sold into the secondary market year-to-date is reported on Schedule A – line 16.

- The amount of real estate loans sold but serviced by the credit union (dollar amount of loan servicing) is reported on Schedule A – line 18.

- The MSR book value is reported on Schedule A –line 19.