Making the Business Case for the CECL Approach – Part II [White Paper]

Key Takeaway

We provide ALM and CECL solutions that help our clients measure, monitor, and mitigate balance sheet risk on an integrated basis. We consider credit, interest rate, and liquidity risk holistically. We charge a fee for our advice and do not rely on commissions, so we can remain objective. We simply want what is best for our client.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released January 2017

Introduction

This white paper is the second of a three-part series. We believe the implementation of CECL presents financial institutions with the opportunity to better integrate credit risk analysis across the organization. While it is imperative to understand expected life-of-loan credit losses in conjunction with the accounting requirements of CECL, this paper makes the business case that forecasted life-of-loan credit losses can be used to better manage an institution.

Our first white paper in the series demonstrated how life-of-loan credit loss analytics can be used to perform capital stress testing, as well as to evaluate the risks and opportunities of potential business strategies. This companion white paper shows how life-of-loan credit loss estimates can be used to develop quantitative concentration limits.

We believe the best managed institutions measure, monitor, and manage credit, interest rate and liquidity risks on an integrated basis as part of their ongoing ALM process.

As a reminder, effective in 2020 for SEC filers and 2021 for all financial institutions, the CECL standard requires financial institutions to record lifetime expected credit loss estimates for loans, investments held to maturity, net investments in leases and off-balance sheet credit exposures. Wilary Winn LLC (Wilary Winn) believes the implementation of CECL presents financial institutions with the opportunity to better integrate credit risk analysis across the organization. We believe that financial institutions can appreciably enhance their concentration risk management by prospectively considering how credit risk changes as economic conditions change and quantifying the potential effects on its capital. The capital stress test results can be then used to set concentration limits and sub-limits. In short, this white paper provides relevant examples on how to establish best practices with the Concentration Risk Management Policy through the use of lifetime credit loss analysis.

Concentration Risk

Banking regulators pay substantial attention to concentration risk. The Basel Committee on Banking Supervision defines concentration risk as any single exposure or group of exposures with the potential to produce losses large enough (relative to capital, total assets, or overall risk level) to threaten a financial institution’s health or ability to maintain its core operations. The Office of the Comptroller of the Currency (OCC) notes that concentration risk management encompasses the management of pools of exposures, whose collective performance has the potential to affect the financial institution negatively even if each individual transaction within a pool is soundly underwritten. This potentially occurs if exposures in a pool are sensitive to the same economic, financial, or business development that if triggered, may cause the sum of the transactions to perform as if it were a single, large exposure. The OCC further states when financial institutions set higher concentration limits for broadly defined pools – especially where those limits are more than 100 percent of capital – the OCC expects appropriate sub-limits for material groups of segmented exposures. Wilary Winn believes that the credit exposure arising from adverse economic environments should be used to help set the sub-limit amounts. Moreover, the National Credit Union Administration notes in its 2010-03 Supervisory Letter that credit union officials and management have a fiduciary responsibility to identify, measure, monitor and control concentration risk. The larger the concentration level, the more robust and advanced the analysis and risk management techniques should be. Additionally, the letter states that concentration risk must be managed in conjunction with credit, interest rate and liquidity risks. Overall, the message to financial institutions from regulators is consistent – concentration risk needs to be actively measured, monitored and controlled.

Concentration Risk Management Policies can be substantially improved by using lifetime credit loss analyses as required by CECL to develop quantitative concentration limits. The risk limits are created by prospectively considering how credit risk will change as economic conditions change, estimating the effect the expected credit losses would have on capital, and determining how much capital the organization is willing to put at risk in pursuit of returns.

Concentration Risk Management Policy

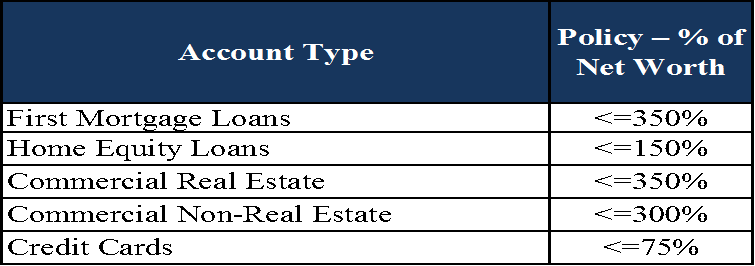

By way of example, the following table shows a Concentration Risk Policy that, in our opinion, is all too often seen.

When we see an actual Concentration Risk Management Policy similar to the previous example our thoughts are that the organization:

- Developed the concentration risk policy by looking at its existing balance sheet;

- Allowed for significant growth in all predominant lending categories; and

- Will make essentially no lending mix adjustments going forward as the limits are set so that the organization will most likely always remain in compliance.

Regulators are often rightly critical of policies developed in the framework described above as many of the concentration loan category limits exceed the entire net worth of the organization. Most regulators will ultimately require the policy to be enhanced with sub-limits for the major loan categories.

Wilary Winn is also critical of this policy example as it is completely silent on credit risk and makes no attempt to measure, manage or mitigate the exposure.

As a result, an organization with a similar policy is potentially at risk. To provide support for our position that quantitative credit risk limits should be included within the Concentration Risk Policy we offer the following example. Let’s assume we have a population of first mortgage loans that equal the example concentration risk limit of 350% of net worth. Let’s further assume that the entire population of these loans have high loan to value (LTV) ratios and subprime credit scores. While our example is admittedly extreme, we note that there is absolutely nothing in the Concentration Risk Policy example to prevent an organization from holding a first mortgage portfolio consisting solely of loans with such weak credit characteristics. If the financial institution encounters adverse economic circumstances, the likely outcome is that the example institution will fail because it has insufficient capital to withstand the expected credit losses arising from holding such risky loans on its balance sheet.

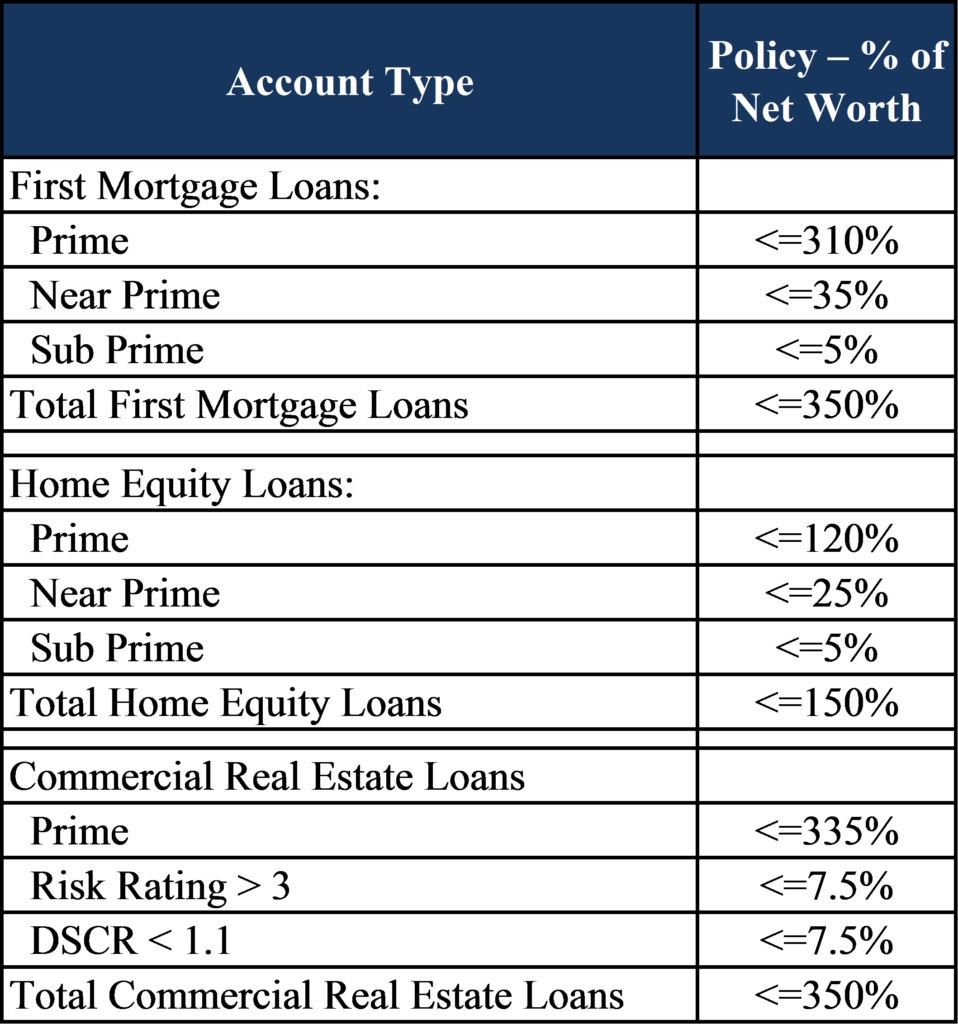

There is absolutely no reason to settle for a Concentration Risk Policy that is silent on credit and potentially puts the organization at risk. Under the requirements of CECL, financial institutions are required to estimate lifetime credit losses for the entire loan portfolio. While various types of models can be used to estimate credit losses, Wilary Winn believes financial institutions will greatly benefit by rejecting “bare bones” approaches and employing the robust discounted cash flows models we described in Part I of this series. We believe the insights and knowledge gained from this comprehensive and integrated CECL calculation process can also be used to develop lifetime credit losses based not just on forecasted economic conditions in accordance with the standard, but also to adverse changes to economic conditions in order to derive capital stress testing results. The calculations require statistical analysis of the past relationship between an economic variable, such as the unemployment rate and the incidence of loan defaults at the cohort level. Once a financial institution has developed lifetime credit losses estimates under multiple economic environments, it is not only able to optimize the composition of its balance sheet, it can also control credit exposure going forward by explicitly setting specific limits for higher risk loan categories within its Concentration Risk Management Policy. Following is an example of a more robust Concentration Risk Policy which Wilary Winn considers to be an example of best practices:

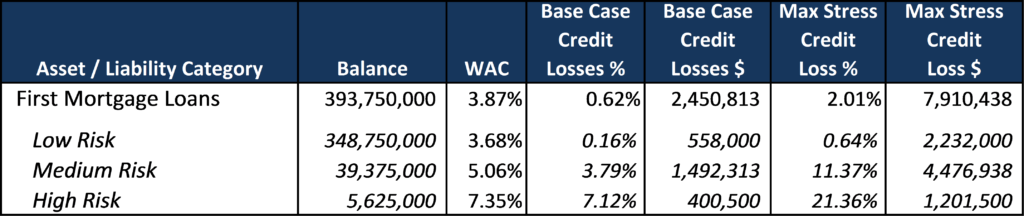

The prime, near prime, and sub-prime limits in this Concentration Risk Management Policy example were developed from iterative analysis of the risk/return trade-off which involved examining the relationship between lifetime credit losses, capital and return. The following example shows how we developed the sub-limits for first mortgage loans. We note that we divided the portfolio in this example into three cohorts – low, medium, and high risk and that each cohort reflects a vastly different credit loss profile.

The table shows the lifetime credit loss exposure for the financial institution’s first mortgage loan portfolio under both a base case economic environment and an economically stressed environment. The purpose of the stress scenario is to measure the adverse impact to capital should a realistic worst case macroeconomic scenario unfold. We believe the goal of a financial institution is to maintain sufficient capital to continue smooth operation of the business even in challenging economic times. In our example, the maximum stress scenario is defined as an economic environment with a 10.2% unemployment rate – the peak national unemployment rate during the Great Recession. Our historical analyses have shown that first mortgage defaults are highly correlated with the unemployment rate. Not surprisingly, lifetime credit losses more than triple on the first mortgage loan portfolio under stressed conditions as lifetime expected credit losses increase from 0.62% to 2.01%. The increase is not linear and the loss rate in near prime category grows from 3.79% in the base scenario to 11.37% in the stress scenario. Even more dramatically, the losses in the high-risk category, which can be considered sub-prime, increase from 7.12% to 21.36%. The analysis shows that the financial institution needs to limit its exposure to near prime and sub-prime credit to ensure its long-term financial health.

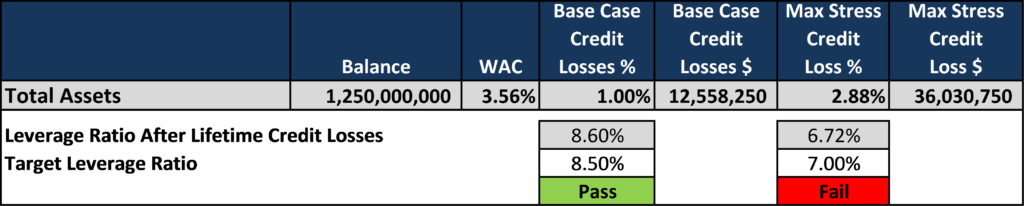

The previous table showed lifetime expected credit loss analysis arising from the first mortgage loan portfolio only. Obviously, the credit loss analysis process must be performed on the entire loan portfolio and for investments with credit loss exposure. The resulting aggregate lifetime credit losses in the base case and economically stressed environment are then deducted from the organization’s capital (pre-credit loss capital) as a measurement of credit loss exposure and compared to targeted capital ratio amounts. An example is shown in the following table:

The previous table highlights aggregate balance sheet lifetime credit losses in both the base case and economically stressed environment. The lifetime credit losses in the base case are 1.00% of total assets and 2.88% in the stress scenario. Deducting aggregate losses from the nominal pre-loss capital value results in a leverage ratio of 8.60% in the base case and a leverage ratio of 6.72% in the stress scenario. The post credit loss leverage ratios are then compared to pre-determined ratio amounts which reflect the financial institution’s predefined risk tolerance. In this example, the leverage ratio resulting from the stress scenario is below the organization’s target level of 7%. As a result, this organization needs to reduce its loan portfolio concentrations in groups with lower credit attributes.

As we can see, credit losses and their impact to capital vary based upon the economic conditions assumed. We used the capital stress test results to limit the amount of exposure the financial institution may have to loans with lower credit attributes given its tolerance for risk.

A financial institution can also optimize its risk/return profile from a model perspective by iteratively adjusting its loan cohorts and estimating potential credit losses under various macroeconomic scenarios. It can then incorporate the analysis results into its Concentration Risk Management Policy in order to measure and manage risk.

By actively monitoring and controlling its exposure to higher risk lending categories, a financial institution can assure itself of long-term business health even if it should encounter adverse economic conditions. As an additional benefit, we believe regulators will view the institution more favorably because it is proactively managing credit risk by including explicit sub-limits in its Concentration Risk Policy for loan groups that contain higher risk.

Conclusion

Financial institutions must become compliant with the required CECL provisions by 2021. However, Wilary Winn believes there are numerous advantages to adopting the CECL approach early. Part 1 of our three-part white paper series on the benefits of CECL implementation clearly demonstrated that the critical examination of credit risk and interest rate risk on an integrated basis through the ALM process can provide a superior method for determining the amount capital to put at risk in pursuit of returns. This paper as part two of our series focused on understanding credit risk exposure in multiple economic environments and its impact on capital in order to establish best practices in Concentration Risk Management policies whereby the most significant credit risk threats to a financial institution’s long-term health are measured, monitored and controlled. Part three of our series will focus on how the CECL approach can be used to optimize risk-based pricing strategies.