Accounting for Bank Acquisitions [White Paper]

Key Takeaway

Wilary Winn offers a complete set of merger-related valuation and accounting services, including determinations of fair value, true-ups of accretion, goodwill impairment testing, and accounting for loans with deteriorated credit quality.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released June 2018

Introduction

Accounting for a bank merger or acquisition begins with determining the fair value of the acquired bank’s equity, assets, and liabilities. Using this information, the acquirer records the acquisition at fair value, including any goodwill, or in rare circumstances, a bargain purchase.

Fair value of equity estimates are based on recent similar transactions, bank stock prices, and the use of discounted cash flow analyses.

Techniques used to estimate the fair value of assets vary by the type of asset. Fair value estimates for loans are derived using discounted cash flow analyses.

Liability fair values are calculated using discounted cash flow analyses. Non-maturity deposits are recorded at par. The related CDI is estimated using a discounted cash flow analysis.

The ongoing accounting involves amortization of purchase discounts, accretion of purchase premiums, and accounting for loans acquired with deteriorated credit quality.

Beginning in 2009, the fair value method must be used to account for business combinations. The accounting is detailed FAS ASC 805 Business Combinations. As of the acquisition date, an acquirer must record the assets, liabilities and equity of the institution it is acquiring at fair value. The valuation must also include potential intangible assets such as the core deposit intangible. The fair value estimates must be made in accordance with the requirements of FAS ASC 820 Fair Value Measurements and Disclosures.

Wilary Winn notes that the business combination accounting rules can apply to a transaction that is not a full acquisition, including branch acquisitions, purchase and assumption agreements, etc.

Determining whether a financial institution has acquired a business or has consummated an asset purchase is a critical first step because:

- Goodwill is recognized in a business combination, but not in an asset acquisition;

- Acquisition costs are generally expensed as incurred by the buyer in a business combination, while the same costs are considered part of the acquisition cost in an asset acquisition; and

- Assets acquired and liabilities assumed in a business combination are measured at fair value, while assets acquired and liabilities assumed in an asset acquisition are measured by allocating the total cost of the net assets based on the fair values of the individual assets acquired and liabilities assumed.

Wilary Winn has performed over 250 merger and acquisition fair value engagements under the new business combination accounting rules. We have provided advice on numerous types of transactions including cash/stock deals, mergers of mutual entities, and FDIC-assisted transactions. Our focus in this white paper is on accounting for business combinations and is designed to share what we have learned along the way and to address the most common questions we encounter. We hope you find it useful. We begin with accounting requirements on Day One – the opening journal entry. We then discuss the rules for Day Two – the ongoing accounting.

Day One Accounting

The first step a bank should take upon acquiring the assets of another financial institution is to determine whether it has acquired a business. We note that under FAS ASC 805, a business combination occurs when a buyer obtains control of a business through a transaction or other event. A “business” includes inputs and processes that are at least capable of producing outputs. However, a business need not include all of the inputs or processes that the seller used in operating the business if market participants are capable of acquiring the business and continuing to produce outputs, for example, by integrating the business with their own inputs and processes1.

When a financial institution enters into a transaction to combine with another entire institution, the result is clearly a business combination. Wilary Winn believes that the acquisition of a bank branch also meets the definition of a business combination because the branch has inputs, processes, and can produce outputs. On the other hand, an acquisition of a loan portfolio would not meet the definition of a business. Determining whether sufficient inputs and processes have been acquired can require considerable judgment and we encourage acquirers to discuss the accounting implications of an acquisition with their external accountants and primary regulators.

Once it has determined it has entered into a business combination, the acquiring bank must undertake several steps to ensure it has the information it needs to properly record the transaction.

It must determine the:

- Fair value of the consideration transferred;

- Fair value of the acquired bank’s financial assets and liabilities;

- Fair value of the acquired banks non-financial assets and liabilities;

- Fair value of any intangible assets – the most common being the core deposit intangible;

- Fair value of the tradename; and

- Amount of goodwill/bargain purchase gain resulting from the transaction.

Fair Value of the Consideration Transferred

Wilary Winn employs three basic approaches to determine the fair value of the consideration provided to the seller – income, guideline transaction and market.

Income Approach

The income approach determines the value of a business or business ownership interest using one or more methods that convert anticipated benefits into a present single amount. The application of the income approach establishes value by methods that discount or capitalize earnings and/or cash flow, by a discount or capitalization rate that reflects market rate of return expectations, market conditions, and the relative risk of the investment. To determine the estimated value of the entity using an income approach, business appraisers generally first estimate the organization’s probable future cash flows. They then discount the cash flows back to the valuation date at an appropriate discount rate. However, Wilary Winn believes that the use of future cash flows is not a reliable indicator of value for financial institutions because items like capital expenditures, working capital, and debt are not clearly defined. As a result, to ensure comparability, we base our analysis on future earnings.

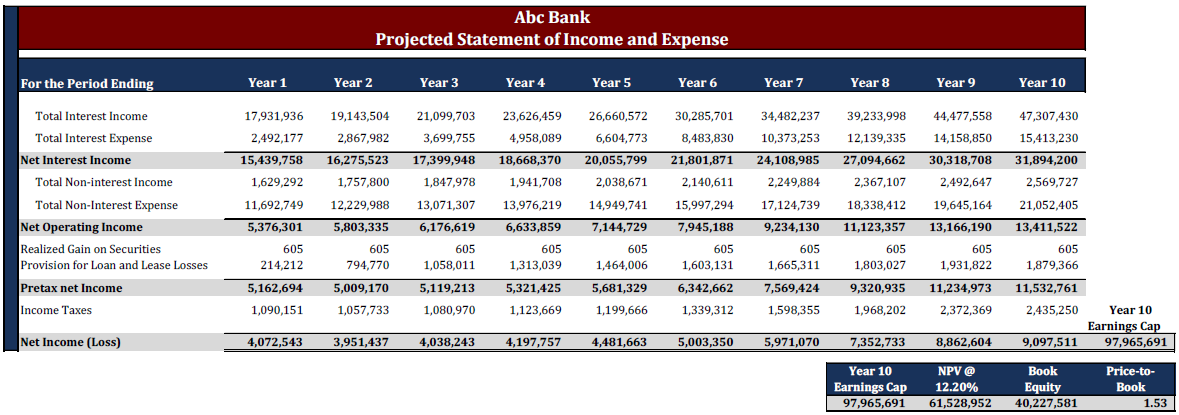

To determine the estimated value of the entity using an income approach, Wilary Winn estimates future earnings by developing ten-year pro-forma balance sheets and income statements using a fundamental analysis. We then develop an estimate for the entity’s lifetime earnings – “the residual” using a Gordon growth model. We discount the resulting estimated cash flows back to the valuation date at a discount rate determined through the use of a Capital Asset Pricing Model (“CAPM”) approach. See below for an example.

In the example above, using a final year growth rate of 2.15% we calculated a residual value of the acquired bank of $98.0M. After discounting the estimated 10 years of earnings and the residual back to the valuation date at a rate of 12.20%, we derive a total value of $61.5M or 1.53 times the acquired bank’s book value of $40.2M.

Guideline Transaction Approach

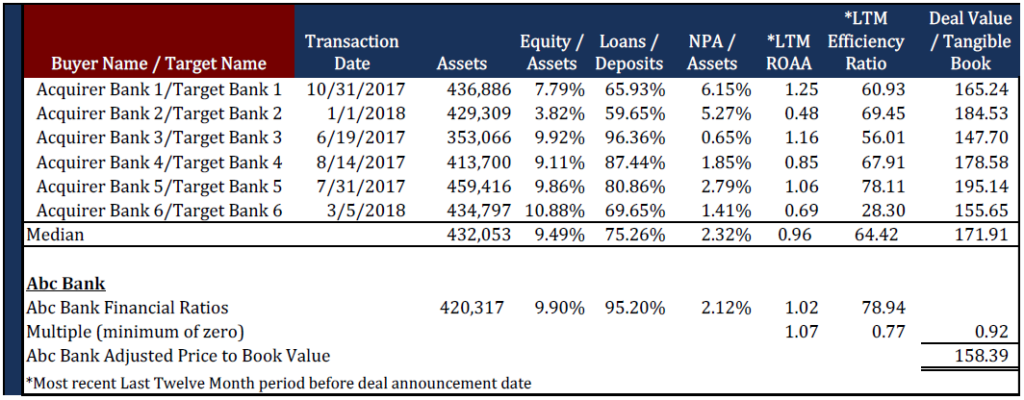

Under the guideline transaction approach, business appraisers seek to identify actual transactions of similar businesses sold. When using this approach, Wilary Winn obtains transaction information, including price-to-tangible book value, for recent acquisitions of banks with similar business operations, profitability, and size located in similar geographic areas to the acquirer. To calculate an adjusted market price to book value, we use the median price-to-tangible book value from our pool of deal results and adjust for differences in profitability.

In the example below, we derived a median deal value to tangible book ratio of 171.91. We then adjust the bank’s specific performance to the industry by increasing the ROAA multiple from 0.96 to 1.07 (1.02 divided by 0.96). We adjust for efficiency similarly. We derive an average deal value to tangible book ratio of 0.92 which is the simple average of the ROAA multiple of 1.07 and the efficiency multiple of 0.77. Finally, we derive an adjusted deal value to tangible book ratio of 158.39 by multiplying the 0.92 by the industry deal value to tangible book ratio of 171.91. Finally, we multiply the adjusted deal value to tangible book ratio by the acquired bank’s capital, resulting in an enterprise value of $63.7M.

Market Value Approach

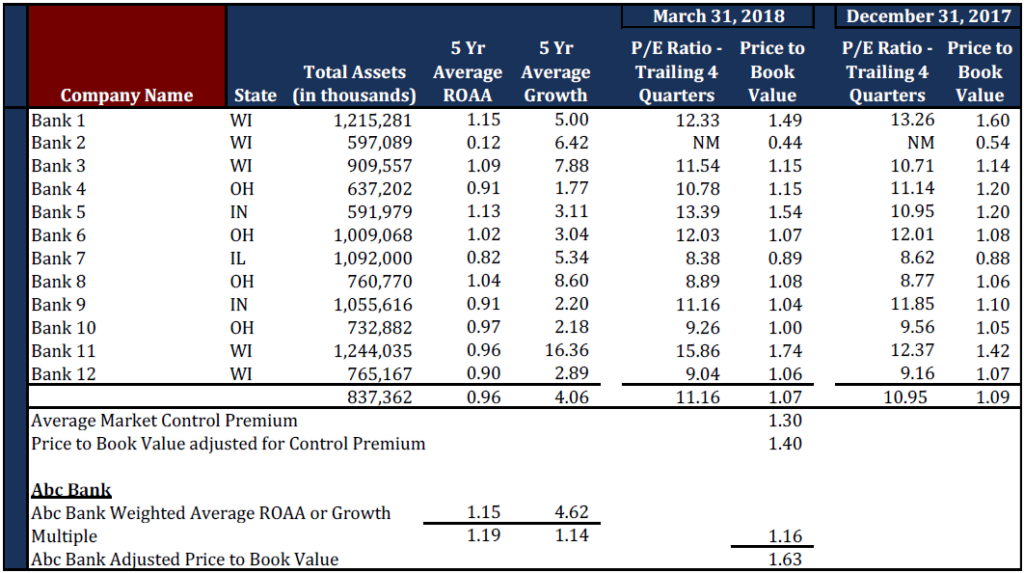

Business appraisers also often use the guideline public company method to estimate fair value. Under this approach, Wilary Winn obtains financial information on the publicly traded banks with similar business operations, profitability, and size located in similar geographic areas to the acquirer. To estimate an adjusted market price-to-book value, we identify the median price- to-earnings and price-to-book ratios from our selected pool of publicly traded banks and then adjust for differences in return, growth, and a market control premium.

In the example below, we derived a median price to tangible book ratio of 1.07, which after adjusting for a control premium of 1.30 equals 1.40. We adjust the bank’s specific performance to the industry by increasing the ROAA multiple from 0.96 to 1.19 (1.15 divided by 0.96). We adjust for growth similarly. We derive an average tangible book ratio of 1.16 which is the simple average of ROAA multiple of 1.19 and the growth rate multiple of 1.14. Finally, we derive an adjusted price to tangible book ratio of 1.63 by multiplying the 1.16 by the market control premium of 1.40. Finally, we multiply the adjusted price to tangible book ratio by the acquired bank’s capital, resulting in a market value of $65.4M.

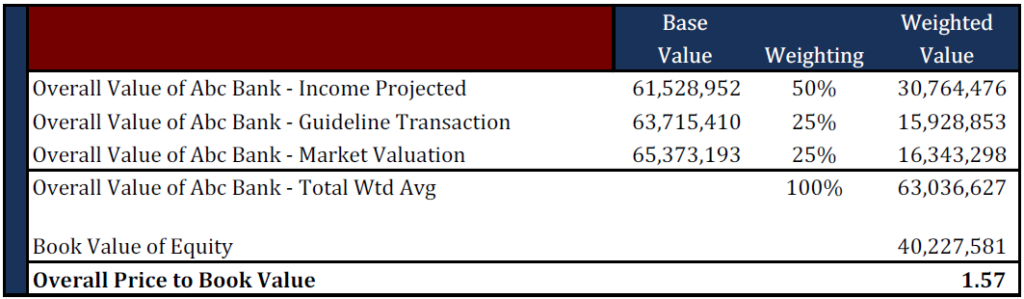

As a final step, we compare and analyze the valuation results we derived under the three methods to reach an overall estimate of fair value.

From the example transaction above, after weighting the three approaches, we derive an overall value of the acquired bank of $63.0M or 1.57 times the acquired bank’s book equity.

Our overall valuation results serve as a market comparison when the acquirer is paying cash. However, when a bank is acquiring another financial institution using its own stock, the valuation approaches are integral to properly accounting for the transaction.

Fair Value of Financial Assets and Liabilities

The financial assets acquired and liabilities assumed typically consist of investments, loans, and deposits. Accrued interest receivable, accounts receivable, accrued interest payable and accounts payable are also considered to be financial assets or liabilities.

Investments

The investments acquired generally consist of “vanilla” bonds and certificates of deposits. We can usually identify a price for the bonds using Bloomberg or another pricing service. We occasionally encounter illiquid securities, which we value using discounted cash flows. To determine the value of a CD, Wilary Winn discounts the expected life of asset cash flows using an estimated market interest rate.

Loans

Wilary Winn believes determining the fair value of the loans is one of the most complex undertakings under the purchase accounting rules because the marketplace for seasoned loans is not active. As a result, valuation experts generally value the loans using a discounted cash flow analysis. Two approaches are permissible under GAAP2. The first approach is to discount the contractual cash flows at an “all in” estimated market discount rate, which by its nature includes a credit spread. The other approach is to develop a “best estimate of expected cash flows” and discount the amounts back to the valuation date at an appropriate discount rate – net of the credit spread. We employ the second method. We begin with contractual cash flows per the loan agreement (e.g. interest rate, amortization term, payment, and loan term). We then modify the contractual cash flows based on our estimates the rates of prepayment, default and loss severity to be experienced prospectively. We discount the resulting expected cash flows back to the valuation date using a proprietary valuation model.

The valuation is performed at the loan level for commercial and residential real estate loans, at the cohort level for other types of loans, and is based on the objective attributes of the loan and current statistical performance variables used in the marketplace. Our prepayment, default and loss severity assumptions are applied based on the characteristics of the loan (type of loan – CRE vs. C&I, risk ranking – pass vs. substandard, etc.).

We derive our expected prepayments using a conditional repayment rate (CRR), which is the annual amount of expected voluntary payoffs as a percentage of the principal amount outstanding at the beginning of the year. We model our defaults using a conditional default rate (CDR), which is the annual amount of expected defaults as a percentage of the principal amount outstanding at the beginning of the year. Finally, our loss severity is equal to the liquidated principal balance minus any recovered amount divided by the principal balance. The combination of the CDR and loss severity derives our future lifetime loss assumptions.

For larger loans such as those collateralized by commercial real estate, we rely on our client’s estimates of expected credit losses or reserve percentages – especially loans with lower credit quality. In our experience, banks typically review these loans in detail as part of their credit risk management and we rely on loss estimates from such reviews for our estimates.

The rates that we use to discount the modified contractual cash flows vary. We generally use the “all in” market interest rates to discount the expected cash flows for loans with a low risk ranking, as our estimated credit loss estimates for these loans are generally quite modest. In other words, our best estimate cash flows are very similar to the contractual cash flows, implying that the amount of credit spread included in the discount rate is also quite modest. In determining the industry standard offered loan rates on commercial loans, we first obtain region specific Federal Home Loan Bank advance rates by term. We then typically add a spread to the advance rates based on the structure of the loan and the region where our client operates. We also benchmark market rates of return provided by the Federal Reserve’s E.2 Survey of Terms of Business Lending reports. The reports provide average loan rates by loan risk level, term of the loan, and size of institution. On multi-family loans, we examine pricing spreads on Freddie Mac multifamily securities. Finally, we survey pricing schedules and market rate surveys provided by our clients and other lenders to determine market rates by loan type within our client’s operating area.

For loans with high risk rankings (watch-list, substandard, etc.), we use the buildup method to develop our discount rate. We begin with an appropriate risk free rate based on the term of the loan (adjusted for amortization, voluntary, and involuntary prepayments), and add a spread for uncertainty, liquidity, and increased costs to service. Because we are using expected cash flows net of credit losses, our discount rates for loans with high risk rankings do not include a credit spread. Wilary Winn believes including the credit spread in the discount rate for these loans with lower credit quality would be “double counting”.

The book value of the loans is thus adjusted for an interest rate differential (discount rate valuation allowance) and the present value of expected credit losses (credit valuation allowance).

Because the estimated fair value of the loans includes estimated credit losses, GAAP requires the allowance for loan losses to be recorded at zero on day one.

See the adjustments to loans in the example loan summary attached as Appendix C – the interest rate differential – $1,309,051 in total and the credit loss discounts – $2,777,849 in total. See the Day Two accounting section of this white paper for more details.

Accounts Receivable and Payable

Wilary Winn generally values the short-term accruals, accounts receivable and accounts payable at book value, because we believe the present value effect is immaterial.

Prepaid Expenses

The treatment of prepaid expenses is another item that is less straightforward than one would imagine. One has to consider whether the prepaid item would have benefit to market participants. For example, a multi-year prepaid contract that cannot be used after the acquisition would have no “fair value” and would be recorded at zero in the Day One journal entry.

Deposits

The fair value of the deposit accounts is dependent on whether they are time or non-time deposits. The non-time deposit deposits are recorded at book value. The value of the non-time deposits is reflected in the “core deposit intangible”. The valuation of intangible assets is discussed beginning on the next page.

Wilary Winn estimates the value of time deposits in a manner similar to the one we use for certificate of deposit investments.

Accrued Liabilities

Wilary Winn recognizes that prior to the change in the accounting rules, many acquiring organizations had the acquired bank accrue the costs of the acquisition on its book prior to the acquisition so the expenses would not flow through the income statement of the combined entity. This is another significant change under the new rules.

In general, the costs of the acquisition and any restructuring costs should flow through the income statement of the acquiring bank3.

The theory is that if the party that receives the primary benefit is the buyer or the combined entity, the cost should run through its income statement. In our experience, the types of costs that can be accrued as part of the acquisition are quite limited. An example would be a compensation arrangement that was in place before the acquisition was contemplated, and that just happens to be triggered as a result of the acquisition. The required payout can be accrued on the acquired bank’s books as of the acquisition date. By way of contrast, a payout negotiated as part of the acquisition should run through the income statement of the acquiring bank.

The acquiring bank should also ensure that the acquired bank has properly accrued its expenses. In other words, the organization should ensure that the acquired bank does not have any unrecorded liabilities.

Fair Value of Non-Financial Assets and Liabilities

The most significant non-financial assets are generally land and buildings. We generally require our clients to obtain commercial real estate appraisals if these assets are material. Real estate leases are another item that must be evaluated in an acquisition. If the lease price is less than market rate, then an asset should be recorded. On the other hand, if the lease price is over the market rate, a liability should be recorded. We calculate these items by discounting the difference in cash flows back over the remainder of the lease term to the valuation date at the acquired bank’s estimated cost of capital.

Intangible Assets

The value of intangible assets should be recorded as well in the Day One journal entry.

Recognition of an intangible asset requires that the asset be separable or have a contractual or legal benefit.

The most common intangible assets in a bank acquisition are:

- Core deposit intangible

- Customer relationships

- Value of the acquired bank’s trade name

- Mortgage servicing rights

Core Deposit Intangible

The premise underlying the core deposit intangible asset is that a rational buyer would be willing to pay a premium to obtain a group of core deposit accounts that are less expensive than the buyer’s marginal cost of funds. Wilary Winn believes the core deposit intangible benefit depends on the type of account. For example, demand deposit accounts have very different economics and behavior than high rate money market deposits. To calculate the estimated fair value of the core deposit intangible, we first segment the accounts by type. Next, we estimate the likely decay, average life, and terminal economic life. The rate paid on the deposit, the non-interest income generated, and the non-interest expense incurred also affect the value of the core deposit intangible. Wilary Winn estimates the value of the core deposit intangible through a discounted cash flow analysis.

Customer Relationships

Wilary Winn believes that the value of the customer relationships is imbedded in the purchase price of the institution. We believe it would be quite difficult to separately determine the value of customer relationships in terms of the ability to cross sell loans or deposits at lower cost, or higher rates of penetration, and therefore, have generally not seen such items recorded.

Acquired Bank’s Trade Name

A trade name can have value based on how widely it is recognized. If the brand is well known and the acquiring bank intends to continue to utilize it, the trade name has value. Trade names can also have a defensive value. That is, it can have value even though the acquiring bank plans to retire the name. For example, imagine the value to Pepsi of having the rights to the Coca-Cola brand name.

Mortgage Servicing Rights

Mortgage servicing rights are the rights to service a loan that has been sold into the secondary market in exchange for a fee. The market for bulk sales of mortgage servicing rights is quite limited. As a result, the value of mortgage servicing rights is generally determined via a discounted cash flow analysis. The most sensitive input in the valuation is the assumption regarding the rate at which the loans will prepay.

Income Taxes

The discussion regarding income taxes which follows is a brief summary of information contained in RSM’s A Guide to Business Combinations – Third Edition June 2016. We thank them for allowing us to reference it in this white paper and encourage those who want more detail to consult the RSM guide or contact your tax practitioner.

For income tax purposes, business combinations are considered taxable or nontaxable. Asset acquisitions are taxable to seller. Nontaxable transactions take two forms. A transaction could be nontaxable because the financial institution is an S-Corporation or, in the case of C Corporation, the buyer purchases stock – a “stock acquisition”. A stock acquisition can be turned into a taxable event if the buyer and seller elect to treat it as such under Section 338 of the U.S. Income Tax Code – a “338 Election”.

The required accounting for income taxes in a business combination are set for in FAS ASC 805-740 which differs from the fair value determinations we have discussed thus far. The first difference is that deferred tax assets and liabilities are measured on an undiscounted basis. In addition, to be recognized, the deferred tax asset must be more than 50 percent likely of being realized.

Taxable transactions will have few temporary differences between book and tax as the basis for most assets and liabilities will be the same. Nontaxable transactions often result in several temporary differences. The tax bases of the assets and liabilities of the target will be the same post-acquisition as they were prior to the acquisition (carryover basis), while the book values will be based on fair value.

Goodwill or Bargain Purchase

On Day One, the acquiring bank records the fair value of the assets acquired and liabilities assumed and the fair value of any intangible assets.

The amount required to balance the Day One journal entry is Goodwill or a Bargain Purchase.

In our experience, acquisitions often result in goodwill. If the acquiring bank is privately held, it can elect to account for the resulting goodwill in one of two ways. The bank can amortize the goodwill straight-line over a period not to exceed 10 years. Otherwise, it can elect not to amortize the goodwill and instead assess it for impairment. The assessment must be made at least annually. Publicly traded banks must use the impairment assessment method.

In our experience with acquisitions involving bank holding companies, we typically see the acquired goodwill recorded at the level of the transaction. For example, if the bank holding companies merge and the consideration transferred is at the bank holding company level, we would generally see the goodwill recorded on the bank holding company’s balance sheet. However, we note that entities can elect to apply pushdown accounting to its reporting entities subsequent to the acquisition in accordance with FAS ASC 805-50-15-10.

See Appendix B1 & B2 for an example comparing the fair value of the balance sheets of a subsidiary bank and the bank holding company to the book values at the acquisition date. Additionally, the goodwill and bargain purchase calculation is included on these appendices. Appendix D shows how to record the acquisition on Day One, including the accounts used to adjust book value to fair value at the bank and bank holding company level.

Wilary Winn further notes that GAAP allows the acquiring bank to true up the Day One journal entry for up to 12 months after the acquisition date to reflect new information that would have affected the valuation amounts had they been known4.

We note that the “new” information is relative to the acquisition date only. The adjustment is designed to reflect information that existed as of the valuation date that was not known at the time. It is not intended to reflect changes in facts and circumstances as of the valuation date. Instead, it is designed to reflect a clarification of facts that existed as of the valuation date. For example, if a loan at the valuation date was a modified loan and was not disclosed as such, an adjustment would be appropriate. On other hand, if the acquired bank obtained an appraisal for a branch location at the acquisition and due to changes in market conditions, the value of the branch was less 11 months later, an adjustment would not be appropriate.

Day Two Accounting

Many find the Day One Accounting to be relatively complex. The ongoing accounting for the recorded premiums and discounts is also quite complex. The following is a quick summary for the items other than loans, followed by a detailed description of the required ongoing accounting for the acquired loans.

The premiums or discounts for the investments acquired are amortized or accreted into income over the estimated life of the investment as an adjustment to interest income. Premiums reduce interest income, whereas discounts have the opposite effect.

The premiums or discounts on the acquired time deposits are amortized or accreted into expense over the estimated life of the liability as an adjustment to interest expense. Premiums reduce interest expense, whereas discounts increase interest expense.

Mortgage servicing rights acquired in the acquisition are generally amortized on a level-yield basis over the estimated life of the loans. The amortization is recorded as a reduction to servicing income. We note that mortgage servicing rights can also be measured and reported on an ongoing basis at fair value, with the change in fair value running through the income statement. This fair value accounting is generally used by large institutions, which have generally hedged the portfolio against interest rate risk.

The core deposit intangible is amortized on a level-yield over the estimated lives of the non-time deposits. The expense should be recorded as a reduction to non-interest income.

The fair value of the fixed assets acquired becomes the basis for depreciation. The fixed assets should be depreciated over their estimated remaining lives, which can be longer or shorter than the term used to calculate depreciation before the acquisition.

The most complex ongoing accounting relates to the acquired loans. The required accounting centers on two questions.

- Do I account for the loans based on their contractual cash flows, or

- Do I account for loans based on their expected cash flows

Contractual Cash Flows

If the acquiring bank expects to receive all of the contractually specified principal and interest payments from an acquired loan, then the loan should be accounted for in accordance with FAS ASC 310-20. That is, the interest rate discount or premium (interest rate valuation allowance) should be amortized or accreted into income on a level-yield over the expected life of the loan. Under this method, the acquiring bank establishes a post-acquisition allowance for loan losses to record credit losses on acquired loans.

Wilary Winn believes that the acquiring bank can account for the acquired loans with the highest credit quality (low risk-rated, reasonable LTVs/DCSRs) using this methodology. We note that our estimated credit losses for these types of loans are generally quite nominal and that we use an adjusted market discount rate to estimate fair value. Thus, the valuation approach and the accounting are consistent. The acquiring bank amortizes the interest rate valuation allowance and the relatively modest credit valuation allowance into income over the expected life of the loan.

The loan fair value adjustments may be accounted for using various methods. The first method is amortizing/accreting the fair value adjustments at the loan category level based on the remaining terms of the categories. We note that examples of templates used to amortize/accrete the fair value adjustments for all of the accounts under this pooling method are attached as Appendix F. Another method would be at the loan level. Based on the sophistication of our clients’ core systems, many institutions elect to input the credit and discount marks into the core system and amortize/accrete the individual fair value adjustments based on the speed of cash flows received.

Expected Cash Flows

On the other hand, loans acquired with “deteriorated credit quality” must be accounted for under FAS ASC 310-30 (pre-codified Statement of Position 03-3 Accounting for Certain Loans or Debt Securities Acquired in a Transfer).

Which Loans Fall Within the Scope Of ASC 310-30?

Acquired loans that meet the following two criteria must be accounted for pursuant to FAS ASC 310-30:

- There must be evidence of deterioration in credit quality subsequent to origination.

- It must be probable that the acquirer will be unable to collect all contractually required payments from the borrower.

The determination of whether acquired loans are to be accounted for under FAS ASC 310-30 must be made at the acquisition date on a loan-by-loan basis, and loans cannot transition between FAS ASC 310-30 and FAS ASC 310-20 subsequent to the acquisition date.

Requirement 1 – Did the Deterioration in Credit Quality Occur Subsequent to Origination?

At first glance, this determination may appear simple. One can review the loan’s performance and underlying attributes to determine whether credit concerns exist. Factors to consider are the risk ranking, debt service coverage ratio, borrower’s credit score, sources and uses of cash, payment history, and debt-to-income levels. However, to qualify for accounting under FAS ASC 310-30, this deterioration in credit quality must have occurred subsequent to origination. Accordingly, a loan that was of lower credit quality from time of its origination may or may not fall into the FAS ASC 310-30 bucket. If the loan has continued to perform based on its contractual terms, then chances are good that deterioration in credit quality did not occur subsequent to acquisition.

To be eligible for FAS ASC 310-30, the credit conditions would have had to have worsened – the risk ranking increased, credit score fell, the loan to value ratio increased, etc.

Requirement 2 – Is it Probable that the Acquirer will be Unable to Collect All Contractually Required Payments from the Borrower?

Wilary Winn believes that if the fair value of the loan includes a credit valuation allowance, it is clear that the acquirer will not receive all of the contractually required payments from the borrower. We further believe that low risk rated, high FICO, and/or low loan to value loans will generally not have a significant credit valuation allowance and would thus fail this requirement, whereas the remainder of the portfolio would likely meet this requirement.

Thus, loans with credit valuation allowances clearly meet Requirement 2, but may not meet Requirement 1. Wilary Winn recommends that the acquiring bank review large credit impaired loans acquired at the loan level to determine if the loans meet the FAS ASC 310-30 accounting requirements. For smaller homogenous loans such as residential real estate loans, we note that GAAP permits the acquiring bank to elect to account for the loans at the group level, thus avoiding the tedious scope determination required under Requirement 15.

Wilary Winn thus recommends that the acquiring bank make two accounting elections for groups of homogenous small balance loans that have credit valuation allowances which are material.

- Account for the acquired loans at the group level.

- Elect to the treat the group level asset in accordance with FAS ASC 310-30.

We believe this dramatically simplifies the ongoing accounting, provided that you can differentiate between the fair value adjustments for the interest rate differential and the expected credit losses.

Wilary Winn believes that the acquiring bank could also elect to include loans with the highest credit quality as it forms the loan groups. For example, an acquiring bank could elect to account for all of the first lien residential mortgage loans acquired as a group based on expected cash flows versus accounting for the loans with the highest credit quality using contractual cash flows. We note that the loans should be grouped based on similar characteristics – residential first lien, residential second lien, commercial real estate, consumer, etc.

We note that GAAP does not allow loans with revolving terms to be accounted for under FAS ASC 310-30 because of the uncertainty of future advances and repayments6. In our experience, the acquiring bank amortizes the discount rate valuation allowance and the credit valuation allowance straight-line over the remaining term of the loan as of the acquisition date of the loan. If it becomes apparent over time that the present value of the cash flows are less than the book value of the loan, then the acquiring bank should increase its allowance for loan losses by the amount of the shortfall.

Recognizing Income Under FAS ASC 310-30

Wilary Winn strongly recommends that large commercial loans with significant credit valuation allowances be accounted for at the loan-level in accordance with the precise tenets of FAS ASC 310-30. For more information, please see our white paper FAS ASC 310-30 Loan Accounting.

For small balance homogenous loans, we recommend that the acquiring bank consider a simplified approach. Under FAS ASC 310-30, the expected cash flows that exceed the initial investment in the loan (its fair value on Day One) represent the “accretable yield,” which is recognized as interest income on a level-yield basis over the life of the loan. Using a real estate loan as an example, the interest rate difference on the loan is $26,997 and the credit only difference on the loan is $8,104. The book value is $400,000, and based on the interest rate and credit reductions, the fair value is $364,899. Under ASC 310-30, the acquiring bank would accrete the $364,899 fair value at a rate of 5.5%. Actual interest and principal received would be accounted for as a reduction of the fair value carrying amount of the loan.

In our experience, our client’s core accounting systems cannot accommodate the precise accounting required under ASC 310-30. In response, we separately identify the present value of the difference between the expected cash flows at the coupon rate and the expected cash flows at the market rate of interest. This is the interest rate premium (discount rate valuation allowance) or the $26,997 in our real estate loan example. We advise our clients to amortize the discount rate valuation allowance into income using sum of the years’ digits amortization (which closely resembles level-yield amortization). Since the discount rate valuation allowance is based on the difference between the rate on the portfolio and the overall market interest rate, our clients can continue to record the contractual interest income as received and continue to rely on their core system to provide the loan-by-loan accounting. The result very closely approximates the precise accounting required under FAS ASC 310-30. Appendix E compares accreting the discount rate valuation allowance using the sum-of-the years’ digits method and recording the contractual cash flows as received to the required accretion required FAS ASC 310-30 for the real estate loan in our example. The schedule shows that the interest income recorded would be slightly higher than the interest income recorded under the exact FAS ASC 310-30 accounting for the first 60 months and then is slightly less for the next 220 months. Our clients have found in practice that the simplicity of this amortization method outweighs the modest differences produced, as compared to the cumbersome reporting required using a precise implementation of the standards.

Wilary Winn further notes that the difference between the cash flows expected at acquisition and the total contractual cash flows is the nonaccretable difference. The nonaccretable difference is the undiscounted principal and interest that will not be received due to prepayment and default assumptions. In our real estate loan example, the amount is $126,899. We note that the total contractual cash flows must be disclosed only once and need not be tracked going forward.

Changes in Estimates of Cash Flows Under FAS ASC 310-30

The acquiring bank must periodically compare the actual cash flows received to the expected cash flows on Day One and reassess the remaining cash flows expected to be collected. If the new total expected cash flows exceed the initial estimate, then the acquiring bank should increase the rate of accretion. In essence, the fair value of the loan has increased, but the increase can only be recognized prospectively through an increased yield. If the expected cash flows have decreased, then the acquiring bank should record an allowance for loan losses.

Because the allowance for loan losses is initially recorded at zero with expected credit losses reflected in the credit loss valuation allowance, the tracking and reporting of credit losses is more complex under the new rules. Some organizations have charged foreclosure losses directly against the credit loss valuation allowance. In our experience, the FDIC prefers to see losses run through the allowance for loan losses and related provision accounts. In this case, Wilary Winn recommends that foreclosure losses be recorded through the three following journal entries. In our example, we assume a foreclosure loss of $100.

Allowance for loan losses 100

Loan receivable 100

Provision for loan losses 100

Allowance for loan losses 100

Credit reserve valuation allowance 100

Other non-interest income 100

The net effect of these entries with regard to profit and loss is zero. However, the actual foreclosure losses incurred are easier to track because they run through the standard accounts. We note that the final credit should run through other non-interest income, not interest income, because the entry is designed to offset the provision expense and is not meant to reflect an adjustment to the prospective yield.

We further recommend that the acquiring bank allocate the carrying amount of the foreclosed loan based on the individual loan’s relative initial fair value. This method mirrors traditional loan accounting and is consistent with the requirements of FAS ASC 310-30. Under this method, a gain or loss would be recognized for the difference between the allocated carrying amount of the loan and the fair value of the collateral obtained in foreclosure. When allocating costs while removing loans from the pool, the accounting principle that should be adhered to is that the yield on the remaining pool should not be disturbed by the removal. That is, the yield on the remaining pool of loans should neither increase nor decrease as a direct result of removing a loan from the pool.

Finally, if the actual cash flows for the loan group differ significantly from the cash flows expected at inception, Wilary Winn recommends that the steps in the Day One valuation be repeated at the new assessment date and that new rates of accretion be calculated or that the allowance for loan losses be increased or decreased depending on whether the new cash flows have increased or decreased.

Other Rules Related to the Grouped Loans

Wilary Winn notes that the integrity of the pool should be maintained throughout its life. Thus, loans should not be added to the pool, nor should loans be removed absent events such as foreclosures, write-offs, or sales of the loan7.

We also believe that the acquiring bank should not apply troubled debt restructuring accounting and disclosure guidance to loans included in a pooled asset under FAS ASC 310-308.

CECL and Purchased Credit Deteriorated (“PCD”) Assets

The current expected credit loss standard will affect acquisition accounting. Similar to the current standard, the new CECL standard requires also loans to be valued at fair value for the purposes of a merger or an acquisition and be accounted for under FAS ASC 310-20 or FAS ASC 310-30. The main difference arises for loans accounted for under FAS ASC 310-20 (loans without significant credit deterioration since origination). Lifetime credit losses on these loans should be recorded in the acquiring institution’s Allowance for Loan Losses at the time of the merger. Higher risk loans that have not experienced credit deterioration since origination will be most affected by this provision. For example, let’s say that a financial institution acquires of group of loans with lower FICOs collateralized by manufactured housing. The fair value of the loans would reflect a significant discount form par – let’s use 80 percent. On day one, the acquiring institution will record an increase to its existing ALLL to reflect the expected lifetime losses on these loans. Meanwhile the 20 percent acquisition discount will be accreted into income over the expected life of the loans.

On the other hand, for loans accounted for under FAS ASC 310-30, lifetime credit losses will be reflected in the fair value difference and, therefore, do not have to be recorded in the institution’s Allowance for Loan Losses at the time of the merger. We believe financial institutions will therefore have an incentive to account for loans with higher risk under FAS ASC 310-30. We note that FASB renamed loans classified under FAS ASC 310-30 as Purchased Credit Deteriorated loans. In order to be classified as a Purchased Credit Deteriorated loan, FASB states that “acquired individual financial assets (or acquired groups of financial assets with similar risk characteristics) that, as of the date of acquisition, have experienced a more-than-insignificant deterioration in credit quality since origination, as determined by an acquirer’s assessment.” In order to meet the definition of more-than-insignificant deterioration in credit quality, we believe that an institution should establish uniform criteria for scoping in PCD loans. This criterion can consist of various credit quality factors such as a certain point fall in risk rating, a certain fall in debt service coverage ratio, or a certain point decrease in FICO score or loans that are 90+ days delinquent.

The specifics for PCD assets are as follows:

- At acquisition, a financial institution will estimate and record an allowance for credit loss, which is then added to the purchase price.

- Favorable and unfavorable changes in expected credit related cash flows will run through the allowance and credit loss expense.

- Existing ASC 310-30 loans will be considered PCD loans upon adoption of the new standard and the amount non-accretable yield at adoption will be the initial allowance for credit loss.

- Non-credit premium or discount will be accounted for based on the effective yield after the gross-up for the allowance.

Conclusion

While the initial and ongoing required accounting can be complex, Wilary Winn does not believe the rules should deter transactions that otherwise make sense. We have worked with our clients, their external auditors and the regulators to ensure our clients have the information and knowledge they need to successfully undertake these transactions. We hope you have found this white paper to be informative and useful.