Accounting & Regulatory Reporting for Mortgage Banking Derivatives [White Paper]

Key Takeaway

Wilary Winn provides valuations of mortgage banking derivatives and turnkey advice on how to properly account for them.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released March 2012

Introduction

Mortgage banking involves relatively sophisticated financial activities, including the creation of derivatives, hedging, and the intricacies of mortgage servicing. As a result, the accounting for these activities is relatively complex. The accounting relates to:

- Interest rate lock commitments

- Forward mortgage loan sales commitments

- Closed loans held for sale

- Mortgage servicing rights

This white paper addresses the accounting and regulatory reporting requirements related to interest rate lock commitments, forward mortgage loans sales commitments, and closed loans held for sale. Our companion paper, “Accounting & Regulatory Reporting for Mortgage Servicing Rights,” addresses the requirements related to mortgage servicing rights.

Interest Rate Lock Commitments

Interest Rate Lock Commitments (IRLCs) are agreements under which a lender agrees to extend credit to a borrower under certain specified terms and conditions in which the interest rate and the maximum amount of the loan are set prior to funding. Under the agreement, the lender commits to lend funds to a potential borrower (subject to the lender’s approval of the loan) on a fixed or adjustable rate basis, regardless of whether interest rates change in the market, or on a floating rate basis. The types of mortgage loan IRLCs are:

- Lock ins for fixed-rate loans. The borrower can lock in the current market rate for a fixed-rate loan.

- Floating rate loan commitments. The interest rate is allowed to “float” with market interest rates until a future date when the rate is set.

The FASB Accounting Standards Codification (“FASB ASC”) provides that IRLCs on mortgage loans that will be held for resale are derivatives and must be accounted for at fair value on the balance sheet1. FASB ASC Topic 820 – Fair Value Measurements and Disclosures specifies how these derivatives are to be valued as described below.

Commitments to originate mortgage loans to be held for investment and other types of loans are generally not derivatives. Consequently, an institution would have to elect to account for these obligations at fair value.

Initial Valuation of IRLCs

The value of the loan to the originating institution is based on many components, including:

- The loan amount

- The interest rate

- The price at which the loan can be sold

- Discount points and fees to be collected from the borrower

- Direct fees and costs associated with the origination of the loan (processing, underwriting, commissions, closing, etc.)

- The value of the servicing to be retained or the servicing released premium to be received

The fair value of IRLCs is conceptually related to the fair value that can be generated when the underlying loan is sold in the secondary market. Fair value is defined by FASB ASC Topic 820 which provides a framework for measuring fair value and expands required disclosures related to fair value measurements. FASB ASC Topic 820 defines fair value as an exit price that would be received to sell an asset or paid to transfer a liability in orderly transactions between market participants at the measurement date2. The statement goes on to provide that a fair value measurement assumes that the transaction to sell the asset or transfer the liability occurs in the principal market for the asset or liability, or, in the absence of a principal market, the most advantageous market for the asset or liability3. The principal market is the market in which the reporting entity transacts with the greatest volume and level of activity for the asset or liability. The most advantageous market is the market in which the reporting entity would receive the highest selling price for an asset, or pay the lowest price to transfer the liability. The determination of the principal market is a key step in applying FASB ASC Topic 820 because if there is a principal market, the fair value should be based on the price in that market, even if the price in a different market is potentially more advantageous at the measurement date4. As a practical matter, we believe that most institutions lock in with an investor at the time they offer the lock to the mortgage applicant and that the secondary market price used to value the IRLC should be based on the prices available from this same investor as this would represent the principal market.

FASB ASC paragraph 820-10-50-2 also establishes a fair value hierarchy for reporting purposes. The hierarchy ranks the quality and reliability of the information used to determine fair values with Level 1 being the most certain and Level 3 being the least certain. The levels are:

- Level 1 – Quoted market prices for identical assets or liabilities in active markets;

- Level 2 – Observable market-based inputs other than Level 1 quoted prices or unobservable inputs that are corroborated by market data

- Level 3 – Unobservable inputs that are not corroborated by observable market data; valuation assumptions that are based on management’s best estimates of market participants’ assumptions

We believe lock in price from the investor represents a Level 2 input because the value of the derivative is based on an observable price in the marketplace.

Valuing IRLCs

Following is an example of how to value the IRLC based on the following assumptions:

Loan amount $100,000

Price to borrower or lock-in price 100

Lock-in interest rate 4.125%

Market interest rate at inception 4.125%

Sales price 101.50 at inception – servicing retained and locked in with an investor

Value of the servicing 1.00%

Projected origination costs $1,000 or 1.00%

The originating institution thus has an expected gain of $1,500 or 1.50% (101.50 {sales price} + 1.00 {value of servicing} – 100.0 {price to borrower} – 1.00 {projected origination costs})

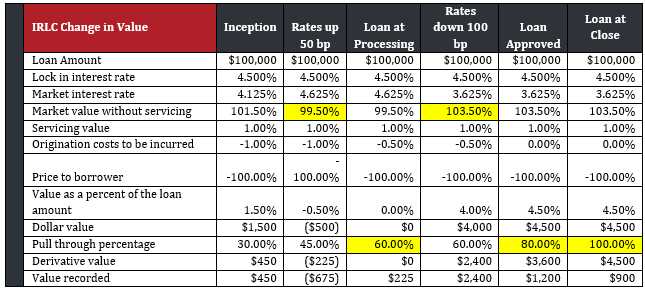

The table below shows the change in the value of the IRLC as market interest rates and estimated pull through percentages change over time. The differences are highlighted in yellow.

As the example shows, the value of the IRLC changes as market interest rates change and as the anticipated pull-through rate changes based on updates in the status of the loan. Essentially, there are four components to consider when determining the subsequent changes in fair value:

- The projected sale price of the loan based on changes in market interest rates

- The projected pull-through rate – the probability that an IRLC will ultimately result in an originated loan

- The decay in the value of the applicant’s option due to the passage of time

- The remaining origination costs to be incurred based on management’s estimate of market costs (Level 3 input)

Additional Valuation Considerations for IRLCs

The example above is highly simplified. Changes in interest rates can affect the value of the servicing asset as well as the value of the loan. In addition, pull-through assumptions in the marketplace can be complex. Factors that may be considered in arriving at appropriate pull-through rates include the origination channel, current mortgage interest rates in the market versus the interest rate incorporated in the IRLC, the purpose of the mortgage (purchase versus refinancing), the stage of completion of the underlying application and underwriting process, and the time remaining until the IRLC expires. We believe these pull-through estimates are Level 3 inputs.

To account for the time decay in the option, one should calculate the market price based on the number of days remaining in the IRLC at the end of the reporting period. For example, if an institution locks in a rate with a borrower for 60 days on January 1 and is calculating the change in the value of the IRLC at January 31, the market rate should be based on a 30 day lock and not a 60 day lock. This is necessary to properly account for the marketplace risk adjustment. (In general, commitments with shorter lock lengths have higher prices than longer lock lengths because the buyer is subject to changes in market interest rates {volatility} for a shorter time period.)

We further note that institutions should consider the risk of nonperformance on their IRLC liabilities based on the institution’s own credit risk5.

Accounting for IRLCs

Changes in the fair value of an IRLC must be measured and reported in financial statements and regulatory reports. The carrying value of the IRLC, based on its fair value, should be accounted for as an adjustment to the basis of the loan when the loan is funded. The amount is not amortized under to FASB ASC paragraph 948-310-25-3 (Financial Services – Mortgage Banking). Therefore the value of the IRLC at closing directly impacts the gain (loss) realized upon the sale of the loan.

In prior guidance, the origination costs were also not amortized. Like the change in the value of the IRLC, the costs were accounted for as an adjustment to the basis of the loan at closing.

However, under FASB ASC Topic 820, we believe that lenders should expense the origination costs for IRLCs as incurred.

Following is an accounting example for our $100,000 loan from inception to loan closing or funding.

A – Record value at inception

B – Record processing costs of $500

C – Record changes in fair value of IRLC

D – Record commission expense of $500

E – Record loan funding at 100.0

Institutions should report each fixed, adjustable, and floating rate IRLC as another asset or as another liability based on whether the IRLC has a positive (asset) or negative (liability) value, with the offset recorded as non-interest income or non-interest expense.

IRLCs with positive values may not be offset against the IRLCs with negative values when presenting assets and liabilities on the statement of financial condition6.

We believe that the fair value of IRLCs is based on Level 3 inputs.

The servicing asset is not recorded until the loan is sold and is accounted for as a reduction in the carrying value of the loan. We note that the servicing value is an element of the IRLC value and that it contains both Level 2 and Level 3 inputs.

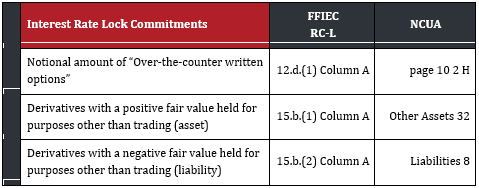

Regulatory Reporting

Information regarding IRLCs must be included in the financial institution’s required regulatory reports (Call Report or 5300). Following is a table that indicates where the information is to be reported.

The total loan amount of loans for which the financial institution has issued commitments, including floating rate commitments are to be reported as over-the-counter written options. The derivative assets and liabilities are to be reported as indicated.

Forward Mortgage Loan Sales Commitments

To avoid interest rate risk, institutions generally enter into mortgage loans sales commitments at the time they make an interest rate lock commitment to the buyer. They can enter into mortgage loan sales commitments on a “mandatory” or “best efforts” basis. Mandatory commitments provide that the loan must be delivered or the commitment be “paired off”. In general, best efforts commitments provide that the loan be delivered if and when it closes.

Mandatory delivery commitments, also known as forward loan sales commitments, are considered to be derivatives under FASB ASC Topic 815 (Derivatives and Hedging)because they meet all of the following criteria:

- They have a specified underlying (the contractually specified price for the loans)

- They have a notional amount (the committed loan principal amount)

- They require little or no initial net investment

- They require or permit net settlement as the institution via a pair-off transaction or the payment of a pair-off fee.

Many took the position that best efforts commitments are not derivatives because there in no pair-off provision. As a result, they could not be marked to fair value to offset the changes in the IRLCs.

However, FASB ASC paragraph 825-10-15-4(b) (Financial Instruments – Overall), provides that an institution can elect to mark a firm commitment that would not otherwise be recognized at inception and that involves only financial instruments.

The statement goes on to say “(An example is a forward purchase contract that is not convertible to cash. That commitment involves only financial instruments – a loan and cash – and would not otherwise be recognized because it is not a derivative instrument.)

We believe the fair value determination should be based on the gain or loss that would occur if the institution were to pair-off the transaction with the investor at the measurement date. We further believe this is a Level 2 input.

We further note that institutions should consider the risk of nonperformance on their forward commitment liabilities based on the institution’s own credit risk7.

Accounting for Mortgage Loan Sales Commitments

The mandatory delivery commitments are to be accounted for at their fair value on the balance sheet. Institutions should report each forward loans sales commitment as another asset or as another liability based on whether it has a positive (asset) or negative (liability) value, with the offset recorded as non-interest income or non-interest expense.

The accounting treatment is similar for the “best efforts” commitments that an institution elects to account for at fair value.

Following is a continuation of our previous example from funding to sale.

Thus, we can see that the gain of $4,500 related to the value of the IRLC is offset by $1,000 of origination costs that were expensed and by the $2,000 decrease in the value of the forward commitment derivative. (This is caused by a net ½ percent fall in market interest rates at a 4 to 1 tradeoff between interest rate and discount points.) Thus, the institution earned its targeted margin of $1,500 or 1.50%.

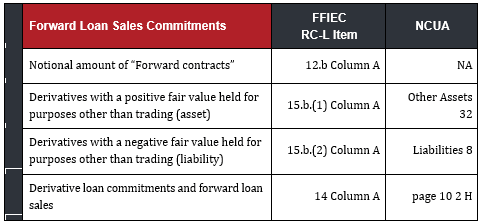

Regulatory Reporting

Information regarding forward contracts must be included in the financial institution’s call report. Following is a table that indicates where the information is to be reported.

The entire gross notional amount of the forward loans sales commitments, mandatory and best efforts, must be included in the financial institution’s call report as “forward contracts” including those hedging IRLCs and those covering the closed loan inventory. The derivative assets and liabilities are to be reported as indicated. Finally, the total of IRLCs and forward contracts are to be reported as shown.

Two other requirements should be noted:

1. Financial institutions may offset derivatives with negative fair values (liabilities) against those with positive fair values (assets) only if the criteria for “netting” under generally accepted accounting principles (GAAP) have been satisfied, which is essentially the right of legal offset.

2. In addition, Financial Institutions may not offset the fair value of forward loan sales commitments against the fair value of the IRLCs.

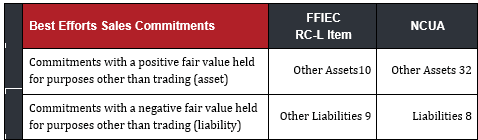

Best Efforts Commitments

In the case where a financial institution has elected to account for its best efforts commitment at fair value, it must report the following.

The required reporting under RC-L is subject to a dollar limitation generally equal to 10 percent of the bank’s total equity capital. Amounts below the threshold need not be reported. If the asset exceeds the threshold, then it must be reported on RC-L and RC-Q 6A and RC-Q Memoranda 1c. The reporting for RC-Q is subject to another threshold. The asset must exceed $25,000 and 25 percent of the total amount reported on RC-L 10.

If the liability exceeds the threshold, it must be reported on RC-L and RC-A 13 A and RC-Q Memoranda 2 c. The RC-Q threshold for other liabilities is $25,000 and 25 percent of the total amount reported on RC-L 9.

Mortgage Loans Held for Sale

Fair Value

We recommend that institutions elect to value the closed loans awaiting purchase at their fair value in accordance with FASB ASC paragraph 825-10-15-4(b). We believe the fair value of the committed loans is the price at which they could be sold in the principal market at the measurement date as a Level 2 input. Similarly, we believe the fair value of the forward sales commitments should be based on the gain or loss that would occur if the institution were to pair-off the transaction with the investor at the measurement date. We further believe this is a Level 2 input. Changes in the fair value of the loans should be offset by the changes in the fair value of the forward sales commitments and thus, there should be no overall gain or loss from changes in market interest rates on committed loans.

Similarly, we believe the appropriate uncommitted loan prices are Level 2 inputs as well. There may be an overall gain or loss depending on the economic effectiveness of the forward sales contracts as a hedge, since both the loans and the forward sales commitments are marked to market separately.

Required Disclosures

FASB ASC paragraph 820-10-50 requires the following disclosures:

- The fair value measurements at the reporting date;

- The level in the fair value hierarchy – Level 1, 2 or 3; and

- For Level 3 inputs, a reconciliation of beginning and ending balances, separately presenting changes during the period attributable to:

- Total gains and losses for the period (realized and unrealized), segregating those gains and losses included in earnings, and a description of where those gains and losses are reported in the statement of income

- Purchases, sales, issuances and settlements (net)

- Transfers in and/or out of Level 3

- The amount of total gains and losses in the period included in earnings that are attributable to the change in unrealized gains or losses relating to the loans still held at the reporting date and a description of where those unrealized gains or losses are reported in the statement of income.

In addition, the statement requires that for annual reporting, the valuation techniques used to measure fair value and a discussion of changes in valuation techniques, if any, during the period be disclosed.

Lower of Cost or Fair Value

If an institution does not elect “fair value” or “hedge” accounting, the closed loans awaiting purchase (warehouse loans) are accounted for at the lower of cost or fair value8.

FASB ASC paragraph 948-310-35 provides that the fair value for loans subject to investor purchase commitments (committed loans) and loans held on a speculative basis (uncommitted loans) are to be determined separately as follows:

Committed Loans – Mortgage loans covered by investor commitments shall be based on the fair values of the loans.

Uncommitted Loans – Fair value for uncommitted loans shall be based on the market in which the mortgage banking enterprise normally operates. That determination would include consideration of the following:

- Market prices and yields sought by the mortgage banking enterprise’s normal market outlets

- Quoted Government National Mortgage Association (GNMA) security prices or other public market quotations for long-term mortgage loan rates

- Federal Home Loan Mortgage Corporation (FHLMC) and Federal National Mortgage Association (FNMA) current delivery prices

We believe the forward sales commitments used to hedge the closed loan inventory and allocated to loans at the loan level (resulting in “committed loans”) can be used to determine the loans’ fair value. The fair value for uncommitted loans is calculated as described above.

The accounting then varies if market interest rates have increased or decreased since the loan was closed and whether or not the loan is committed or uncommitted. Following are the four possible scenarios:

Committed Loan – Market Rates Increase

If market rates have increased, the fair value of the forward loan sales commitment has increased and should be recorded. The loan has decreased in value by a similar amount and an institution should record a corresponding loss on the value of the loan. The result is no overall gain or loss to the institution.

Committed Loan – Market Rates Decrease

If market rates have decreased, the fair value of the forward loan sales commitment has decreased and the economic value of the loan has increased. However, the loan cannot be “written up” above cost, resulting in an overall loss.

Uncommitted Loan – Market Rates Increase

If market rates increase, the fair value of the forward sales contracts has increased and the value of the loan has decreased. The fair value of the loan and the contract are based on market prices. The result is an overall gain or loss depending on the economic effectiveness of the forward sales contract as a hedge.

Uncommitted Loan – Market Rates Decrease

If market rates have decreased the fair value of the forward loan sales commitment has decreased and the economic value of the loan has increased. However, the loan cannot be “written up” above cost, resulting in an overall loss.

Hedge Accounting

This asymmetrical accounting resulting from decrease in market interest rates has led some institutions to elect hedge accounting for their closed loan inventory. Hedge accounting for mortgage loans is an extremely complex area and is beyond the scope of this memo. Moreover, we believe the election of fair value is simpler and provides the same benefit.

Regulatory Implications

If a Financial Institution is accounting for its closed loan inventory at the lower of cost or fair value, then the forward loan sales commitments used to hedge them for economic purposes are treated as “non-hedging” derivatives for regulatory purposes.

The following disclosures are required if a Financial Institution elects to account for its closed loan inventory at fair value.

FFIEC

The total amount of gains and losses must be included on RI Memoranda 13a and RI-13b.

The total amount of loans held for sale measured at fair value must be reported on RC-C 1 and RC-Q 3 Level 2.

Significant Mortgage Banking Operations

In addition, banks with more than $1 billion of total assets and banks with less than $1 billion of total that engage in significant mortgage banking activities – defined as more than $10 million of loan originations or sales per quarter for 2 consecutive quarters must complete Schedule RC-P – 1-4 Family Residential Mortgage Banking Activities in Domestic Offices. The schedules require the following reporting:

- Retail originations during the quarter of 1-4 family residential loans for sale are reported on 1 a.

- Wholesale originations and purchases during the quarter of 1-4 family residential loans for sale are reported on 2 a.

- 1-4 family residential mortgage loans sold during the quarter are reported on 3 a.

- 1-4 family residential mortgage loans held for sale at quarter-end are reported on 4a.

- Noninterest income for the quarter from loan sales and servicing of 1-4 family residential mortgage loans is reported on 5a.

- Repurchases and indemnifications of 1-4 family residential mortgage loans during the quarter is reported on 6a.