Auto Loan Delinquency Trends: Steady Overall, Rising for Millennials [White Paper]

Key Takeaway

Wilary Winn offers comprehensive CECL calculations as well as capital stress testing, concentration risk analyses, and estimates of real return.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released June 2019

Introduction

This white paper is part of a continuing series highlighting credit trends in the consumer lending marketplace. See the Resources page of our website for other research. Our focus here is on the recent uptick in auto loan delinquencies. We begin with a brief summary of the overall consumer debt marketplace to provide context. Next, we discuss the auto loan marketplace in detail, including by type of lender. Finally, we discuss the financial well-being of the millennial generation in detail, as this segment of the United States population has exhibited steadily increasing rates of transition to seriously delinquent status on auto loans.

Total Consumer Debt

The following chart shows the United States total consumer debt, segregated by type, from 2003 to 2019. Total consumer debt has been steadily increasing since 2013 and totaled $13.67 trillion at 2019 Q1. The subcomponents of total consumer debt at 2019 Q1 included $9.24 trillion in mortgages, $0.41 trillion in HE revolving credit, $1.28 trillion in auto loans, $0.85 trillion in credit cards, $1.49 trillion in student loans, and $0.40 trillion in other. Outstanding amounts for student loans and auto loans were each at record highs as of 2019 Q1, while outstanding amounts for mortgages and credit cards were near record highs as of 2019 Q1.

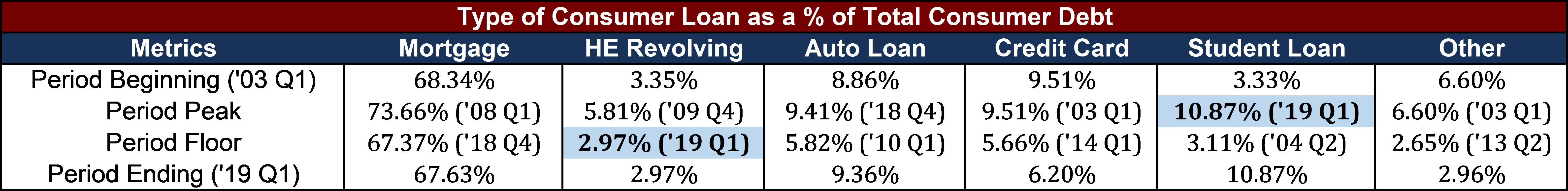

The following table compares the period beginning, peak, floor, and ending concentrations for each of the consumer debt types shown in the previous chart. Student loans significantly expanded from 3.33% of total consumer debt at 2003 Q1 to 10.87% of total consumer debt as of 2019 Q1. Auto loans floored at 5.82% of total consumer debt at 2010 Q1 and increased to 9.36% of total consumer debt as of 2019 Q1. At the same time, the concentrations of mortgages and HE revolving loans have been contracting, and were at 67.63% (near period floor) and 2.97% (period floor) of total consumer debt, respectively as of 2019 Q1. Reasons for changes in concentrations include rising education costs, record high average auto loan amounts, and declining homeownership rates.

Auto Debt by Lender Type

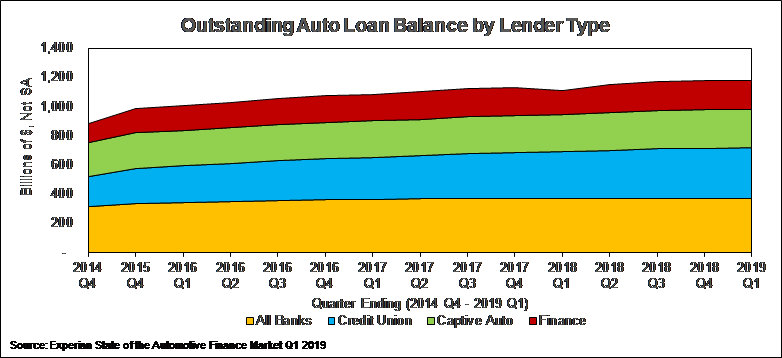

The following chart shows the outstanding auto debt segregated by lender type, from 2014 to 2019. According to the data from Experian, there were $1.18 trillion in auto loans outstanding as 2019 Q1, which consisted of $368 billion held by banks, $351 billion held by credit unions, $261 billion held by captive auto divisions, and $202 billion held by alternative finance companies1.

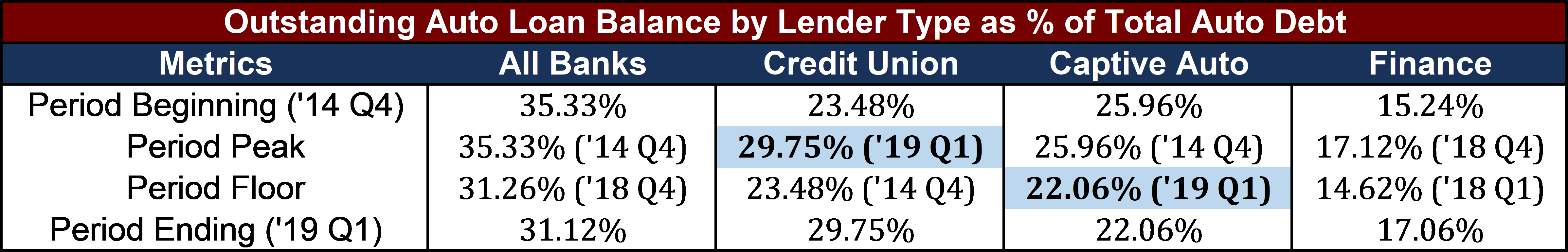

The following table compares the period beginning, peak, floor, and ending concentrations for each of the lender types shown in the previous chart. Over the period shown, credit unions and alternative finance companies have increased their market share at the expense of banks and captive auto lenders. As of 2019 Q1, auto loans held by credit unions comprised 29.75% (period peak) of the outstanding auto loan debt and finance companies held 17.06% (near period peak), whereas banks held 31.26% (near period floor) and captive auto lenders held 22.25% (period floor).

Originated Auto Loan Credit Quality

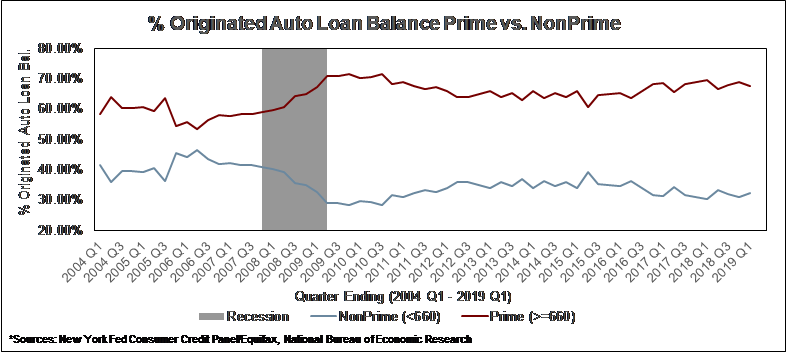

The following chart shows the percentage of originated auto loans that were prime (FICO score greater than or equal to 660) versus nonprime (FICO score less than 660), from 2004 to 2019. As can be seen in the chart, the quality of post-recession originated auto loans is better than pre-recession, due to lenders improving underwriting standards. The percentage of originated prime auto loans was 67.72% in 2019 Q1, which is near the shown period high of 71.74% in 2009 Q4. In 2015 Q2, 60.63% of originated auto loans were prime, which is a post-recession low.

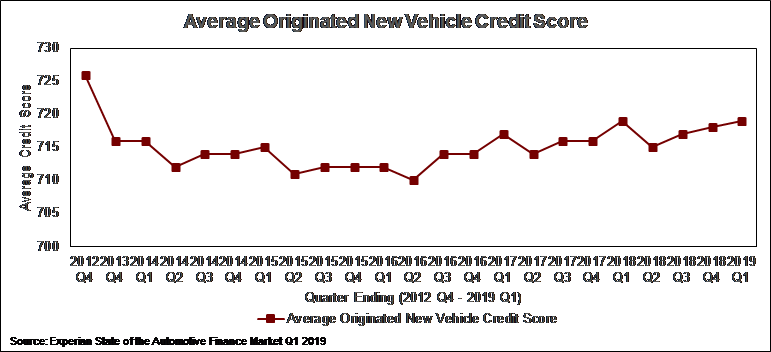

FICO scores are higher for new vehicle loans than for used. The following chart shows the average FICO score of originated new vehicle loans from 2012 to 2019. In 2019 Q1, the average FICO score of originated new vehicle loans was 719, which is the second highest value over the period shown, behind 726 in 2012 Q4.

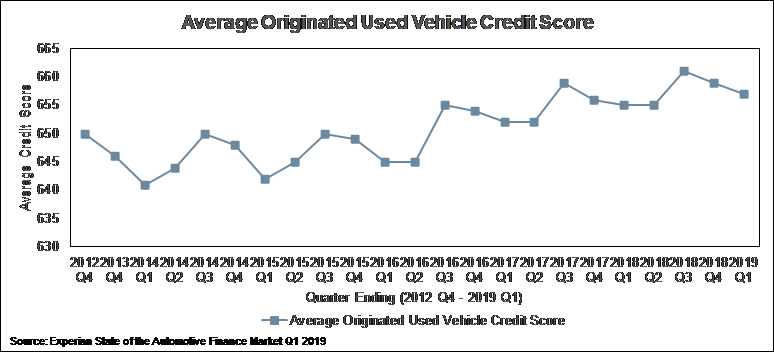

The following chart shows the average FICO score of originated used vehicle loans from 2012 to 2019. In 2019 Q1, the average FICO score of originated used vehicle loans was 657, which is the third highest value over the period shown, behind 661 in 2018 Q3 and 659 in 2018 Q4.

Outstanding Auto Loan Credit Quality

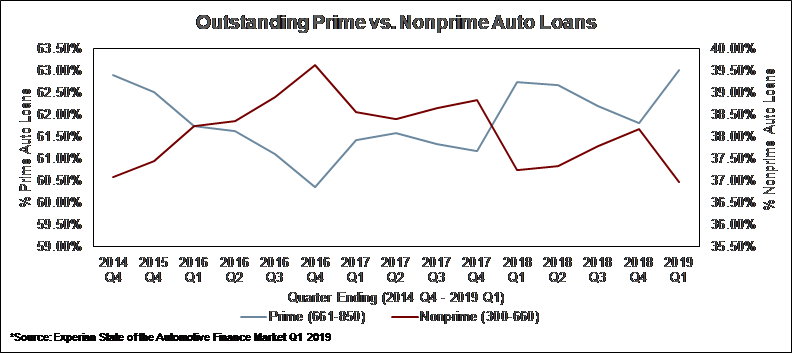

Outstanding balances varied slightly from the origination trends. As of 2019 Q1, prime auto loans totaled 63.02% of the outstanding balance compared to 67.72% of loan originations in 2019 Q1. Nonprime auto loans comprised 36.97% as of 2019 Q1, which is below the peak over the period shown of 39.64% at 2016 Q4.

Auto Loan 60 Day Delinquencies Rates

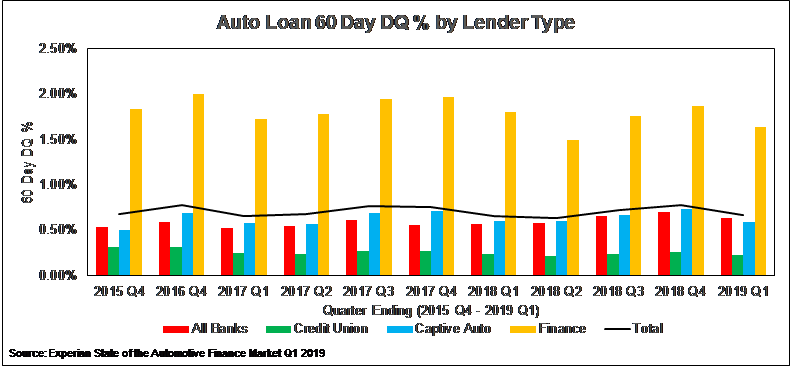

The following chart shows the 60-day delinquency rate for auto loans segregated by lender type, from 2015 to 20192. As can be seen in the chart, the total auto loan 60-day delinquency rate remained relatively unchanged from 2015 to 2019, with 0.67% of total auto loans 60 days delinquent as of 2019 Q1. Delinquencies vary significantly by lender type, as auto loan 60-day delinquency rates were 0.23% for credit union lenders, 0.63% for bank auto loans, 0.59% for captive auto division loans, and 1.64% for alternative finance auto loans. We note the 60-day delinquency rate for alternative finance lenders is significantly higher due to their propensity for lending to riskier subprime borrowers.

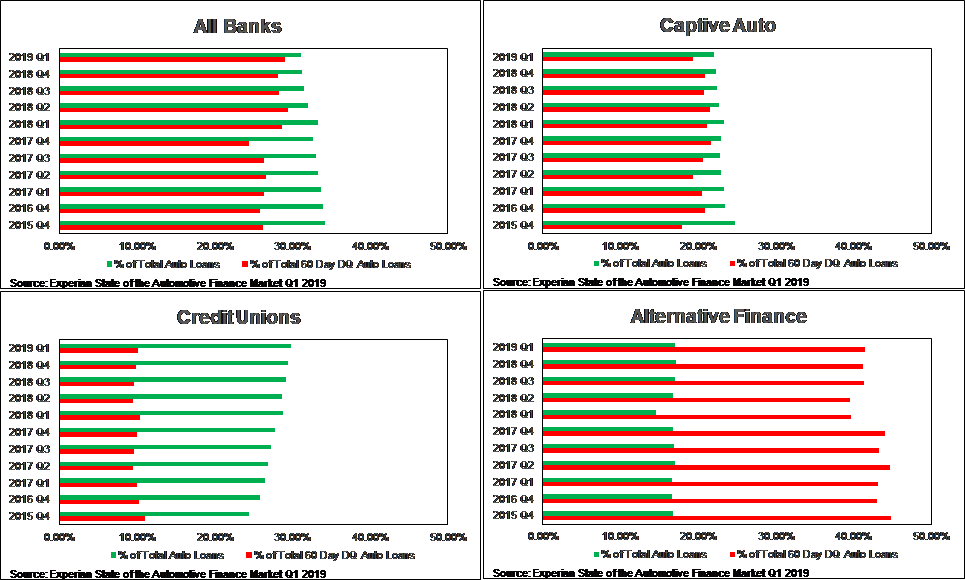

The following charts compare each lender type’s share of total outstanding auto loans (green bars) to its respective share of total outstanding 60-day delinquent auto loans (red bars) from 2015 to 2019.

Credit unions had a 10.15% share of total 60-day delinquent auto loans as of 2019 Q1, which is significantly lower than their 29.75% share of total outstanding auto loans at the same date.

Conversely, alternative finance lenders had a 41.49% share of total 60-day delinquent auto loans as of 2019 Q1, which is significantly higher than their 17.06% share of total outstanding auto loans at the same date. Banks and captive auto divisions had relatively equal shares of total outstanding auto loans and total outstanding 60-day delinquent auto loans as of 2019 Q1.

Auto Loan 90 Day Delinquencies Rates

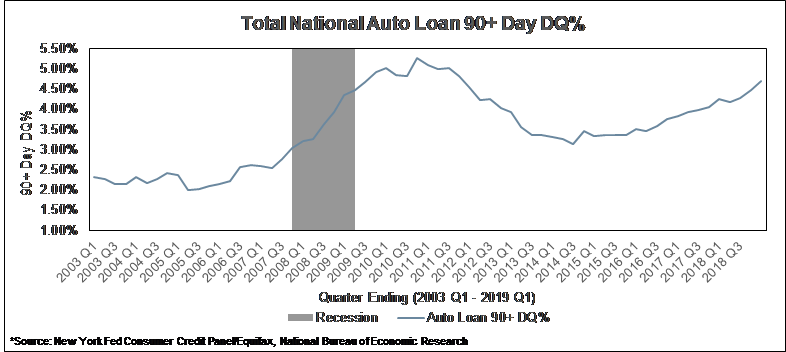

The following chart shows the national 90+ day delinquency rate for auto loans from 2003 to 20193. As of 2019 Q1, the national 90+ day delinquency rate on auto loans was 4.69%, which is lower than the post-recession peak of 5.27% at 2010 Q4, but also significantly higher than the post-recession floor of 3.14% at 2014 Q3. This poses the following question: why is the national 90+ day delinquency rate rising on auto loans given that credit scores on originated auto loans has been steadily improving and the 60-day delinquency rate on auto loans has remained relatively unchanged in recent years?

The answer to that question appears to be linked to increasing transitions to 90+ day delinquency status within the 18-29 and 30-39 age groups. The following chart shows the percentage of auto loans transitioning from a 30-60 day delinquency status to a 90+ day delinquency status, stratified by select age groups. At 2014 Q1, the 18-29 and 30-39 age groups were transitioning to a 90+ day delinquency status at rates of 2.30% and 2.34%, respectively. As of 2019 Q1, the 18-29 and 30-39 age groups were transitioning to a 90+ day delinquency status at significantly higher rates of 4.15% and 3.00%, respectively. This poses another question, why are millennials (which Pew Research Center defines as individuals age 23 to 38 in 2019) struggling with their car payments?

On a side note, the same age groups haven’t displayed a similar dramatic run-up in transition to 90+ day delinquency status on total loans, as shown in the following chart. This could be indicative of millennials being more willing, or more able, to default on their auto loans as opposed to their student loans, credit cards, or mortgages.

Millennials

The millennial generation, including individuals aged 23 to 38 in 2019, makes up approximately a fifth of the United States population. Some regions have a higher share of millennials (West with 23.29%), others have a lower share of millennials (Midwest with 21.26%), but millennials are roughly about a fifth of the population of each region and nationally. Given that the higher end of the millennial cohort is age 38, it can be stated that the generation is beginning to assume the important role of being the primary drivers of the U.S. economy, oft occupied by the middle-aged. Thus, the economic livelihood of the millennial generation will play a pivotal role in overall economic performance in the coming decade. This fact makes the increasing transition to 90+ day delinquency status on auto loans for millennials all that more concerning and warrants further investigation into the economic well-being of the millennial generation. We begin our millennial analysis by showing that total debt held by the cohort has been increasing. Next, we point out that millennial unemployment rates are near historic lows and that the cohort has experienced modest growth in inflation-adjusted earnings. Finally, we discuss that the combination of increased leverage and decreased net worth for millennial households is potentially causing the cohort to transition to 90+ day delinquency status on auto loans at a higher rate.

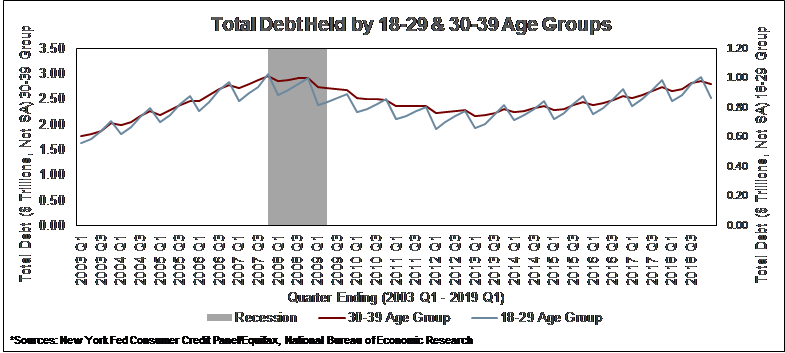

The following chart shows total debt held, not seasonally adjusted, by the 18-29 and 30-39 age groups, from 2003 to 2019. As of 2019 Q1, the 18-29 and 30-39 age groups had $2.80 trillion and $0.86 trillion in debt, respectively, which is near shown period highs of $2.96 trillion and $1.03 trillion at 2007 Q4. Though slightly concerning, the rise in total debt is not entirely meaningful without adjustments for inflation and population.

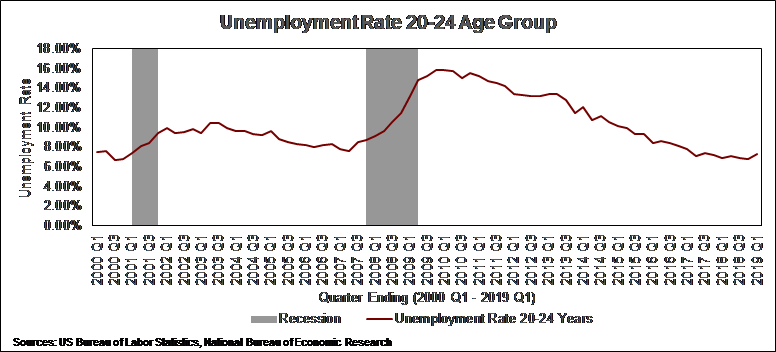

The following chart shows the unemployment rate for the 20-24 age group from 2000 to 2019. As of 2019 Q1 the unemployment rate for the 20-24 age group was 7.30%, which is near the low for the period shown of 6.70% at 2000 Q3.

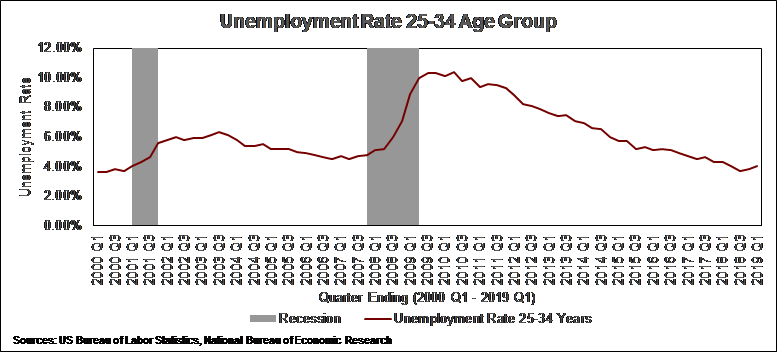

The following chart shows the unemployment rate for the 25-34 age group from 2000 to 2019. As of 2019 Q1 the unemployment rate for the 25-34 age group was 4.00%, which is near the low for the period shown of 3.60% at 2000 Q2.

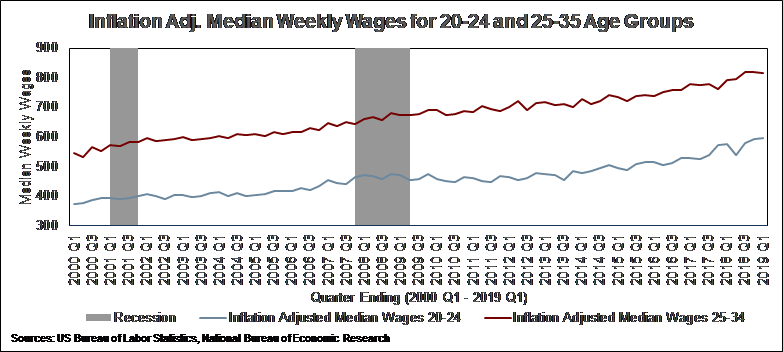

The following chart plots the inflation-adjusted median weekly wages for the 20-24 and 25-34 age groups from 2000 to 2019. Between 2000 Q1 and 2019 Q1, the inflation-adjusted median weekly wages for the 20-24 and 25-34 age groups grew at annual rates of 2.48% and 2.14%, respectively. Growth in inflation-adjusted median weekly wages is indicative of an increase in spending power.

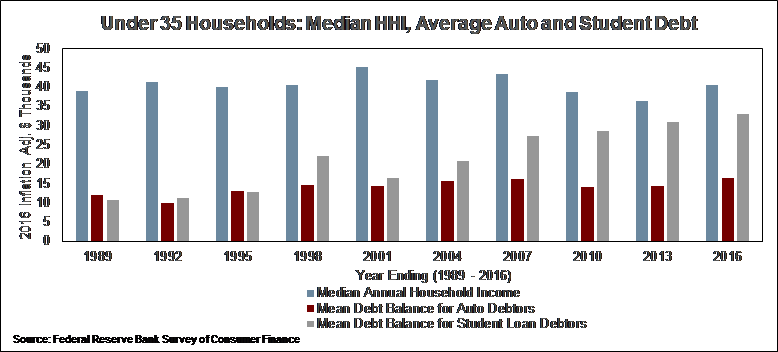

The following chart plots median household income, against the mean value of auto debt for those with auto debt, and the mean value of student debt for those with student debt, for under age 35 households from year-ends 1989 to 2016. Dollar amounts are adjusted for inflation and stated in 2016 dollars4. Worth noting given the differences in income growth trajectory, data for this chart pertains to under 35 households and is inflation adjusted based on 2016, whereas the previous chart pertained to individuals in the 20-24 and 25-34 age groups and was inflation adjusted for 2019. As can be seen in the chart, median household income remained relatively unchanged between 1989 and 2016 for under 35 households, whereas the average auto and student loan debt balances have increased dramatically. In 2016, the median household income for under 35 households was $40,500, the average amount of auto debt for auto debtors was $16,300, and the average amount of student debt for student debtors was $33,000. This is a far cry from 1992, when the median household income for under 35 households was $41,300, the average amount of auto debt for auto debtors was $9,900, and the average amount of student debt for student debtors was $11,200.

We believe this debt pressure caused the net worth of millennials to decline.

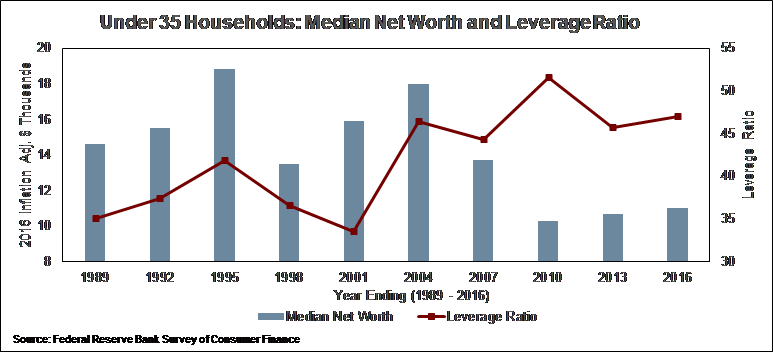

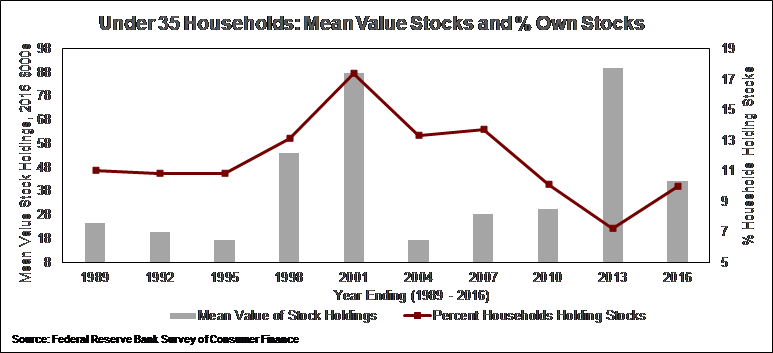

The following chart plots the median net worth against the leverage ratio for under 35 households, from year-ends 1989 to 2016. The net worth of under 35 households has increased little since the aftermath of the financial crisis and is significantly lower relative to pre-recession highs. How can this be the case given that the economy is booming, and the stock market is on an historic bullish run?

A big part of the reason is that under 35 households largely missed out on the post-crisis bull market run-up. The following chart plots the average value of stock holdings for those who held stocks against the percentage of households that owned stocks, from year-ends 1989 to 2016. In 2007, 13.7% of under 35 households held stocks. In 2013, that number was down to 7.2%. Plummeting stock prices and portfolio values stemming from the recession led to young adults shying away from equity markets, and as a result, many households missed out on the run-up. From December 2010 to December 2016, the S&P 500 returned an annualized 12.65% with dividends reinvested, whereas from December 2016 to December 2018 that number was down to 8.95%. It is concerning that under 35 households are beginning to increase their ownership of stocks at what could be the tail-end of the bull market, especially in the context of the previously outlined issues of low median net worth and an increasing transition to 90+ day delinquency rates on auto loans.

Conclusion

Automobile debt is only a fraction of total consumer debt, but any signs of weakness in the consumer credit market are worth monitoring. The overall asset quality of outstanding and new originations on auto loans remains strong and overall auto loan delinquency rates remain near post-recession lows. However, the millennial generation has exhibited significant increases in the rate of transition from a 30-60 day delinquency status to a 90+ day delinquency status on auto loans in recent years. This is especially concerning given that the millennial generation is supposed to be the future engine of the United States economy, and the additional context that millennial households have a poor net worth, a high leverage ratio, and are beginning to increase holding of stocks at what might be the end of the bull market.

Endnotes

- The total outstanding auto debt figure is calculated differently in the first chart (data from NYFed) and second chart (data from Experian). The NYFed includes “severely derogatory balances”, while Experian doesn’t. ↩︎

- Per Experian regarding their 60-day delinquency rate calculation methodology: “Our report is using a 60 day delinquency rate which is from 60-89 days. We also only count the first instance of delinquency in the quarter.” ↩︎

- This national 90+ day delinquency rate for auto loans, which comes from the New York Federal Reserve, includes severely derogatory auto loans in the calculation, whereas the previous charts did not. An economist at the New York Federal Reserve described the severely derogatory status to me in the following way: “we include severely derogatory balances in our calculation, which include charge off and repo balances can stick in our data as the lenders continue to report them on borrowers’ credit reports”. ↩︎

- Means and medians aren’t apples to apples (median auto and student debt metrics weren’t available), but the chart still paints an insightful picture into the changes in economic standing for America’s young adults. ↩︎