BASEL III [White Paper]

Key Takeaway

We provide valuation, financial accounting and regulatory capital advice related to loan servicing rights, non-Agency MBS and TruPs.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released January 2015

Introduction

BASEL III introduced major changes to the calculation of risk-based capital. It had direct effects on our clients that:

- Owned mortgage servicing rights;

- Owned TruPs;

- Owned non-Agency MBS; and/or

- Sold loans to the FHLBanks under a limited recourse program.

Guidance regarding reporting for mortgage servicing rights and the FHLB credit enhancement obligation can be found in Wilary Winn’s Accounting and Regulatory Guidance for the Mortgage Partnership Finance® Program (April 2020, Version 11), available on the Resources page of our website.

The focus of this paper is the risk weightings for securitizations, including the synthetic securitization arising from the MPF program credit enhancement.

The BASEL III reporting rules become effective January 1, 2015. As you are all aware, the rules have four primary objectives:

- Increase the quantity of regulatory capital – by increasing minimum regulatory capital percentages for selected capital categories;

2. Increase the quality of regulatory capital – by introducing a new Common Equity Tier 1 category, restricting elements that can be counted as capital, and establishing new deductions and limitations;

3. Promote regulatory capital conservation – by introducing a Capital Conservation Buffer which restricts activities such as paying dividends or executive bonuses unless the threshold is met; and

4. Improve regulatory capital risk sensitivity – by adjusting risk weightings and credit conversion factors.

The new rules directly affect our clients in four ways:

1. The total mortgage servicing rights asset is limited to 10% of Common Equity Tier 1 Capital and is included in the 15% capital threshold limitation along with deferred net operating loss carrybacks and significant investments in the capital of unconsolidated financial institutions in the form of common stock. The amount of the eligible MSR asset is subject to a 250% risk weight beginning January 1, 2018.

2. The amount of TRuP CDOs that a bank can own is limited to 10% of Common Equity Tier 1 provided that it is a non-significant investment (it owns less than 10% of the TRuP issuing bank’s common stock). The amounts deducted from each category of capital are based on the corresponding deductions approach and the eligible portion is risk-weighted under the securitization rules.

3. Non-Agency MBS are risk-weighted under the new securitization rules.

4. The credit enhancement obligation arising from the Federal Home Loan Banks’ MPF programs is treated as a synthetic securitization and is subject to new risk weighting.

Guidance regarding reporting for mortgage servicing rights and the FHLB credit enhancement obligation can be found in Wilary Winn’s Accounting and Regulatory Guide for the Mortgage Partnership Finance Program® (April 2020, Version 11), available on the Resources page on our website.

The focus on the remainder of this Wilary Winn Perspective is on the risk weightings for securitizations, including the synthetic securitization arising from the MPF program credit enhancement. To understand the requirements, we will begin with the BASEL III definitions:

“A securitization exposure is an on-balance sheet or off-balance sheet credit exposure (including credit-enhancing representations and warranties) that arises from a traditional securitization or synthetic securitization (including a re-securitization).”

The exposure amount for the on-balance sheet component of an exposure is equal to its carrying value (except for an available-for-sale or held-to-maturity security if the bank has made an AOCI opt-out election). If the bank has made an AOCI opt-out election, the exposure amount for an available-for-sale or held to maturity security is the bank’s carrying value less unrealized gains and plus any unrealized losses.

The exposure for the off-balance sheet credit enhancement obligation is equal to the dollar amount of credit enhancement obligation.

The exposure can be risk-weighted in one of three ways:

1. Multiply the exposure by 12.5 and include the resulting amount in risk-weighted assets thus reducing capital dollar for dollar.

2. Use the Simplified Supervisory Approach (“SSFA”)

3. Use the Gross-Up Method

If a bank elects to use the Gross-Up Method or the SSFA it must do so consistently across all of its securitization exposures and the exposure under either approach is subject to a risk-weighting floor of 20%.

Simplified Supervisory Formula Approach

Under the SSFA approach, the risk weighting is determined using a relatively complex set of calculations. The calculation begins with an analysis of the capital requirements that apply to all exposures underlying the securitization. Risk weights are assigned based on the subordination level of an exposure. The formula assigns relatively higher capital requirements to the riskier junior tranches in a securitization which are designed to absorb losses first, while the senior tranches benefit from the subordination provided by the junior tranches. Risk weights are also dependent on the level of credit support and delinquencies within the underlying group of loans. Risk weights increase as the credit support for a particular security deteriorates or when delinquencies in the underlying group of loans increase.

We note that Wilary Winn has an SSFA risk-weighting tool for the MPF program available on our website at www.wilwinn.com under Resources. We further note that Wilary Winn includes the required BASEL III risk weights for our non-Agency MBS and TruP CDO clients as part of our valuation reports. If you are not a client, please call us at 651-224-1200 or e-mail us at [email protected].

For readers who are interested in the details of the SSFA approach, a step-by-step description of the calculation follows.

Begin with the calculation of KG.

KG – is equal to the weighted-average risk weight of the underlying exposures – which in our non-Agency MBS example is 4 percent for current loans and 8 percent for loans which are 90+ days delinquent or in non-accrual. Adjust KG for delinquent loans to derive KA according the following formula:

KA = (1-W)*KG + (0.5*W)

W = The proportion of the loans sold and outstanding that meet the following criteria:

• Ninety days or more past due;

• Subject to a bankruptcy or insolvency proceeding;

• In the process of foreclosure

• Held as real estate owned

• Has contractually deferred interest payments for 90 days or more

• Is in default

Next, determine the attachment and detachment points. A is the attachment point and is equal to the amount of subordination or credit protection under a bank’s exposure. D is the detachment point and is equal to the subordination plus the exposure. Essentially A represents the point at which a bank begins incurring losses and D represents the point at which it would no longer be incurring losses.

If the detachment point percentage D is less than or equal to KA, the risk weighting is 1,250 percent. This is because the resulting calculation will result in an increase to risk-weighted assets of less than 50 percent – the baseline capital requirement. In this circumstance, the regulation essentially requires dollar-for-dollar capital treatment. If A is greater than or equal to KA, the risk weight is equal to KSSFA times 1,250 percent, subject to a minimum supervisory floor of 20 percent.

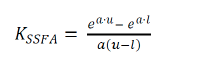

The KSSFA formula is determined as follows:

The KSSFA formula calculates the theoretical losses a bank could incur over the life of the underlying loans based on its exposure and the amount of credit enhancement benefit it enjoys. The formula essentially fully recognizes the benefit of the credit enhancement up to the required baseline capital percentage of KA. The calculation is then based on the losses that a bank could incur by comparing the exposure to the amount of the credit enhancement amount in excess of the baseline capital requirement.

If D is less than KA, then risk weight is equal to 1250%. If A is greater than or equal to KA, risk weight is KSSFA times 1250%.

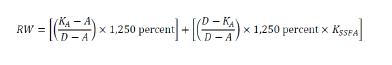

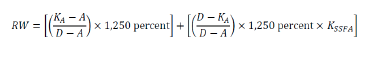

If A is less than KA and D is greater than KA the applicable risk weight is a weighted average of 1,250 percent and KSSFA times 1,250 percent.

The precise formula is as follows:

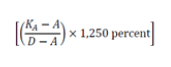

Risk weight = greater of:

; and

20 percent (Supervisory Floor)

This formula begins by comparing the credit enhancement percentage to the required baseline capital percentage of KA. The first part of the formula requires dollar for dollar capital treatment for any shortfall in the credit enhancement percentage compared to KA based on the losses a PFI could incur given its exposure and its credit enhancement percentage.

The second part of the formula is a calculation of the losses a bank could incur in excess of the required baseline capital requirement of KA using the KSSFA formula.

As an example, we look at the risk weighting for a mezzanine non-agency mortgage-backed security under the SSFA approach:

The financial institution holds this security with a carrying value of $200,000, which is also the security’s exposure amount. Loans that are 90 + days delinquent or in non-accrual status account for 9.93% of the security, which is parameter W under SSFA.

Therefore, KG is calculated as:

KG = 4% * (1 – 9.93%) + 8% * (9.93%)

KG: 4.40%

Parameter W is essentially the percentage of loans that are 90 + days delinquent or in non-accrual status: 9.93%

Next, we calculate KA as:

KA = (1-W)*KG + (0.5*W)

KA: 8.93%

The attachment point A is equal to the amount of subordination or credit protection under a bank’s exposure. D is the detachment point and is equal to the subordination plus the exposure.

Attachment Point (A): 6.29%

Detachment point (D): 11.34%

Parameter ρ is set to 0.5:

ρ: 0.5

Parameter α is computed using the following equation: 1/ ρ* KA

α: -22.41

Parameter μ is computed using the following equation: D – KA

μ: 2.41%

Parameter ɩ is equal to A – KA with a floor of 0%

ɩ: 0.00%

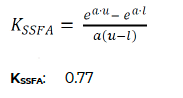

We then compute KSSFA:

If D is less than KA, then risk weight is equal to 1250%. If A is greater than or equal to KA, risk weight is KSSFA times 1250%. Since our example does not satisfy these criteria, risk weight is calculated using the following formula:

Risk Weight (RW) = 11.14

The total increase to risk-weighted assets under SSFA is equal to the exposure amount time risk weight, with a floor of 20%.

Increase to risk weighted assets = 200,000 * 11.14 = $2,228,000

Gross-Up Method

To use the gross-up approach, a bank must calculate the following four inputs:

- Pro rata share, which is the par value of the bank’s securitization exposure as a percent of the par value of the tranche in which the securitization exposure resides;

- Enhanced amount, which is the par value of tranches that are more senior to the tranche in which the banks’ securitization resides;

- Exposure amount of the securitization exposure as discussed earlier; and

- Risk weight, which is the weighted-average risk weight of underlying exposures of the securitization.

The credit equivalent amount of a securitization exposure under this section equals the sum of:

- The exposure amount of the banks’ securitization exposure; and

- The pro rata share multiplied by the enhanced amount.

To calculate risk-weighted assets for a securitization exposure under the gross-up approach, a bank must apply the risk weight required under the rules to the calculated credit equivalent amount. Similar to the SSFA approach, the risk weight under the gross-up approach is subject to a floor of 20% of the exposure amount.

As an example, we look at the risk weighting for same mezzanine non-agency mortgage-backed security described in the previous section under the Gross-Up approach:

Institution’s Par Value: 400,000

Tranche Current Balance: 2,400,000

The pro-rata share is calculated by dividing the institution’s par value into the trance current balance:

The pro-rata share is calculated by dividing the institution’s par value into the trance current balance:

Pro rata share: 16.67%

The exposure amount is equal to the carrying value of the Security:

Exposure Amount: 200,000

The enhanced amount is the par value of all the tranches that are more senior to the tranche in which the exposure resides:

Enhanced Amount: 39,000,000

We calculate the Credit Equivalent Amount, which is the sum of the exposure of the banking organization’s securitization exposure and the pro rata share multiplied by the enhanced amount:

Credit Equivalent Amount: 200,000 + (39,000,000 * 16.67%) = 6,700,000

The next step is to calculate the risk-weight of the underlying loans within the Security’s collateral group. A 50% risk-weight is assigned to all loans that are current, whereas a 100% risk-weight is assigned to loans that are delinquent.

90+ Day DQ: 9.93%

Underlying RW: 50% * (1 – 9.93%) + 9.93% = 54.97%

The risk-weighted assets under the gross-up approach is the applicable risk weight times gross-up credit equivalent amount.

RW Assets: 54.97% * 6,700,000 = $3,682,655

Conclusion

In our example, a bank would be better off reporting the securitization under the SSFA method rather than the Gross-Up method because the amount included in risk-weighted assets would be $2,228,000 compared to $3,682,655.