Beyond CECL Compliance: Leveraging CECL for Strategic Decision-Making [White Paper]

Key Takeaway

By leveraging the insights gained from CECL, institutions can move beyond compliance to achieve improved strategic decision-making and a stronger competitive position.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released June 2025

Introduction

This white paper explores the opportunity to use Current Expected Credit Loss (CECL) as a strategic tool for improved decision making. By leveraging data, models, and insights gained from CECL, financial institutions can make more informed strategic decisions to strengthen financial performance and gain a competitive advantage. This white paper demonstrates how integrating CECL into broader strategic decision frameworks can transform a regulatory requirement into a competitive advantage.

By leveraging CECL for strategic decision-making, financial institutions can achieve improved financial performance and a stronger competitive position.

Leveraging CECL for Strategic Decision-Making

The primary objective of this white paper is to demonstrate how CECL can be leveraged for strategic decision-making. While initially designed to improve the accuracy of credit loss accounting, CECL provides financial institutions with a wealth of actionable data that extends far beyond compliance. By utilizing the forward-looking nature of CECL models, institutions can uncover valuable insights into portfolio performance, credit risk trends, and long-term economic impacts. These insights enable organizations to integrate risk management more effectively into strategic planning and design data-driven strategies that provide a competitive edge and improve profitability.

Integrating CECL Into Strategic Decision-Making

The CECL standard fundamentally reshaped the way financial institutions evaluate and manage credit risk. By requiring the estimation and recognition of expected losses over the lifetime of a loan, CECL introduces a forward-looking, data-driven approach to credit loss measurement. While initial efforts have largely focused on achieving compliance and operational integration, the true potential of CECL lies in its capacity to generate actionable insights that extend well beyond regulatory requirements.

By leveraging granular loan-level data, advanced modeling techniques, and a deeper understanding of portfolio dynamics, CECL gives financial institutions the ability to analyze and respond to credit risk. These insights create opportunities to optimize loan portfolios, implement risk-adjusted pricing strategies, and identify new opportunities, making CECL a driver of competitive advantage.

This paper examines how financial institutions can move beyond compliance to leverage the strategic value of CECL. By incorporating CECL insights into core business strategies, institutions can strengthen their risk management practices and identify and capitalize on new opportunities, ensuring a competitive advantage improved financial performance.

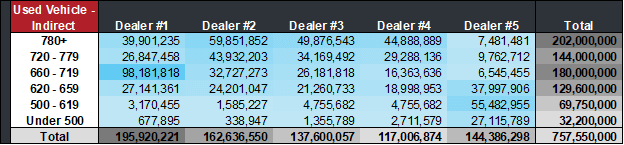

Portfolio Management And Optimization

One of the most valuable strategic applications of CECL is its ability to enhance portfolio management through a granular, data-driven approach. Using loan-level detail in CECL modeling allows institutions to identify underperforming segments with greater precision. For example, analyzing indirect loan performance by dealer and credit cohort can reveal patterns of adverse selection, where certain dealers consistently originate loans that result in increased losses. The following table displays a Used Vehicle – Indirect portfolio stratified by credit cohort and dealer. As shown below, while nearly 70% of the total portfolio is considered Prime, the concentration in Prime loans from Dealer #5 is only 16%.

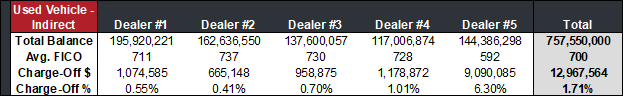

Moving one step further, the following table displays the total balance, average FICO score, and charge-off details by dealer. The portfolio as a whole looks relatively healthy, with an average FICO score of 700. However, a disparity is clearly present when comparing Dealer #5 to the others. The average FICO score for loans from Dealer #5 is 592, well below the portfolio average of 700. As a result, loans from Dealer #5 produce the most charge-offs. Despite making up only 19% of the total Used Vehicle – Indirect portfolio, loans from Dealer #5 drive 70% of the actual charge-offs. This insight enables financial institutions to reassess dealer relationships, implement stricter underwriting controls, or, if necessary, to exit unprofitable partnerships to protect portfolio quality.

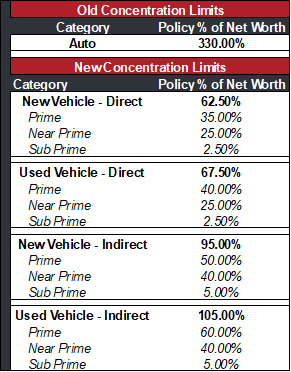

Beyond identifying underperforming segments, CECL data can be used to develop more refined credit risk sub-limits, ensuring that growth strategies are aligned with risk tolerance. Rather than applying broad portfolio-wide limits, financial institutions can establish differentiated concentration limits based on credit quality, loan type, or geographic region. This approach not only strengthens risk management but also supports strategic growth by directing resources toward lower-risk areas with more favorable credit performance. The following table illustrates how concentration limits can be expanded from a single, broad category to a more granular set of categories with additional sub-limits for credit quality. The expanded limits provide a clearer framework for managing exposure and optimizing portfolio performance.

Furthermore, these sub-limits can be adjusted dynamically in response to changing economic conditions. During periods of economic uncertainty or downturns, institutions can use CECL-driven insights to scale back exposure to higher-risk segments, limiting origination in areas more vulnerable to credit deterioration. Conversely, as economic conditions improve and credit performance stabilizes, sub-limits on riskier loan segments can be selectively increased to capture higher-yielding opportunities. This adaptive approach ensures that portfolio management remains both disciplined and responsive, enabling institutions to balance risk and return effectively across economic cycles.

By integrating CECL insights into portfolio management strategies, financial institutions can enhance their ability to identify risks, optimize capital deployment, and improve overall portfolio performance. The depth of analysis made possible by CECL strengthens risk oversight and also provides a structured framework for strategic decision-making that aligns with dynamic market conditions.

Loan Pricing and Product Design

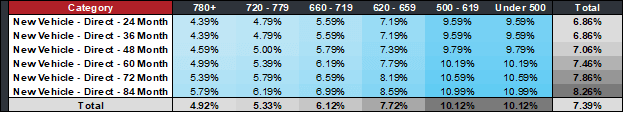

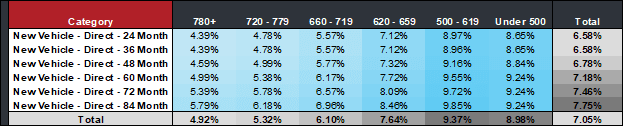

CECL’s forward-looking credit loss estimation provides financial institutions with a framework for developing more precise risk-adjusted pricing strategies. By leveraging granular loan-level data, institutions can align loan pricing with expected credit risk, ensuring that loans to higher-risk borrowers are priced appropriately while competitive rates can be offered to lower-risk segments. This approach enhances both risk management and profitability by ensuring that pricing decisions accurately reflect the underlying risk profile of each loan. For example, the following table contains pricing for New Vehicle – Direct loans stratified by term and credit score. As shown below, a clear risk-based pricing strategy is displayed as offered rates increase, as loan terms lengthen, and as credit scores decrease.

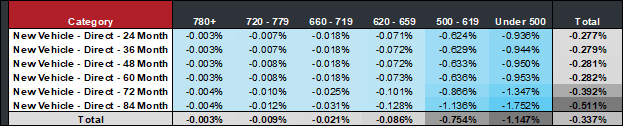

With insights provided from CECL modeling, institutions can then determine the expected losses at the same granularity, which can then be used to determine the negative yield component, as shown below.

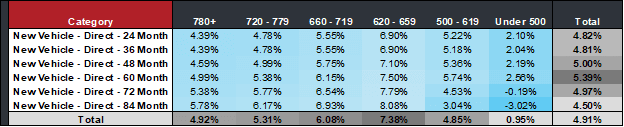

Lastly, by combining the two, an institution has insight into how well the risk-based pricing strategy holds under expected losses. As shown in the table below, the risk-adjusted returns remain positive across all terms and credit cohorts, indicating that the risk-based pricing strategy adequately compensates for the increase in losses expected in higher-risk loans.

Beyond pricing optimization, CECL insights can inform product design strategies by identifying borrower segments that offer strong credit performance and lower expected losses. For example, institutions can develop targeted loan products such as home equity loans specifically designed for borrowers with low loan-to-value (LTV) first mortgages. These borrowers present a more favorable risk profile due to their substantial equity positions, reducing the likelihood of default and potential loss severity. By designing products that align with favorable credit characteristics, financial institutions can expand lending opportunities while continuing to manage credit risk.

Furthermore, CECL-driven product development can be dynamic, adjusting to shifting economic conditions and evolving risk trends. During periods of economic stability, institutions may expand offerings to include slightly riskier borrower segments with appropriate pricing adjustments. Conversely, in times of economic uncertainty, product structures and pricing can be adjusted to limit exposure to higher-risk segments while maintaining loan growth in more stable asset classes. For example, the table below represents the same risk-based pricing strategy displayed previously. However, results are based on CECL modeling that incorporates a severely adverse economic environment.

As shown above, the risk-based pricing strategy shows signs of stress, particularly in the longer-term, lower credit cohorts. In this situation, an institution would have the insight to be able to react and adjust pricing accordingly. While the scenario modeled is highly unlikely, it displays the power offered by detailed CECL modeling and the insights that can be incorporated into strategic decisions.

By integrating CECL analytics into loan pricing and product design, financial institutions can create a more disciplined and responsive lending strategy. This improves risk-adjusted returns and also enhances market competitiveness by enabling institutions to offer well-structured products that meet the needs of borrowers as well as the institution’s risk appetite.

Product and Customer Strategy

CECL’s ability to provide granular insights into borrower risk profiles enables financial institutions to refine their product and customer strategies with greater precision. By segmenting borrowers based on expected credit performance, institutions can identify and prioritize lower-risk borrowers for retention efforts. Proactively engaging these borrowers with competitive loan offers, rate incentives, or loyalty programs can strengthen relationships and reduce attrition, preserving a stable and high-quality loan portfolio.

Beyond credit risk segmentation, CECL data can be leveraged to assess overall customer profitability by integrating expected loan performance with deposit behaviors and funding costs. By netting expected loan returns against deposit costs and other account-related expenses, financial institutions can develop a more comprehensive view of each customer’s contribution to overall profitability. This approach allows institutions to focus growth efforts on relationships that provide the most value, rather than solely on credit risk or loan yield in isolation.

CECL-driven insights also enable institutions to tailor cross-selling and upselling strategies with a focus on both risk and profitability. Borrowers with lower expected losses can be targeted for additional lending products, such as home equity loans, personal lines of credit, or auto refinancing, ensuring that credit expansion efforts align with sound risk management principles. Additionally, institutions can design product offerings that enhance overall relationship value, such as bundling loan products with deposit accounts or wealth management services, optimizing both revenue and risk-adjusted returns.

By integrating CECL insights into product and customer strategy, financial institutions can move beyond broad, one-size-fits-all approaches to a more data-driven, targeted framework. This ensures that lending and marketing efforts are not only aligned with risk appetite but also focused on maximizing long-term customer value and institutional profitability.

Conclusion

The CECL standard fundamentally changed how financial institutions assess and manage credit risk. CECL’s forward-looking framework provides a valuable opportunity to enhance strategic decision-making well beyond compliance. Institutions that systematically incorporate CECL insights into their broader strategy can strengthen risk management practices, optimize capital allocation, and improve portfolio performance.

CECL’s predictive capabilities, grounded in detailed loan-level data and economic forecasting, enable institutions to take a more proactive approach to risk. Leveraging these insights allows financial institutions to refine loan pricing models, inform product development, and enhance long-term planning. Additionally, CECL-driven analytics can support strategic initiatives such as geographic expansion, mergers and acquisitions, and stress testing.

Integrating CECL across an institution maximizes strategic value by ensuring that risk, finance, and executive leadership teams collaborate effectively. Institutions must also invest in data quality, modeling sophistication, and technology infrastructure to fully realize CECL’s potential as a decision-support tool.

Financial institutions that view CECL as more than a compliance exercise are better positioned to manage uncertainty and drive sustainable growth. By embedding CECL insights into strategic planning, institutions can enhance decision-making processes, improve financial performance, and maintain a competitive advantage in a constantly changing environment.