Beyond CECL Compliance: Leveraging CECL to Enhance Risk Management [White Paper]

Key Takeaway

Wilary Winn provides holistic solutions to measure, monitor, and mitigate interest rate, liquidity and credit risk on an integrated basis. By leveraging the insights gained from CECL, institutions can move beyond compliance to achieve enhanced risk management and a stronger competitive position.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released August 2024

Introduction

This white paper explores the opportunity to use CECL as a strategic tool for enhanced risk management. By moving beyond the minimum compliance requirements, financial institutions can leverage the data, models, and insights gained from CECL to develop a deeper understanding of their credit risk profiles and make more informed decisions. This white paper demonstrates how integrating CECL into broader risk management frameworks can transform a regulatory requirement into a competitive advantage.

By focusing solely on compliance, institutions are missing a crucial opportunity to transform CECL into a strategic tool that can enhance their risk management practices.

The primary objective of this white paper is to demonstrate how CECL can be leveraged for strategic risk management. By moving beyond compliance, financial institutions can transform CECL into a powerful tool for improving risk insights, enhancing predictive analytics, and making more informed strategic decisions, including capital at risk. This paper aims to provide a comprehensive guide on integrating CECL into broader risk management practices, thereby turning a regulatory requirement into a competitive advantage.

Regulatory Requirements

The Current Expected Credit Loss (CECL) standard, established by the Financial Accounting Standards Board (FASB), introduced several key regulatory requirements to which financial institutions must adhere. These requirements include:

- Estimation of expected lifetime credit losses: Institutions must estimate expected credit losses over the expected life of their financial instruments, including loans and securities.

- Forward-looking: The estimates must incorporate reasonable and supportable forward-looking information, such as economic forecasts and market trends, to anticipate potential credit losses.

- Timely reporting: Regular updates and timely reporting of expected credit losses are required to ensure that financial statements accurately reflect current levels of risk.

- Documentation and disclosure: detailed documentation and disclosure of methodologies, assumptions, and data used in the estimation process are required for transparency.

Implementation Challenges

With the implementation of the CECL standard came significant challenges, particularly in data collection. Collecting the necessary data for CECL involves gathering a vast volume and variety of data, including historical loss data, borrower information, and economic indicators. This produces extensive datasets, which must be carefully managed to ensure the information is collected and recorded accurately. The quality and integrity of this data are critical, as any inaccuracies or missing information can lead to flawed loss estimates, potentially compromising the reliability of the results and their usefulness in strategic planning.

Another major challenge lies in model selection and development. Creating models that accurately estimate expected credit losses involves sophisticated statistical techniques. A reliable model must be able to handle various scenarios and economic conditions without breaking down. Moreover, the nature of CECL demands continuous model updates, back-testing, and validation to reflect the latest economic trends and internal data. This ongoing requirement not only necessitates substantial resources and expertise but also underscores the importance of maintaining current and accurate models to ensure compliance and reliability.

Limitations of a Compliance-Only Approach

A compliance-only approach to CECL often results in institutions focusing solely on meeting the minimum regulatory requirements. This reactive stance limits an institution’s ability to proactively identify and mitigate risks. By concentrating primarily on compliance, institutions could overlook the potential of an accurate and reliable CECL analysis to provide early warnings of emerging risks. This narrow focus means missed opportunities for early intervention, where timely action could prevent minor issues from escalating into more significant problems.

Additionally, a compliance-centric approach can lead to inefficient resource allocation. When resources are directed primarily towards ensuring compliance, the opportunity to optimize broader risk management processes is missed. This results in a suboptimal use of resources, where an institution’s overall risk management capabilities are not fully maximized. Consequently, institutions fail to leverage the strategic value that CECL can provide. The insights and information generated through CECL processes are not fully utilized to inform strategic decision-making, limiting the potential for enhanced risk management and long-term planning.

By focusing solely on compliance, institutions are missing a crucial opportunity to transform CECL into a strategic tool that can enhance their risk management practices. The next section of this white paper will explore how financial institutions can move beyond compliance and leverage CECL to gain a competitive edge in risk management and capital allocation.

Integrating CECL into Risk Management

Despite its challenges, CECL presents a unique opportunity for financial institutions to enhance their risk management frameworks. By looking beyond compliance and fully integrating CECL into strategic processes, institutions can gain valuable insights into their risk profiles. This integration allows for more accurate forecasting, comprehensive data analysis, and stronger stress testing. This ultimately enables proactive risk management and informed decision-making.

Following are three scenarios where CECL can be integrated into risk management:

- Predictive Analytics – showing the importance of a well-designed model with predictive ability that can be used strategically;

- Scenario Analysis and Capital at Risk – showing how stress testing under varying macroeconomic conditions can show how much capital is at risk in each scenario; and

- Comprehensive Data Analysis – showing the effect of varying loan mix scenarios made possible by a model that is predictive and sufficiently granular.

Predictive Analytics

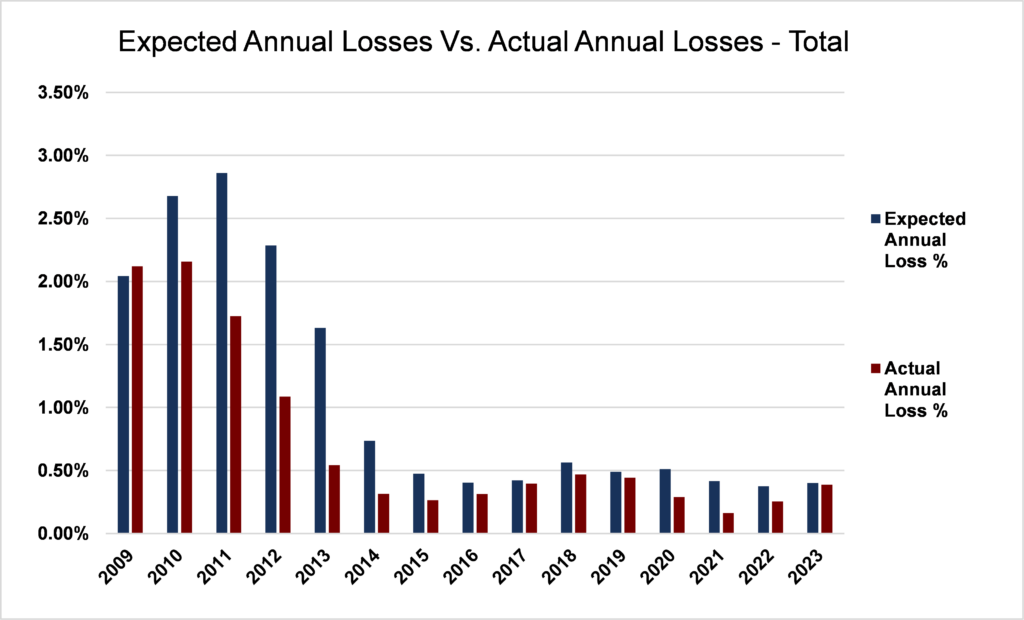

A well-designed CECL model provides a forward-looking estimate of credit losses by incorporating various economic factors. While the results produced are representative of expected lifetime losses, additional analysis allows institutions to consider the timing of losses for budgeting and strategic planning purposes. The following chart shows expected annual losses compared to actual annual losses for all Wilary Winn clients. We note that the expected annual loss results are produced a year in advance of the actual losses. For example, at December 31, 2022, Wilary Winn’s CECL modeling projected 0.40% in annual losses for our clients for 2023. Actual losses for 2023 were slightly below this forecast at 0.39%, demonstrating the model’s effectiveness in anticipating future losses. The predictive insight that a well-designed CECL model provides gives financial institutions a greater understanding of their credit risk profiles and allows for a more informed budgeting and strategic planning process.

Scenario Analysis and Capital at Risk

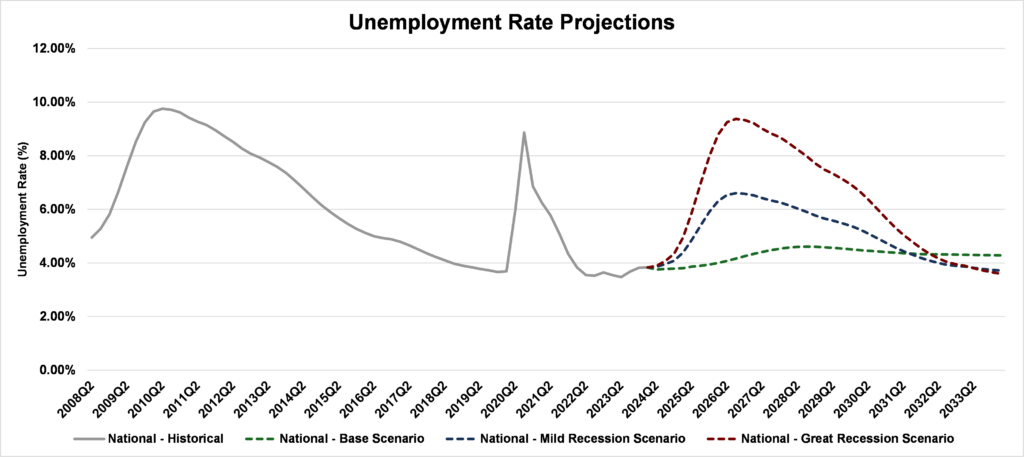

Another point of integration made possible by additional analysis of data collected for CECL is improved scenario analysis. A well-developed CECL model allows for adjusting economic inputs to determine the effect various scenarios could have on an institution’s expected credit losses and capital. For example, through using our discounted cash flow (DCF) model, we can incorporate projections for unemployment and home price appreciation/depreciation. This allows us to create scenarios based on real events, such as the Great Recession. Additionally, this gives us the ability to create entirely new hypothetical scenarios such as a Mild Recession scenario. The following graphs show the projections used in modeling potential Base, Mild Recession, and Great Recession scenarios.

As shown in the above graphs, the Great Recession scenario projects a repeat of the unemployment rates experienced during the respective time period, and the housing price projection mirrors the change in housing prices during that period. The Mild Recession scenario shows similar projections, but to a lesser magnitude. The Base Scenario projects stability in unemployment as well as moderate increases in home prices over the forecast period.

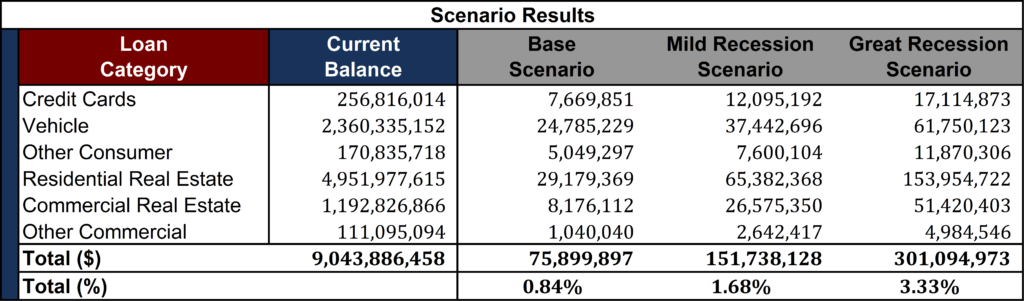

The results from these scenarios are shown in the table below. As expected, the Great Recession scenario generates the highest expected credit losses, as the rapid increase in unemployment combined with the steep decrease in home prices leads to both increased default rates and increased severities. Our modeled default rates change dynamically based on the projected unemployment rate in any given forecast period. Similarly, our severity assumptions are influenced by the projected changes in housing prices throughout the forecast. As a result, the model is capable of handling a wide variety of economic scenarios, which aids financial institutions in strategic planning and contingency planning.

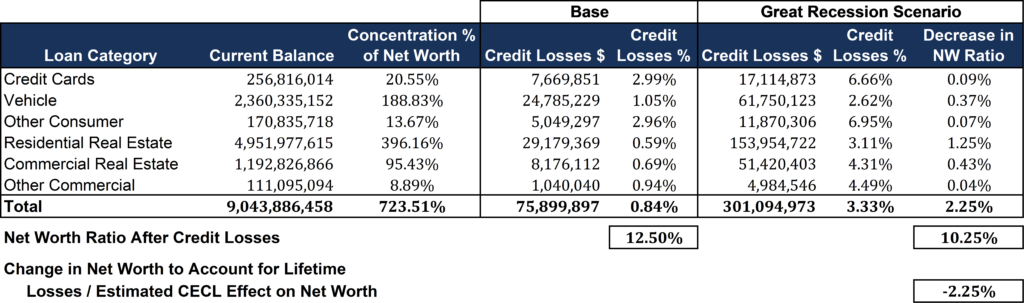

To further expand on the value of additional scenario analysis made possible by the data collected for CECL, financial institutions can determine the impact on capital that various adverse scenarios could have. For example, in the analysis presented above, the current net worth ratio of the institution is 12.50%, inclusive of the reserve currently held corresponding to the Base Scenario. As shown in the table below, if economic conditions were to rapidly deteriorate similar to what happened during the Great Recession, the institution could expect a 2.25% decrease in net worth based on the additional reserves that would be needed to account for the increased risk of credit losses. This testing allows an institution to determine if they would remain well capitalized in an adverse economic environment, and if there is room for additional risk on the balance sheet. Furthermore, the additional data collected allowing institutions to perform analyses at a more granular level gives insight into specific areas where early risk mitigation efforts would make the most impact, such as residential real estate and vehicle loans in the example below.

Comprehensive Data Analysis

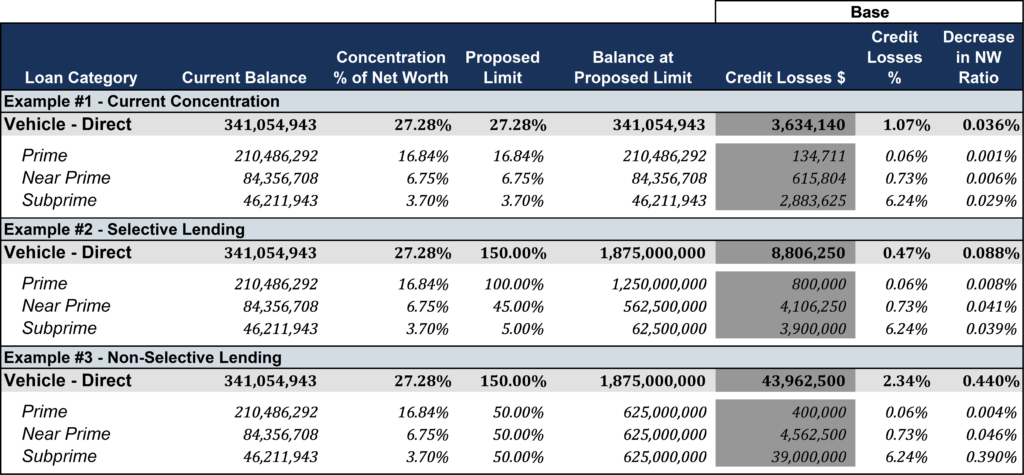

The data collected for CECL compliance can be leveraged for broader risk management purposes beyond meeting regulatory requirements. Financial institutions can further analyze this data to gain deeper insights into their risk profiles, identify emerging trends, and understand potential vulnerabilities. For example, the following table shows three examples of an institution’s direct vehicle portfolio stratified by credit tier. The first example shows the institution’s current concentrations, with decreasing concentrations as credit quality worsens. The associated CECL amount for the current portfolio is $3.6 million or 1.07%, with the largest portion of the losses attributable to the lower credit quality loans. An example of how to strategically leverage this information is to show how credit risk changes as the loan mix changes given a fixed concentration limit. In this case, our example financial institution wants to grow its direct vehicle portfolio to an amount equal to a concentration limit of 150% of net worth. In Example #2 – Selective Lending – we show the effect on credit losses if the institution were to focus on prime lending with concentrations of 100% of net worth in prime-rated direct vehicle loans, 45% in near prime, and 5% in subprime. In Example #3 – Non-Selective Lending – we show the effect on credit losses if the institution were to grow to equal balances across all credit categories.

As shown in Example #2, while the overall direct vehicle portfolio increases from $341.1 million to $1.9 billion, the CECL percentage associated with the portfolio decreases from 1.07% to 0.47%. This is because we have set a sublimit for subprime lending that will reduce its concentration within the portfolio from 13.5% in the current case to 3.3%. In Example #3, we allocate the 150% limit equally and allow subprime loans to increase from $46.2 million to $625.0 million, which results in the CECL percentage increasing from 1.07% at current concentrations to 2.34% after growing the portfolio in a non-selective manner.

These simplified examples demonstrate the insight that additional analysis of CECL results and the data used to produce those results offers. By leveraging this data, institutions can make informed strategic decisions, optimize portfolio composition, consider the amount of capital being put at risk and enhance overall risk management. The insights gained from such analysis allow institutions to follow best practices and provide a clear path to optimizing credit strategies and managing risk more effectively.

Qualitative Adjustments

In addition to leveraging quantitative data, incorporating qualitative adjustments into CECL processes can significantly enhance risk management. Qualitative adjustments involve incorporating market expectations and expert judgment into the CECL reserve setting process, providing more thorough coverage of potential risks that are not inherently modeled. Various departments within a financial institution have specific insight that is not always captured through CECL models. For example, a consumer lending team could advocate for increasing the reserve on vehicle loans under the assumption that collateral values are inflated, which proved accurate during the pandemic. Another example is a commercial lending team advocating for increased reserves on commercial loans associated with properties in downtown areas. By involving various departments in the CECL reserve setting process, a financial institution can encourage a culture of proactive risk management that promotes continuous engagement.

By leveraging CECL for predictive analytics, scenario analysis, and comprehensive data analysis, financial institutions can transform compliance efforts into strategic opportunities. These practices not only enhance the institution’s risk management capabilities but also provide valuable insights that support informed decision-making and long-term strategic planning.

Conclusion

The Current Expected Credit Loss (CECL) standard, while primarily a regulatory requirement, offers financial institutions an opportunity to enhance their risk management practices. By leveraging the comprehensive data and forward-looking models required for CECL compliance, institutions can achieve more accurate and timely risk assessments, develop proactive risk mitigation strategies, and make better-informed strategic decisions.

To fully take advantage of the benefits that leveraging CECL to enhance risk management can provide, financial institutions should focus on the following:

- Invest in high-quality data and governance – ensuring the accuracy and integrity of the data used in CECL processes is critical in generating reliable results that can be leveraged for further analysis.

- Integrate CECL into risk management frameworks – using CECL data as a core component of risk management strategies aids in aligning various departments to promote a consistent attitude towards risk.

- Leverage predictive analytics and scenario analysis – use CECL in budgeting and forecasting for strategic planning purposes and model a variety of scenarios to remain well informed of the loan portfolio’s sensitivity to changing economic conditions.

- Enhance stress testing practices – incorporate CECL data into both regulatory and internal stress testing to assess the institution’s capital adequacy under adverse conditions.

- Embrace a proactive approach – leverage CECL insights to develop early warning systems and proactive risk mitigation strategies, ensuring readiness for potential challenges.

In conclusion, CECL offers much more than just a regulatory burden. It provides a framework for enhancing risk management and strategic decision-making. By leveraging the insights and data from CECL, financial institutions can transform compliance efforts into strategic opportunities, ultimately strengthening their risk management frameworks and achieving better outcomes.