Community Bank Leverage Ratio and the MPF Program: Coronavirus Update

Key Takeaway

Wilary Winn provides robust life-of-loan credit loss estimates that quantify capital at risk under various macroeconomic scenarios.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released April 2020

Introduction

The Community Bank Leverage Ratio (“CBLR”) final rule was recently adopted by the federal banking agencies and became effective on January 1, 2020. The rule is optional and designed to simplify the calculation of regulatory capital. It allows community banks to calculate a leverage ratio based on total assets. Qualifying banks would thus no longer have to calculate risk-weighted assets.

We note that the final rule was modified today by two interim final rules under Section 4012 of the Coronavirus Aid, Relief and Economic Security Act. The modifications are included in this white paper.

Qualifying Community Banking Organization

A qualifying community banking organization is defined as a depository institution or depository institution holding company that is not an advanced approaches banking organization and that meets the following criteria:

- CBLR greater than 9 percent (8% for quarters 2 – 4 of 2020 and 8.5% in 2021);

- Total consolidated assets of less than $10 billion;

- Total off-balance sheet exposures (excluding derivatives other than credit derivatives and unconditionally cancelable commitments) of 25 percent or less of total consolidated assets; and

- Total trading assets and trading liabilities of 5 percent or less of total consolidated assets.

Calculation Of The CBLR

The CBLR is calculated as the ratio of Tier 1 Equity to average total consolidated assets. The Federal Banking Agencies estimate that as of March 31, 2019, there were 5,221 insured depository institutions with less than $10 billion in total assets and that 85% would qualify to use the CBLR. FHLBank Topeka estimates 85% of banks in its region would also qualify to use the CBLR.

We note that the three-year phase-in of the potential adverse impacts from CECL on regulatory capital remain in effect under the CBLR framework. We further note that banks required to account under CECL in 2020 can elect to delay its effect on regulatory capital for two years before reverting to the phase-in, under an interim final rule adopted by the banking regulators on March 27, 2020.

Off-Balance Sheet Exposures

While most of the qualifying criteria are relatively straightforward, off-balance sheet exposures require further explanation. Under the proposal, total off-balance sheet exposures would be calculated as the sum of the notional amounts of certain off-balance sheet items as of the end of the most recent calendar quarter. Total off-balance sheet exposures would include:

- The unused portions of commitments (except for unconditionally cancellable commitments);

- Self-liquidating, trade-related contingent items that arise from the movement of goods;

- Transaction-related contingent items including performance bonds, bid bonds, warranties and performance standby letters of credit;

- Sold credit protection through

- Guaranties

- Credit derivatives

- Credit enhancing representations and warranties

- Securities lent and borrowed, calculated in accordance with reporting instructions to the Call Report;

- Financial Standby Letters of credit;

- Forward agreements that are not derivative contracts; and

- Off-balance sheet securitization exposures.

Total off-balance sheet exposures would not include derivatives (such as foreign exchange swaps and interest rate swaps) but would include credit derivatives.

The off-balance sheet exposure limitation has a direct effect on FHLB MPF® participating financial institutions. PFIs opting into the CBLR would no longer have to calculate the risk-weighted assets arising from the CE Obligation amount in accordance with BASEL III. It simply reports the total net CE Obligation amount under Tier I leverage ratio calculation as an off-balance sheet securitization exposure. The total net CE Obligation amount, combined with other off-balance sheet exposures, cannot exceed 25 percent of total assets.

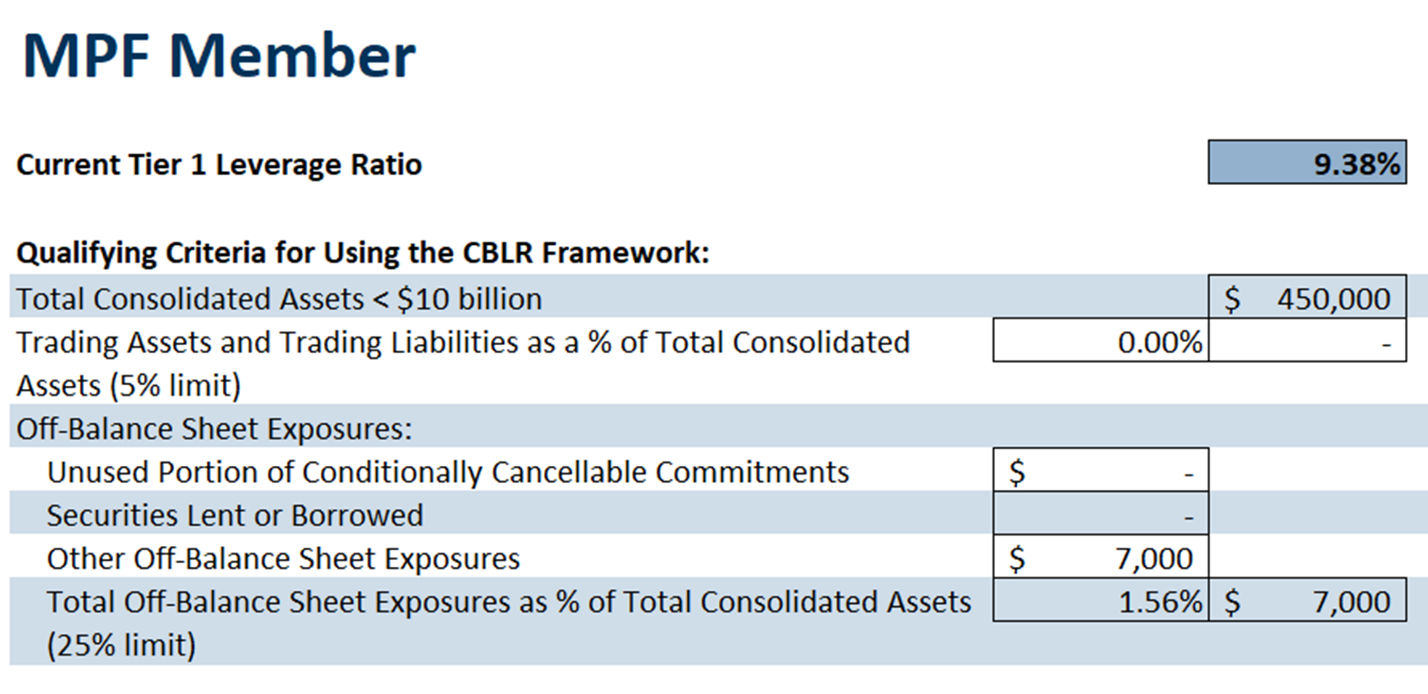

The table shows a simplified example assuming the PFI has $7,000 of net CE Obligations and no other off-balance sheet exposures.

CBLR Less Than Required Minimum

What happens if a community bank elects the CBLR and then falls below the required minimum, because of growth in total assets and/or declines in Tier One equity. If a community bank falls below the required minimum CBLR threshold, it could revert to use of the existing rules. If a community bank elects to remain in the CBLR framework, the rule provides a two-quarter grace period to restore the ratio. The final interim rules provide that during the grace period, the bank’s capital ratio must not fall more than 100 basis points below the required CBLR threshold. In 2022 and thereafter, to remain in the CBLR framework during the grace period, a community bank would have to meet the requirements to be well-capitalized under the existing rules.

Before Adopting The Rule

Even at the minimum of 8 percent, the CBLR capital threshold is well in excess of the 5 percent considered to be well-capitalized under the risk-based capital rules. Wilary Winn therefore strongly encourages PFIs to evaluate how adopting the CBLR framework would affect the amount of capital required to be held in bank. If the amount of capital restricted under the CBLR is substantially greater than the amount required under the existing rules, and the PFI has plans or needs to deploy it, we recommend the PFI consider reporting under the existing regulations.

Changes From The Proposed Rule

The key changes made to the final rule include:

- Adoption of tier 1 capital versus tangible equity;

- Removal of the qualifying criteria for mortgage servicing assets and deferred tax assets arising from temporary differences;

- Removal of CBLR regulatory capital proxy rules when a community bank’s CBLR fell below 9% and it wanted to remain in CBLR framework; and

- Insertion of the two-quarter grace period.

For details on the finalized rule, see our white paper from September 26, 2019.