CECL and ASC 310-30 [White Paper]

Key Takeaway

Wilary Winn offers comprehensive CECL calculations as well as capital stress testing, concentration risk analyses, and estimates of real return.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released August 2016

Introduction

CECL changes the accounting for purchased assets with deteriorated credit. Under ASC 310-30 these assets are defined as Purchase Credit Impaired, or “PCI”. PCI accounting is relatively complex when it is based on the expected cash flows. Interest income to be recognized is derived from the purchase price and the net present value of the cash flows to be received. Increases in the cash flow result in an increase in the accretable yield, recognized over the life of the asset. Decreases in cash flow require the recoding of an allowance, resulting in an immediate loss.

Under CECL, purchased assets with deteriorated credit quality are defined as “purchased with credit deterioration (“PCD”)”. The definition expands the scope of assets that are subject to the specialized accounting. The big change is that favorable and unfavorable changes in expected credit cash flows run through the income statement. Existing PCI loans will be considered to be PCD upon adoption of CECL.

As you know, FASB finally released the long anticipated CECL guidance. This memorandum very briefly addresses the basics and then details how the new standard will affect the accounting for assets now accounted for in accordance with ASC 310-30.

The basics:

- Why – FASB believed that GAAP did not properly reflect risk pre-financial crisis because of the delayed recognition of credit losses

- What – ASU 2016-13 Measurement of Credit Losses on Financial Instruments

- When – Issued June 16th

- Effective – 2020 for SEC filers, 2021 for all other, early adoption permitted beginning 2019

- How – In general adopt a cumulative effect adjustment to retained earnings, but there are special rules for PCI assets

CECL applies to:

- Loans

- HTM securities

- Net investments in leases

- Off balance sheet credit exposures:

- Loan commitments

- Standby letters of credit

- Financial guarantees/similar instruments

CECL does not apply to assets measured at fair value, including AFS securities. However, FASB issued ASC 326-30 in conjunction with CECL which changed the accounting for AFS securities.

CECL’s major provisions are as follows:

- Departs from the incurred loss model – the probable threshold was removed and CECL results in day one life of asset loss recognition

- Loss is recognized through an allowance for financial assets, including HTM debt securities, and through a liability for off balance sheet exposures

- Changes in the allowance – positive and negative are recorded immediately through credit loss expense

This memorandum is not intended to be yet another exhaustive discussion of CECL. Instead, it focuses in accounting for ASC 310-30 assets only. For more information on implementing the standard, see Wilary Winn’s white paper – Implementing the Current Expected Credit Loss (CECL) Model, which is available on our website.

While many have worried that CECL will have an adverse effect on the Allowance for Loan and Lease Losses, it proposes favorable changes to the accounting for purchased assets with deteriorated credit, currently called Purchase Credit Impaired or “PCI” assets. CECL provides a new definition for these types of assets – purchased with credit deterioration (“PCD”). PCD assets are those which have experienced a more than insignificant deterioration in credit quality since inception. Wilary Winn believes the new definition expands the scope of assets subject to this specialized accounting. Nevertheless, because positive changes in credit-related cash flows will run through the income statement immediately rather than as an increase to accretable yield, we believe the accounting is relatively more favorable under the new standard.

The specifics for PCD assets are as follows:

- At acquisition, a financial institution will estimate and record an allowance for credit loss, which is then added to the purchase price.

- Favorable and unfavorable changes in expected credit related cash flows will run through the allowance and credit loss expense.

- Existing ASC 310-30 loans will be considered to be PCD loans upon adoption of the new standard and the amount non-accretable yield at adoption will be the initial allowance for credit loss.

- Non-credit premium or discount will be accounted for based on the effective yield after the gross-up for the allowance.

Example

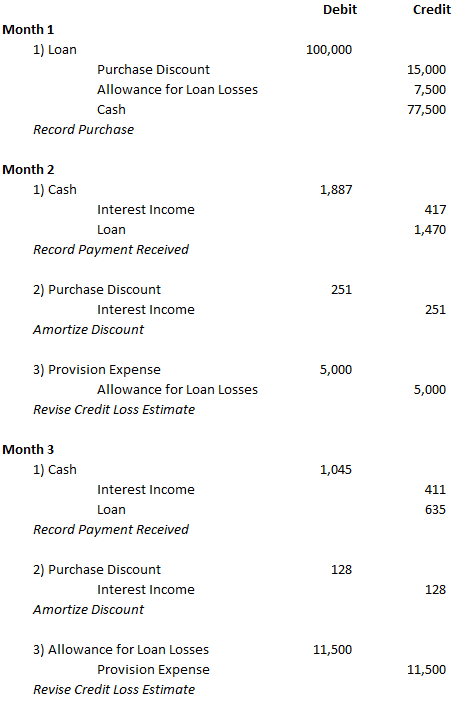

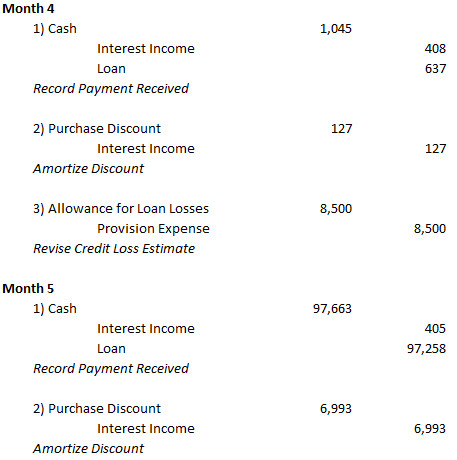

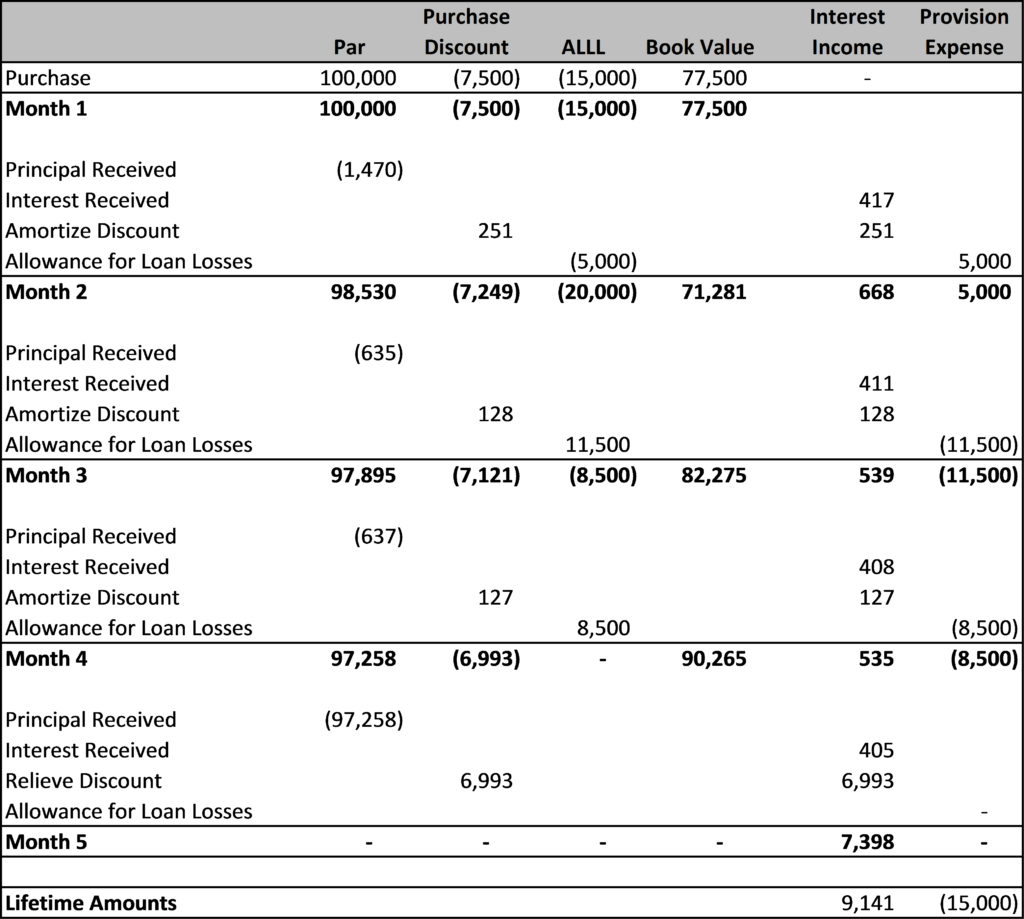

The example shown below illustrates the accounting for PCD assets under CECL. The financial institution purchased a loan with a principal balance of $100,000 for $77,500. It set the initial reserve for expected credit losses at $15,000. It also recorded a purchase discount of $7,500, which it will amortize on a level-yield basis.

The contractual P&I payment is $1,887 per month. The stated interest rate on the loan is 5%.

At the end of month two, the financial institution reevaluates the loan and determines that the loan is riskier than it thought. It records a $5,000 increase in the credit reserve based on its new estimate of the amount of principal it will receive.

In month three, it agrees to extend the maturity date of the loan because it believes the extension will aid the borrower and will result in the receipt of $11,500 in additional principal over the life of the loan. Therefore, it reduces the credit reserve by $11,500. The contractual P&I is modified to $1,045 per month. In addition, it lowers the amount of discount accreted from $251 to $128 reflecting the lengthening of the maturity date from 5 years to 10 years.

In month 4, the borrower informs the financial institution that it has a firm offer on the property and intends to repay the loan with the proceeds in full. The financial institution believes there no longer is a credit risk on the loan and relieves the remaining ALLL amount of $8,500 to provision expense.

In month 5, the borrower repays the loan in full. The remaining discount is released into income.

The monthly journal entries are shown below along with a table summarizing the results.

Journal Entries

As shown in the example above, positive changes in credit-related cash flows will run through the income statement immediately rather than as an increase to accretable yield.