Credit Union Merger Results Through 2020 [White Paper]

Key Takeaway

We are the number one provider of credit union merger fair value determinations, providing us with deep insight and knowledge of the marketplace. Nationally recognized experts, we combine sophisticated financial expertise with a thorough understanding of the required accounting and have led trainings on the subject for the NCUA. Our white papers have been downloaded thousands of times.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released May 2021

Introduction

This white paper provides readers with an overall perspective of the merger marketplace. The data includes industry-wide information on the number of mergers in the most recent decade and the size of the transactions.

We also provide valuation metrics from the work we have performed, including the changes in the fair values of the equity acquired, loans, share deposits and the core deposit intangibles. We show the number of transactions resulting in goodwill or a bargain purchase and conclude with our thoughts on forthcoming trends.

We are frequently asked about credit union merger activity. This white paper is an update to our Credit Union Merger Results Through 2018 posting from February of 2019. It is the first in a planned set of ongoing quarterly updates. In this paper, we recap activity through the end of 2020, including the effects of COVID-19. We conclude with our thoughts on where we believe the credit union merger marketplace is headed over the next few years.

In this post, you will find industrywide information about the:

- Number of credit union mergers

- Size of the institutions merged-in

- Number of credit union purchases of banks

In addition, we provide insights from our own merger valuation work including the:

- Number of transactions which resulted in goodwill

- Trends in the value of the core deposit intangible

- Average value of the financial assets and equity acquired as well as liabilities assumed

If you are interested in more detail for a specific topic, please let us know.

Industry Merger Statistics

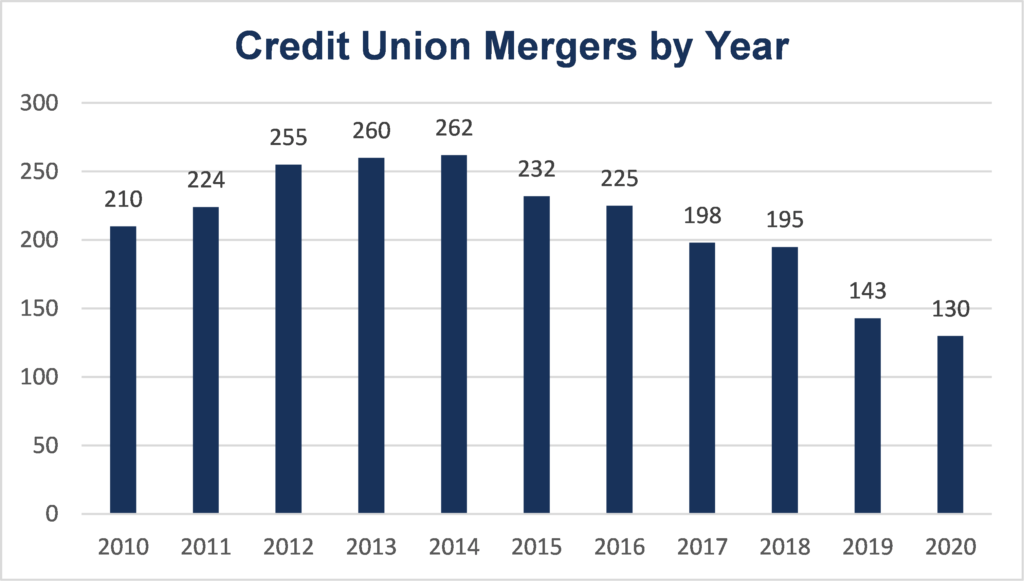

The following graph tracks the number of credit union mergers completed each year since 2010. Consistent with our 2018 update, the industry continued to experience a decline in the number of mergers year-over-year since 2014.

Some of the decline in 2020 can be attributed to the significant operational and financial challenges credit unions faced resulting from COVID-19. Credit unions largely shifted attention away from long-term strategic planning to focus on immediate operational needs. Additionally, credit unions faced near-term financial concerns arising from elevated interest rate, liquidity, and credit risks. Despite these challenges, total mergers decreased by just 13 in 2020 compared with 2019 as activity picked up late in the year.

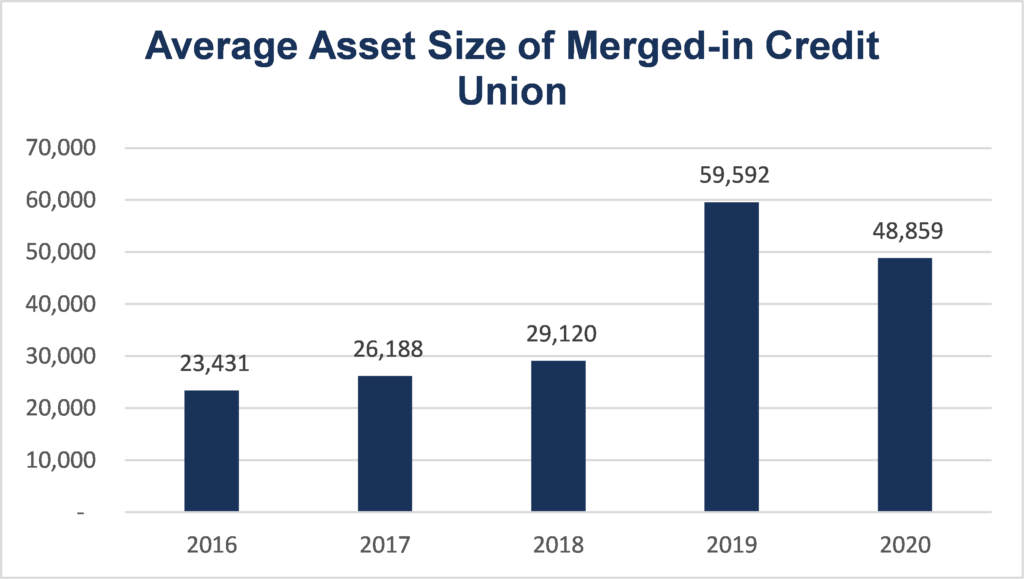

While the number of total mergers has dipped over the previous two years, the average asset size of the credit unions being merged-in increased in 2019 and 2020.

We note that three significant mergers that occurred during this time drove the increases. In all three cases, the institution merged-in exceeded $1.0B in total assets at the time of the merger. The three mergers include:

- Gesa Credit Union merger with Inspirus Credit Union

- SchoolsFirst Federal Credit Union merger with Schools Financial Credit Union

- TruStone Financial Federal Credit Union merger with Firefly Federal Credit Union

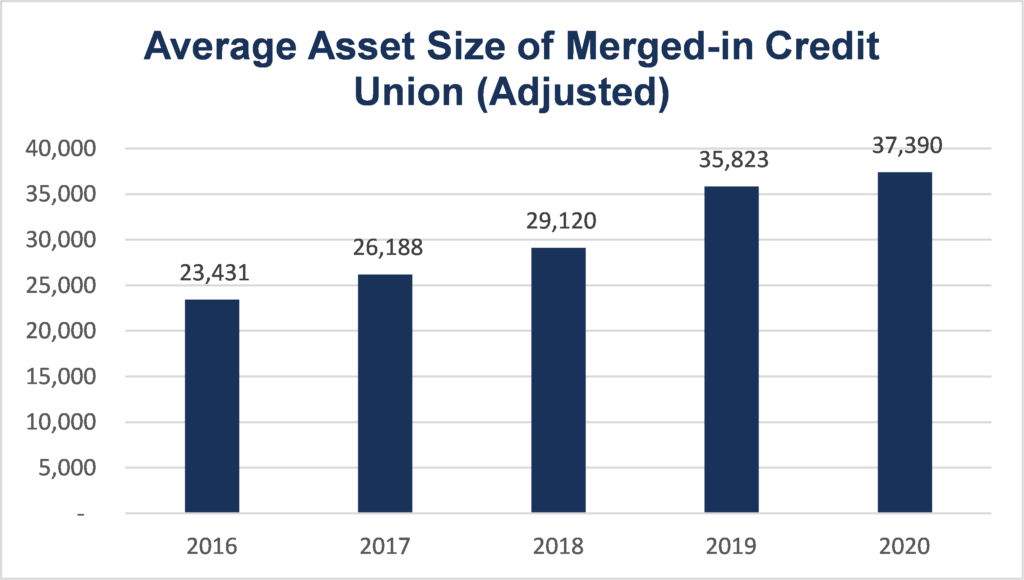

If these three mergers are removed, the average asset size of the credit unions being merged-in decreases to the levels shown in the following graph. However, the average asset size of the merging-in institutions has still increased year-over-year since 2016.

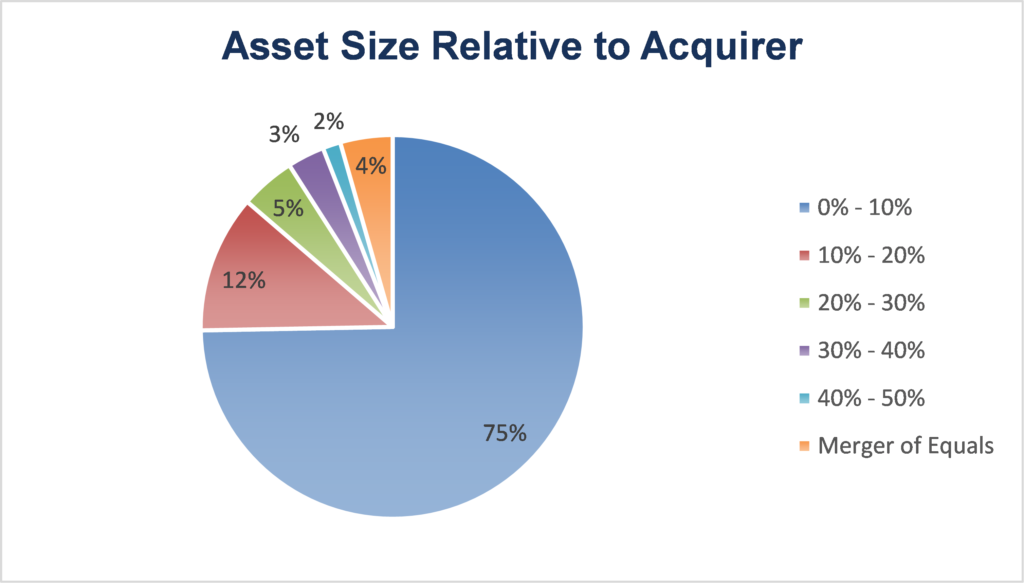

Despite the recent increase in total assets acquired, since 2016 most mergers consisted of a much larger credit union acquiring an institution equal to less than 10% of the acquirer’s total assets. Conversely, only 4% of mergers were classified as “merger of equals” over this same time-period.

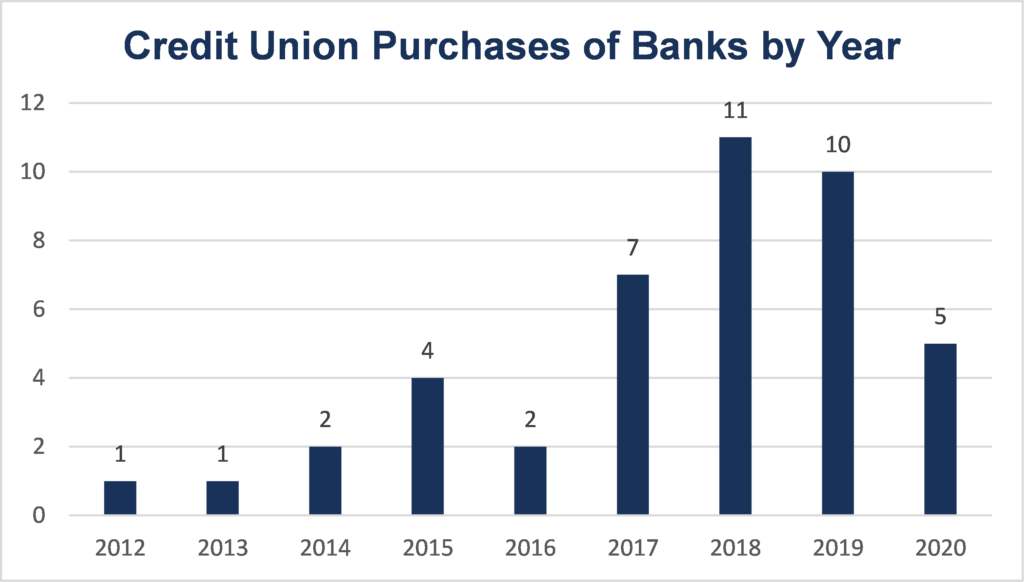

Similar to the number of credit union mergers seen in 2020, credit union acquisitions of banks declined in 2020 following the historically high levels of deals completed in 2018 and 2019. Wilary Winn believes the complexity of these deals from a tax and regulatory approvals standpoint, coupled with the challenges faced in 2020, resulted in a slowdown in these types of transactions. Further detail surrounding the strategic, tax, and regulatory considerations concerning these types of transactions can be found in our white paper titled Credit Unions Purchasing Community Banks.

Wilary Winn Merger Financial Statistics

Wilary Winn serves nearly 300 credit unions, including 45 of the top 100. We have performed over 300 merger engagements since 2009, ranging in transaction size from $2M to $2B in total assets. We note that all valuation work is performed on the acquired institution.

Purchase accounting requires that the merged-in institution’s balance sheet be recorded at fair value. To estimate the value of the acquired credit union, we begin by estimating the fair value of the equity acquired. We then estimate the fair value of the financial and non-financial assets and liabilities. Our third step is to estimate the value of the core deposit intangible. Next, we estimate the value of the trade name. Our final step is to estimate the amount of goodwill or bargain gain arising from the merger. The following charts reflect data compiled from valuation work we have performed since 2009.

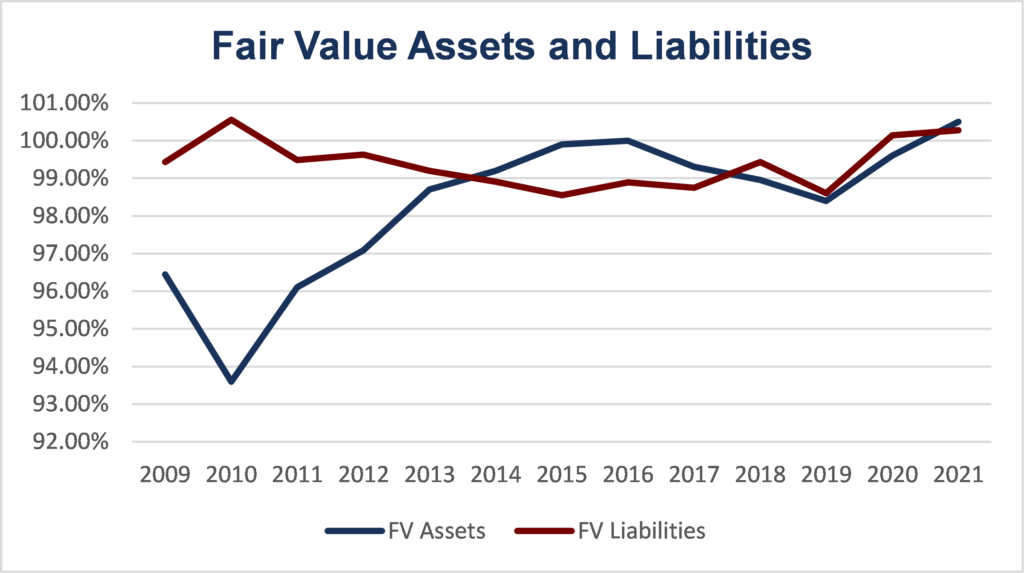

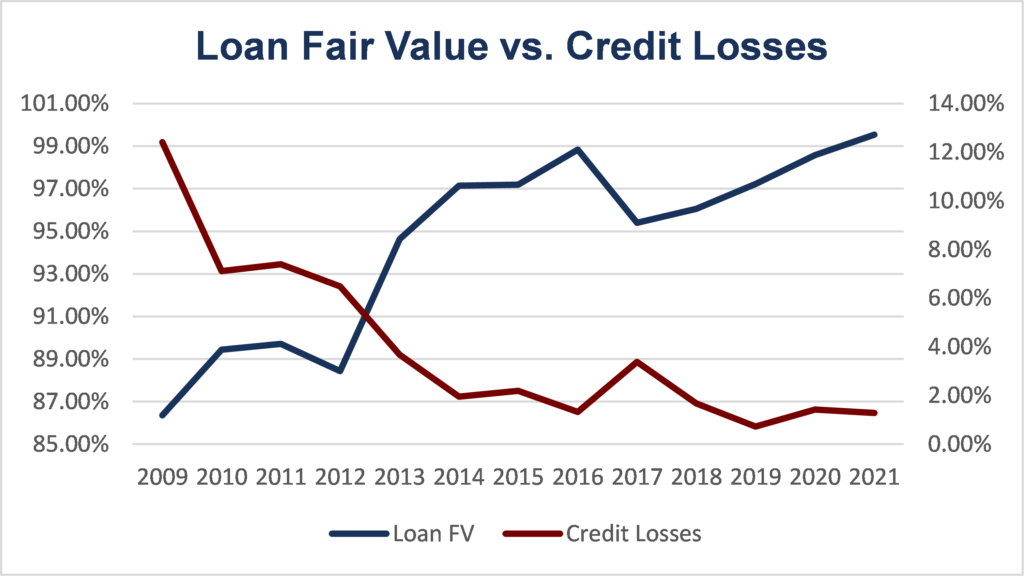

The fair value of assets and liabilities calculated in our valuation work is shown in the chart above. While the fair value of liabilities has remained relatively consistent throughout time, the fair value of assets has improved considerably since 2010. We attribute this increase to a marked improvement in our clients’ loan portfolios, as shown in the following chart.

The fair value of assets acquired further increased in 2020 and 2021, driven by rising premiums on loans and investments in the low interest rate environment of the most recent 14 months.

Loans

Share Accounts and Core Deposit Intangibles

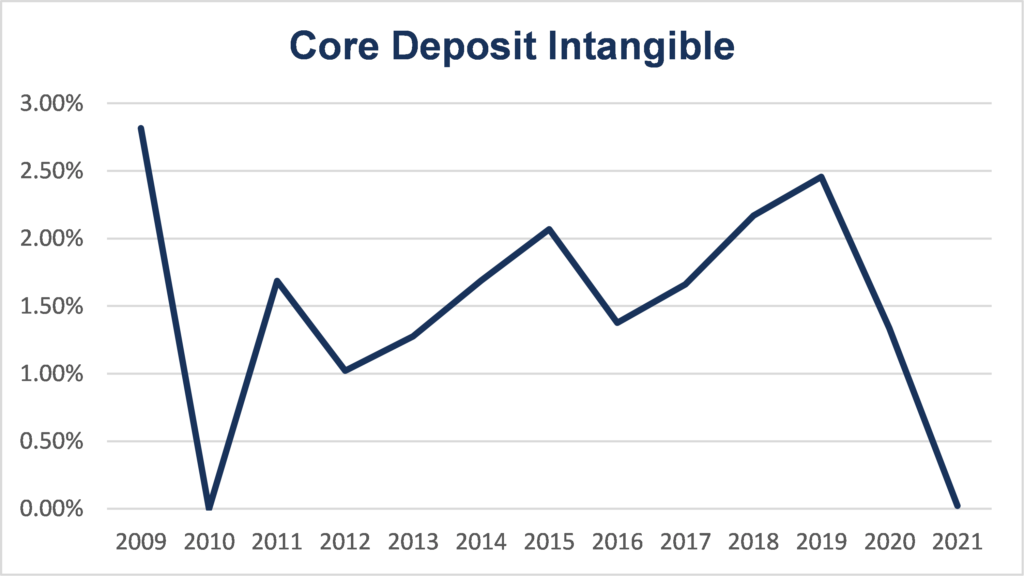

The premise underlying the core deposit intangible is that a rational buyer is willing to pay a premium to obtain a group of core deposit accounts that are less expensive than the buyer’s marginal cost of funds. Wilary Winn’s calculations of the core deposit intangible from 2009 through year-to-date 2021 are shown in the following chart. Core deposit intangibles peaked in 2019. Premiums dropped significantly in 2020 and 2021 due to reductions in market borrowing costs (marginal cost of funds), while the rates paid on deposits at most institutions decreased at a much slower pace. This decreased spread reduces the benefit of holding deposits relative to borrowing, thus decreasing the intangible benefit. Wilary Winn notes that the core deposit intangible is typically the most expensive accounting cost related to a merger, as this intangible asset must be amortized over time as a decrease in non-interest income.

Equity

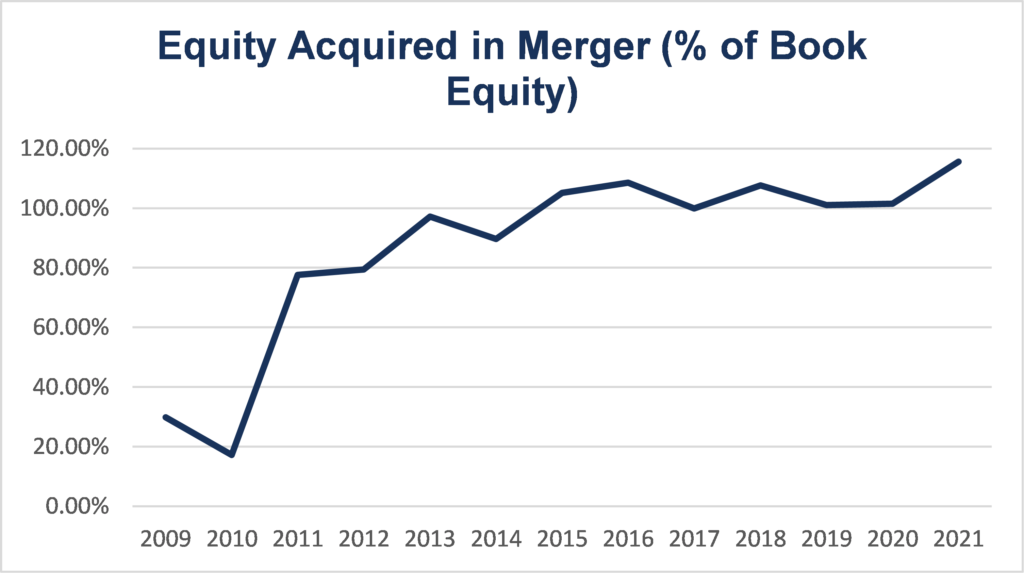

The chart below shows the fair value of the equity acquired in merger as a percentage of book equity for all merger transactions performed by Wilary Winn since 2009. Similar to the fair value of assets, the fair value of the equity acquired has increased significantly over the period shown and is currently above par. Wilary Winn notes that premiums paid for credit unions tend to be lower than bank premiums seen in the marketplace. We attribute this to bank shareholders’ direct access to earnings in the form of share prices and direct dividends, whereas credit unions typically pay out earnings to members in the form of increased services, lower loan rates, and higher deposit rates over time.

Goodwill and Bargain Purchases

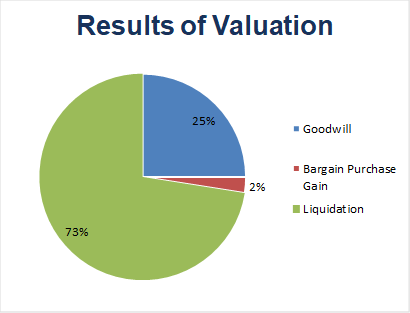

The overall results of our valuations are shown in the following chart. Goodwill results when the estimated value of the ongoing institution is higher than the fair value of its net assets. We note that goodwill commonly occurs when the merging-in credit union is healthy and has performed at a high profitability level. Wilary Winn calculated goodwill in 25% of our valuations, whereas in 73% of our valuations the overall fair value was equal to the institution’s liquidation value, or the fair value of net assets plus the core deposit intangible.

Only 2% of our valuations resulted in a bargain purchase gain, which we generally see only in NCUA-assisted transactions.

Merger Industry – Looking Forward

While future merger activity remains uncertain, we have seen an uptick in the number of announced deals in the latter half of 2020 and into 2021. We believe the following trends will drive the credit union merger marketplace over the next few years.

- We expect the unfavorable low interest rate environment to persist over the next few years, creating earnings challenges. As a result, we anticipate an increase in the number of financially distressed institutions seeking merger partners. While capital levels remain relatively strong across the industry, we believe many smaller institutions will look to be merged-in before their capital erodes further.

- We expect to continue to see an increase in the number of mergers of equals. Credit unions of moderate size view the opportunity to merge as a means to quickly achieve economies of scale to better compete in the ever-evolving financial services industry.

- The pandemic accelerated the shift of many institutions to digital banking and highlighted the need for strong technological solutions. However, credit unions often lack the resources to adequately meet the technology needs of their members. As a result, many institutions will seek merger partners with superior technology or combine in order to have the resources required to offer the electronic banking demanded in the marketplace.

- We expect credit union purchases of banks to increase in the latter half of 2021 and 2022, as credit unions will continue looking for strategic ways to scale and grow membership bases in a post-pandemic world.