Credit Unions Purchasing Community Banks [White Paper]

Key Takeaway

This paper explores strategic considerations, tax consequences, and legal & regulatory issues related to the recent trend of credit unions buying banks.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released December 2019

The recent trend of credit unions buying banks has become one of the hot topics in the industry. While the number of actual transactions is quite small relative to the number of mergers and acquisitions that take place each year, the trend has been a featured item at recent financial institution industry conferences and the subject of several articles in industry trade publications. By way of comparison, we note that through September 30, 2019, there have been 18 deals either completed or with expected completion dates in 2019 or 2020 in which a credit union buys a bank. This compares to 298 bank-to-bank transactions either completed or with expected completion dates in 2019 or 2020 and 111 approved credit union-to-credit union mergers.

A credit union purchasing a bank is a relatively complex undertaking, and the purpose of this white paper is to provide credit unions and community banks with the information they need to ensure both buyer and seller are making informed decisions. Wilary Winn’s 500 community financial institution clients are equally divided between credit unions and community banks and we have completed over 250 merger related valuation engagements over the most recent 10 years. Given the complex legal and tax nature of these transactions, we asked firms that specialize in providing advice to community banks – the law firm of Winthrop & Weinstine and Eide Bailly, a top 25 public accounting firm – to partner with us in writing this white paper.

The paper is divided into three sections.

- Strategic considerations from the perspective of the buyer and the seller

- Tax consequences

- Legal and regulatory issues

I. Strategic Considerations

Credit Union Perspective

We believe a transaction in which a credit union purchases a bank could result in beneficial outcomes provided the credit union has compelling strategic reasons to do so. The credit union could be “going on offense” by trying to accomplish one or all of these objectives – expand into new geographic areas, add expertise it does not possess, grow membership, drive economies of scale, or diversify its balance sheet. Alternatively, the credit union’s strategy could be defensive in nature by, for example, purchasing a bank within its geographic footprint to prevent a competitor from entering or expanding its presence in the credit union’s marketplace.

However, the premium required to undertake the transaction might not make economic sense. For example, a credit union cannot legally purchase bank stock in most instances. It must purchase the assets and assume the liabilities of the bank, which is then liquidated. The consideration must be paid in cash and the transaction can have adverse tax effects for the selling shareholders of the bank – especially when the bank is a C-corp. All other things being equal, a credit union purchasing assets and assuming liabilities must be willing to pay more for the target institution than would a bank to offset the tax liabilities and additional legal costs. See the tax and legal sections for more detail.

Moreover, in our experience, a transaction in which a credit union buys a bank is dilutive to GAAP equity and regulatory capital because, unlike a credit union merger where the equity remains in the combined entity, the credit union is buying out the bank’s equity and paying it to the selling shareholders. In addition, any cash paid in excess of the fair market value of the assets purchased and liabilities assumed results in goodwill.

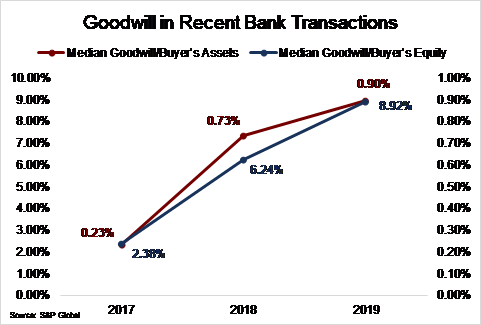

We note that recent transactions have resulted in substantial amounts of goodwill. The following table shows the increased amount of goodwill as a percentage of both buyer’s assets and equity for all credit union to bank acquisitions since 2017.

We caution that while goodwill can currently be counted in a credit union’s regulatory net worth, the NCUA is in the process of reviewing regulatory capital requirements in the context of its proposed and now delayed risk-based capital and the newly promulgated Community Bank Leverage Ratio (“CBLR”). We note that goodwill and other intangibles are deducted from regulatory net worth under the banking regulators’ risk-based capital and CBLR rules as well as the NCUA’s proposed risk-based capital rules.

Finally, we note that the legal process is more complex, and the costs associated with the transaction are higher when a credit union purchases a bank since multiple regulators are involved.

Community Bank Perspective

When evaluating offers for the bank, shareholders need to ensure that they are comparing the bids on an “apples-to-apples” basis. An all cash bid from a credit union could be the highest gross offer, but the bank should consider the possible income tax consequences, as well as the legal and regulatory costs arising from the transaction to determine the amount it will receive on a net basis. Finally, a seller should consider the net proceeds it would receive for assets the credit union is unwilling or unable to purchase.

Price

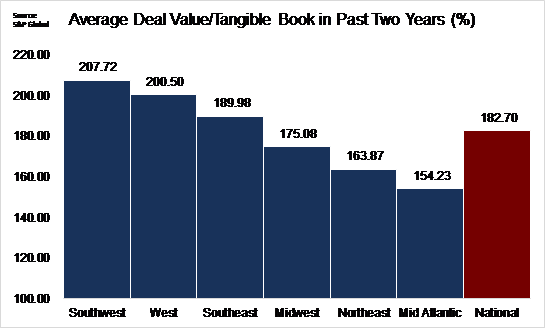

The following table shows the average deal value/tangible book value over the previous two years for bank-to-bank acquisitions in both the nation and by region. While the focus of this paper is on credit union-to-bank acquisitions, there is limited publicly available information for these transactions. Recognizing the differences between credit unions and banks and the potential tax and regulatory costs associated with the differing deals, we nevertheless believe understanding and utilizing current bank-to-bank deals in the marketplace can be a useful way to benchmark an offer submitted by a credit union.

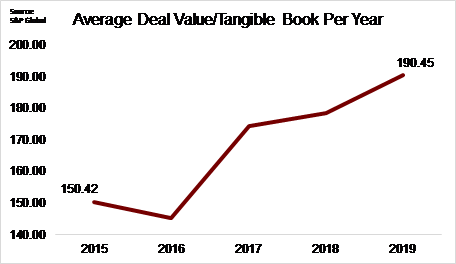

We note that the average deal value/tangible book value for bank-to-bank acquisitions in the marketplace has increased considerably over the past 5 years as shown in the following graph.

We believe the increase in prices in 2018 and 2019 are due to increased competition for customer deposits, easing bank regulations, lower corporate tax rates, and the hunt for digital capabilities. Going forward, it is difficult to predict whether this trend will continue. The industry is facing potential NIM compression resulting from the reduction in the Federal Funds rate, political uncertainty entering an election year, and the ongoing uncertainty regarding the future health of the economy.

Tax and higher legal costs aside, a community bank might be willing to sell to a credit union because the credit union is willing to pay cash while a community bank might want to merge with the selling shareholders, thus trading one form of illiquid bank stock for another. In addition, the bank should evaluate the bidder’s ability and willingness to serve the bank’s customers, retain its employees, and to ensure a smooth transition in the community in which the bank operates.

Cultural Considerations

This might be the most critical area of all. Questions that a credit union might want to ask itself as it considers an acquisition include:

- Does the acquired institution have similar goals and values? We believe this will often be the case as credit unions and community banks are both generally focused on serving their communities.

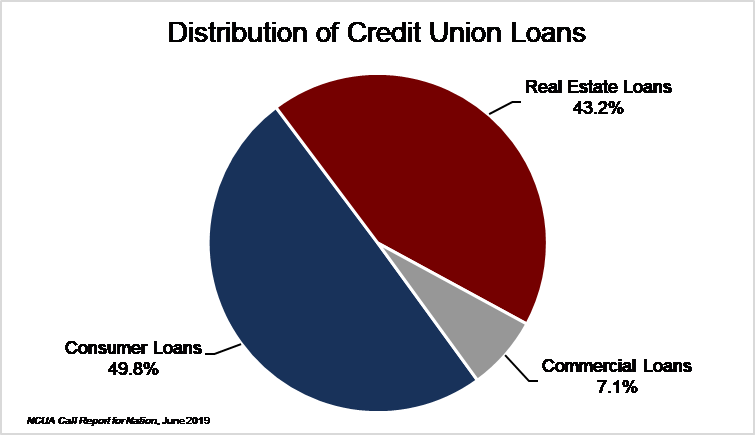

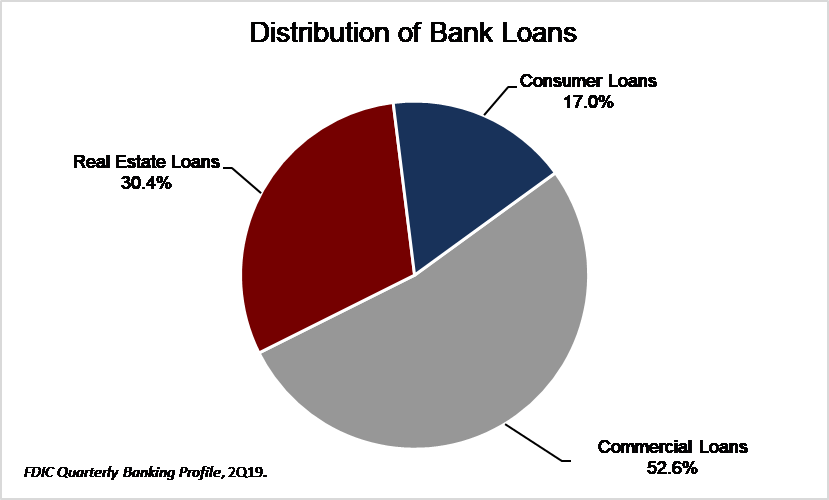

- Does the to-be-acquired institution have a similar business model and operating strategy? This very often might not be the case. Credit unions generally focus on consumer and residential real estate loans, while most community banks focus on commercial real estate loans and other business loans. This is reflected in the following two pie charts.

Expertise

One of the reasons to acquire a bank is to obtain specific expertise. A common example is commercial lenders. This can create two complications. The first is ensuring the credit union can retain the loan officers because, in our experience, the loan customers are very loyal to their loan officer. If the loan officer does not stay, the credit union could have difficulty retaining the customer and its deposits. The second complication is that commercial real estate and acquisition, development, and construction loans often comprise a significant portion of a bank’s balance sheet. These loans can be very difficult to evaluate, and an acquiring credit union would either need to possess the expertise to perform due diligence on these loans prior to the acquisition or outsource the work. Finally, we note that a credit union is limited to the amount of commercial loans it can hold on its balance sheet. A federally insured credit union has an individual lending cap for commercial loans to one borrower equal to the greater of 15 percent of net worth or $100,000, plus an additional 10 percent of the credit union’s net worth if the amount exceeding the 15 percent is fully secured. In addition, a federally insured credit union has an aggregate cap on net member loan balances equal to the lesser of 1.75 times its actual or required net worth.

Membership

Another reason for a credit union to acquire a bank is to expand into a new geographic area or expand its field of membership. Retaining members is difficult enough in credit union-to-credit union mergers and can be more challenging when purchasing a bank – the bank customers might simply not want to join. That said, a credit union acquirer might be able to better serve the customers than the acquired bank by offering:

- Better rates

- More loan and deposit products (e.g. mortgage lending and consumer loans)

- Mobile banking

- More branch locations

The bank’s customer profile might also help the credit union diversify its member base. For example, the banking customers could be older with abundant savings and little need for loans providing the acquiring credit union with additional liquidity.

Governance

We believe this is the most persuasive argument for a credit union to consider purchasing a bank versus trying to merge with another credit union. Unlike credit union mergers where the acquired credit union often insists on participating in the governance structure, the bank’s selling shareholders are paid in cash, do not have an ongoing economic interest in the bank, and therefore are often very willing to exit the combined institution.

Employees

Retention of the employees the acquiring credit union wants to keep is one of the most critical items in a successful acquisition. The acquiring credit union should gain a keen understanding of the bank’s compensation strategies and structures through its due diligence. It should also identify key employees to retain as well as those who will be terminated on or soon after the acquisition date. This is important for morale, as well to ensure the credit union can enjoy the economies of scale arising from the transaction. We recommend that the acquiring credit union consider the use of stay put contracts for those key employees it wants to retain and legally binding non-compete agreements for those it does not plan to retain.

Balance Sheet Considerations

An acquisition of a bank by a credit union could provide multiple balance sheet benefits. The acquisition could reduce concentration risk by diversifying the credit union’s loan portfolio. It could lessen interest rate risk by adding loans that reprice more frequently than the loans in the credit union’s portfolio. Commercial and industrial loans are often variable rate loans and commercial real estate loans often include fixed rate pricing for five or seven years and then reprice to the market. The transaction could also provide additional liquidity through the bank’s core deposits.

The acquiring credit union should model the effects the transaction might have on its ALM profile as part of its due diligence.

The acquiring credit union should also carefully assess its ability to serve the bank’s business customers. This includes considering the credit union’s lending expertise, its ability to retain the bank’s lending team, caps on member business loans, etc. Retaining the business lending relationship is key to retaining the business customer’s deposits.

Last, but not least, the credit union should consider the effect the transaction will have on its capital. In our experience, a transaction in which a credit union buys a bank is dilutive to GAAP equity and regulatory capital because, unlike a credit union merger where the equity remains in the combined entity, the credit union is buying out the bank’s equity and paying it to the selling shareholders. In addition, any cash paid in excess of the fair market value of the assets purchased and liabilities assumed results in goodwill. We caution that while goodwill can currently be counted in a credit union’s regulatory net worth, the NCUA is in the process of reviewing regulatory capital requirements in the context of its proposed and now delayed risk-based capital and the newly promulgated Community Bank Leverage Ratio (“CBLR”). We note that goodwill and other intangibles are deducted from regulatory net worth under the banking regulators risk-based capital and CBLR rules. We note this dilution is not an issue if the acquiring credit union has ample excess capital to deploy.

Accounting Considerations

Like all mergers and acquisitions transactions, the initial and ongoing accounting for the transaction must be done in accordance with the rules for “purchase accounting”. The accounting can be quite complex and is beyond the scope of this white paper. For details see – link to our bank acquisition white paper.

II. Tax Consequences

A bank can be one of two kinds of taxpaying entities – an S-corporation or a C-corporation. Whether a bank is one versus the other can have major tax effects on the transaction. The sale of an S-corporation bank can result in taxes at the shareholder level only, whereas the sale of a C-corporation bank can result in taxes both at the bank level and to the shareholders. The form of the acquisition agreement also affects the taxes that will arise from the transaction. An acquisition can be structured as a taxable “purchase & assumption” deal, otherwise termed as a taxable asset sale, where the buyer purchases the bank’s assets and assumes the bank’s liabilities – consisting mostly of the deposit accounts. Alternatively, if the buyer is another bank, bank holding company, or other taxpaying entity, the transaction can be structured as the sale of stock and avoid the “double” taxation. Finally, a bank can also offer its stock as consideration to the selling shareholders, which could result in no tax at the time of the sale provided it is properly structured.

Sellers and buyers need to fully understand the tax consequences as they negotiate the purchase price.

Taxable Asset Sale

Because nearly all states do not permit a credit union to purchase the stock of a commercial bank, an acquisition of a commercial bank by a credit union generally must be structured as a taxable asset sale, where the credit union purchases the bank’s assets and assumes the bank’s liabilities. In this case, the bank charter is left as a shell corporation containing the cash purchase price paid by the credit union. The shell corporation is then likely liquidated with the cash proceeds distributed to the selling shareholders.

As a general rule, a bank buyer prefers to structure an acquisition as a taxable asset sale, because the buyer can amortize and deduct the premium paid for income tax purposes, generally over a 15-year period. The net present value of the deduction of the premium is approximately 22%-25%, decreasing the after-tax purchase price for the bank buyer. Of course, a credit union cannot reap the buyer’s tax benefits of a tax-deductible premium. It must undertake the acquisition as a taxable asset sale simply because it cannot own bank stock in most jurisdictions.

A taxable asset sale of a C-corporation bank generally results in “double taxation.” Any premium paid on the deal will first be taxed at the corporation level, currently at a 21% federal tax rate, plus the applicable state tax rate. After the corporation pays that tax and distributes the remaining sales proceeds to the shareholders, the shareholders will again pay tax on their capital gain from liquidating their stock investment.

We note that any net operating loss or tax credit carry-forwards available to the C-corporation can offset the gain from a premium received. Because of the double taxation, most C-corporation sales transactions are structured as stock sales.

On the other hand, most S-corporation sales transactions are structured as taxable asset sales because there is only a single layer of tax on a premium paid. The taxable gain associated with a premium is not taxed at the corporate level. It instead flows through to the shareholders as a taxable gain and in turn increases their stock basis. We note that this tax advantage applies only to S-corporation banks that have made their S- election more than five years before the sales transaction. If the selling bank had not yet reached its fifth anniversary as an S-corporation, it would potentially be subject to the IRC Section 1374. A portion or all of the premium could be subjected to a 21% federal corporate level tax, as well as potentially a state-level corporate tax depending on the circumstances. Thus, an S-corporation that recently made its S-corporation election could also be subjected to the “double tax” penalty of a corporation selling its assets, versus the corporation’s sellers selling their stock and paying a single layer of income tax.

Merger

If state laws permit a state-chartered credit union to merge with a bank and it does so, the transaction is treated for tax purposes as a taxable disposition of assets, regardless of the fact that the form of the transaction was a merger. This is because a credit union is exempt from federal income tax and the transaction thus falls under IRC Section 501(c)(14). IRC Section 337(b)(2) and Treasury Regulation 1.337(d)-4 outline the rules that apply when a taxable entity, like a bank, transfers all or substantially of its assets to a tax-exempt entity like a credit union. It is a “deemed sale” of the taxable entity’s assets at their respective fair market values with the same result as a taxable asset sale. Further, a credit union does not issue stock to the selling shareholders, so the merger transaction cannot be structured as a tax-free stock-for-stock exchange.

Taxable Asset Purchase Price Allocations

There are other nuances that go into calculating the gain or loss from taxable asset sales. The purchase price is spread amongst the assets of the selling corporation according to the assets’ respective fair market values, pursuant to IRC Section 1060. Depending on the schematics of the purchase price allocation, there could be opportunities for a selling S-corporation to realize an ordinary loss on some assets (tax benefit at the higher ordinary tax rates) and increase the capital gain portion of the transaction (premium/goodwill), with lower rates on capital gains for the S-corporation’s shareholders. A C-corporation pays ordinary taxes and the capital gain income at the same rate; thus, purchase price allocation schematics generally present less of a planning opportunity for C-corporations.

Simplified Illustration

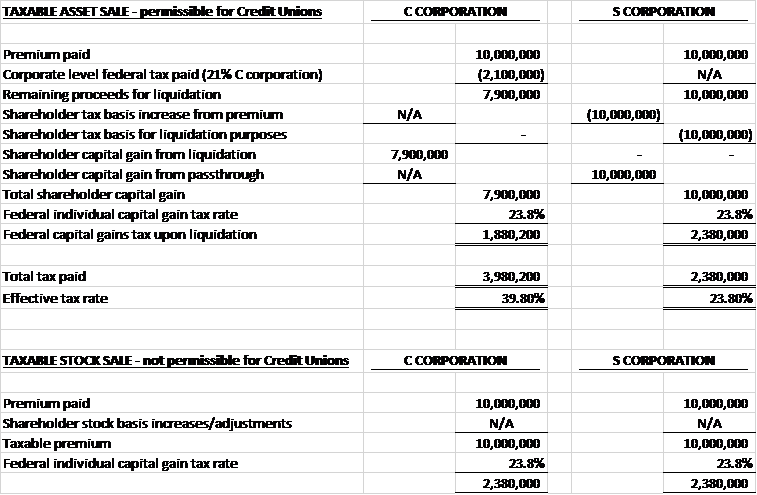

The simplified illustrations below show the taxes arising from the sales transaction depending on its structure – taxable asset sale versus stock sale – and the form of the tax paying entity – C- versus S-corporation. The illustration does not incorporate any Section 1060 purchase price schematics, so actual results would vary from the illustration, particularly for an S-corporation, where the tax burden could likely be decreased by a purchase price allocation that would produce ordinary losses and increased capital gains, thus reducing total tax burden on the shareholders.

As you can see from the simplified illustration above, there are definite tax consequences that can arise from when a credit union is the purchaser and the seller is a C-corporation. The additional tax cost can be significant and should be a major component in assessing the feasibility of entering into a transaction with a credit union as the buyer.

III. Legal and Regulatory Issues

There are a number of legal and regulatory issues that must be considered in connection with a potential acquisition of an FDIC insured bank by a credit union.

Legal Structure

As we noted earlier, in the majority of cases a credit union cannot own or acquire the shares of the bank. To be more specific, a federal credit union cannot purchase the shares of a community bank or merge with it. A few states, Florida being the prime example, explicitly allow a state-chartered credit union to merge with a bank. Other states forbid the transaction just as the NCUA does, and the majority of state statutes are silent on the matter.

As such, the legal structure utilized in a credit union’s acquisition of a bank is an agreement for the credit union to purchase all the assets and assume all the liabilities of the bank. This means that there must be an individual transfer of each asset, an assumption of each liability and an assignment of any intangible or collateral rights at closing. This creates a more complex and burdensome legal process to ensure all the required legal documents necessary to complete the transfer of each asset and the proper assumption of each liability are prepared and executed. This process is more complex than what occurs when the transaction is structured as a purchase of stock or merger.

Legal Agreement

Any transaction where a credit union purchases a bank must include a definitive purchase and assumption agreement setting forth the key terms and conditions of the transaction. This agreement must be the result of an arms-length negotiation and both the credit union and the bank have duties to protect their respective interests. These fiduciary duties fall to the officers and directors of the credit union and the bank.

Directors and officers of a bank want to maximize shareholder value as part of any sale and minimize any post-closing risk or risk that the sale will not be consummated. This requires the bank to negotiate a definitive agreement that limits the scope of representations and warranties given, reduces the conditions to closing, and eliminates post-closing liabilities. Because directors and officers of a bank ultimately report to the shareholders of the bank, those individuals are often intimately involved in negotiating, reviewing, and approving any agreement. This means that banks will want a detailed legal agreement clearly setting forth the specific representations, warranties, and covenants being made as part of the transaction.

Credit unions have generally used more simplified agreements in credit union to credit union mergers, in part, because the two credit unions become one and no cash is being paid out of the acquiring credit union. Further, a credit union might be less concerned about obtaining representations and warranties or incurring post-closing liabilities in a merger of two credit unions because it retains the capital of the credit union being merged. However, because a bank purchase is an all cash deal, it is important for credit unions to obtain appropriate representations and warranties regarding the condition and status of the bank and have some form of recourse post-closing to protect the credit union from risk of loss due to a breach of the definitive agreement, fraud, or other damages. This requires credit unions to spend more time, care, and legal expenses negotiating and finalizing a definitive agreement than in a typical credit union to credit union merger.

One final difference for both banks and credit unions in any legal agreement for the acquisition of a bank by a credit union concerns the scope of the operating covenants that govern the operation of the selling bank from the date a definitive agreement is signed until closing. Typically, any bank sale will include negotiated operating covenants restricting the selling bank from taking any extraordinary actions from the date the definitive sale agreement is executed through the date of closing. These operating covenants are heavily scrutinized by federal bank regulators to ensure that the acquiring entity is not exerting extraordinary control over the bank it intends to buy prior to actually owning the bank. Typically, the NCUA is more relaxed about a buying credit union’s ability to control bank operations prior to the closing date. This creates an issue of prior control that the bank’s officers and directors need to recognize and address appropriately with the banks. This results in the need for careful negotiation of such covenants in any definitive agreement.

Regulatory Process

Both the credit union and the bank will be required to file regulatory applications as part of a credit union acquisition. This results in different regulatory considerations for both buyer and seller than what one sees in a bank to bank transaction or a credit union to credit union merger.

NCUA

The NCUA does not yet have a formal framework in place to review and approve the purchase of banks by credit unions. They are working on one and we understand it is forthcoming. However, the NCUA does follow an information process for approving such acquisitions.

As noted above, the purchase and assumption agreement should detail the specific assets to be purchased and liabilities to be assumed, which will be subject to approval by the NCUA. Such a request for approval must include a description of the transaction and include copies of the relevant transaction documents.

In general, when deciding whether to approve a proposed transaction, NCUA regulators will consider the effect on members, financial impact of the transaction, and issues related to field of membership and impermissible assets. For example, credit unions are not permitted to hold certain types of deposits or loans often held by banks. NCUA anticipates this possibility and generally gives a post-transaction period (up to six months) to sell or bring any non-conforming loans into compliance.

Additionally, credit unions must show that they have performed appropriate due diligence on the various loans and deposit accounts at the bank. This could be a challenge if the credit union is involved primarily in consumer lending activities, while the bank being acquired engages in commercial lending, agricultural lending, manufacturing lending, asset-based lending, or other forms of lending with which the credit union is unfamiliar.

We are carefully monitoring the NCUA’s progress on issuing a framework for these transactions. One of our biggest concerns is the continued inclusion of goodwill in regulatory capital. Goodwill and intangible assets like the core deposit intangible (CDI) are direct deductions from banks’ regulatory capital. The NCUA is the only banking regulator not requiring it to be deducted. We note that goodwill and the CDI are deducted from capital under the NCUA’s proposed risk-based capital rules. We understand that the NCUA is reconsidering issuing the risk-based capital rules especially given the recently promulgated Community Bank Leverage Ratio (CBLR) rules for banks with assets under $10 billion. We caution credit unions to consider that the CBLR rules for banks also require that goodwill and the CDI to be deducted from regulatory capital.

Field of Membership

One of the most significant regulatory issues that arises in a credit union’s acquisition of a bank is the field of membership requirements for credit unions. A credit union should not assume that they will be able to automatically acquire and retain all accounts and customers of a bank as part of an acquisition. Credit unions are governed by field of membership requirements and, unlike when a credit union merges with another credit union, in a bank acquisition a credit union’s field of membership does not automatically expand to include the customers of the bank. Credit unions will need to be prepared to address with the NCUA why the former bank customers fit within the credit union’s current field of membership or request an expansion or amendment to their current field of membership. If the identified loans or customers are not properly within the credit union’s existing or amended field of membership, the NCUA will require the credit union to divest of those customers within a reasonable period of time.

Banking Regulators

Banks can be state- or nationally-chartered. State-chartered banks are regulated by the state in which they were formed and by the FDIC – the primary insurer of their deposits. Nationally-chartered banks are regulated by the Office of the Comptroller of the Currency (“OCC”) and the FDIC. In addition, state chartered banks that are members of the Federal Reserve are federally regulated by the Federal Reserve as its primary federal regulator and also by the FDIC. A bank considering a sale to a credit union must file with its primary federal regulator and applicable state regulator.

Once the purchase and assumption is completed, the bank will be a shell charter with minimal to no assets remaining in the organization. As such, for a state-chartered bank, both the federal and state banking regulators will require that the former bank dissolve. In the case of a national bank, the OCC will require that the shell charter be merged into an affiliated entity. This will require a special regulatory application to the applicable federal bank regulator. Additionally, if the bank being sold is a state-chartered bank, the appropriate state banking agency will require an application in connection with the sale. Considerations for each of the FDIC, OCC and Federal Reserve are listed below. Additionally, while a summary of certain requirements that may be applicable to state banks as part of such a sale is set forth below, a complete fifty state review of applicable state bank regulatory requirements is beyond the scope of this paper.

FDIC

Federal law explicitly requires prior written approval from the FDIC before any insured depository institution may transfer FDIC insured deposits to a “noninsured bank or institution” – this includes credit unions because credit union deposits are insured by the NCUA and not by the FDIC. We note this applies even for the sale of a branch by a bank to a credit union if the credit union assumes the deposits of that branch. We note that the FDIC recently indicated that is considering the implications of credit unions buying banks.

The FDIC will require its own interagency merger application to be filed with it even though the sale to the credit union is a purchase and assumption transaction. In fact, an acquisition of a bank by a credit union, regardless of the bank’s primary federal regulator, will require FDIC approval as the FDIC is the only federal bank regulator that can act on the assumption of an FDIC insured bank’s deposits by a credit union. If the FDIC is not the primary federal regulator for the bank, the FDIC will work closely with the OCC or the Federal Reserve (as the case may be) throughout the application review process.

Similar to the application submitted to the NCUA, the FDIC application will require a detailed description of the proposed transaction and copies of the relevant transaction documents. Additionally, the FDIC requires a description of any non-conforming or impermissible assets that the credit union may not be permitted to retain – as noted above, this would include certain types of deposits or non-conforming loans that cannot be held by a credit union. As part of the application, a description of the method of divestiture or disposal and anticipated time period must be submitted to the FDIC. Finally, in reviewing applications which contemplate a credit union as the surviving entity, special consideration is given to the disclosures made to depositors regarding the change in deposit insurance.

OCC

Due to the requirement from the NCUA that the transaction be structured as a purchase and assumption transaction, the OCC requires a two-step process when a credit union seeks to acquire a national bank. The first step is to receive approval for the sale of substantially all the assets and assumption of substantially all the liabilities of the national bank. The second step is to receive approval to merge the then uninsured national bank with and into its holding company. The filings required for both steps can be filed simultaneously with the OCC along with a transmittal letter summarizing the process.

A unique complication can occur if the state where a national bank’s holding company is incorporated in does not provide explicit authority for the merger of an uninsured national bank with and into a state corporation. This will require a state-by-state analysis of permissibility. If this is the case, the national bank may need to include the additional step of forming a subsidiary and first merging the then uninsured national bank into the subsidiary with the subsequent merger into the holding company to immediately follow or finding some other avenue to merge the shell bank out of existence. As with the streamlined process first outlined, the formation of the operating subsidiary can occur all in one filing along with the steps outlined above.

Federal Reserve

We note that if the bank in question is a Federal Reserve member bank, that the Federal Reserve Board does not currently have formal requirements for its member banks which are considering a sale to a credit union in a whole bank purchase and assumption transaction. However, some form of application to the regional federal reserve bank would be necessary. Due to the low volume of such applications, the Federal Reserve has not yet issued formal guidance on how this application process might work, but given the need to partner with the FDIC, it is likely that the Federal Reserve process would be similar to that required by the FDIC.

State Banking Agencies

For state-chartered banks which enter into purchase and assumption agreements with credit unions, once approval is given for the transaction, the key issue from the state’s perspective is the fact that a shell entity with a bank charter remains after consummation of the sale. While each state has its own process for addressing such shell charters, many state rules allow for voluntary liquidation of the bank following such a transaction – though the required shareholder approvals and applications vary state-by-state. As noted above, a survey of all applicable state rules is beyond the scope of this paper.

IV. Conclusion

The acquisition of a bank by a credit union is a relatively complex transaction involving multiple regulatory agencies, federal and state income taxes, and multiple strategic considerations. We hope this white paper has helped readers better understand the ramifications that could arise in undertaking a deal of this type.

The issues addressed in this white paper are complex and are based on general information and examples only. Readers should not rely on the information contained in this paper regarding potential transactions without first seeking advice, input and comments from their independent accountants, attorneys and primary regulators before undertaking the such a transaction. Readers are strongly encouraged to seek such independent advice as the specific facts and circumstances in each particular transaction could lead to different accounting, tax, legal and regulatory interpretations than those described herein.

Please do not hesitate to contact any of us if we can be of assistance.

V. About the Authors

Douglas Winn

Mr. Winn co-founded Wilary Winn. His primary responsibility is to set the firm’s strategic direction. From an idea in 2003, Wilary Winn has grown into a national presence with financial institution clients located across the United States. Wilary Winn’s clients include more than 300 community banks, 73 of which are publicly traded and over 300 credit unions, including 41 of the top 100.

Mr. Winn is a nationally recognized expert regarding accounting and regulatory reporting for financial institutions and speaks regularly at industry conferences. He has led seminars sponsored by the AICPA, FDIC, FFIEC, FHLBanks, NCUA, and many of the country’s largest accounting firms. You can reach Doug at [email protected].

Anton J. Moch

Mr. Moch joined Winthrop & Weinstine, P.A., in 2001 and is a shareholder practicing in the field of community banking and financial services. From its inception, Winthrop & Weinstine has specialized in representing banks and financial institutions and has deep bench strength and extensive experience in banking law with a multi-practice approach allowing it to provide a full range of services, including community banking, governance, mergers and acquisitions, enforcement and regulatory compliance, securities, trust services, commercial lending, creditors’ remedies, insurance, tax, corporate, real estate, employment, intellectual property, antitrust, and specialized financial services litigation.

Mr. Moch’s in-depth experience and strong relationships with community banks allows him to work with and advise senior officer teams, board of directors and ownership groups on a broad and varied set of issues, including, mergers and acquisitions, branch acquisitions, corporate restructuring, expansion strategies, organic growth strategies and activities, De Novo charters and De Novo branching issues and the sale of financial organizations to third parties. Mr. Moch also has extensive experience regarding compliance and regulatory issues, routinely assists community banks with regulatory filings and applications and works in close connection with his contacts at federal and state regulatory agencies. You can reach Tony at [email protected].

Paul Sirek

Eide Bailly is a top 25 public accounting firm with more than 700 community financial institution clients. Mr. Sirek’s focus at Eide Bailly is on the financial institutions industry. He provides management consulting, tax planning, and tax compliance services to financial institutions ranging in size from less than $50 million to more than $1 billion. He conducts tax research projects, and he assists financial institutions with merger and acquisition issues including tax structuring of transactions and the regulatory application process. Paul also assists bank holding companies and financial institutions with regulatory filings including FR Y-9C, FR Y-9LP, and FR Y-9SP reports.

Mr. Sirek is attentive and very responsive, promptly replying to inquiries and providing a high level of customer service. He communicates current tax developments to clients and staff so they are up to date on requirements, and he consults with financial institutions, as well as their shareholders, on S-corporation conversions and S-corporation planning issues. His goal is to provide clients with the tools they need for growth and success. You can reach Paul at [email protected].