Loss Reserve Increases for the Four Largest U.S. Bank Holding Companies Related to the COVID-19 Pandemic

Key Takeaway

The immediate recognition of the potential credit losses from COVID by the largest banks are a good illustration of how CECL should work. Wilary Winn offers CECL estimates that closely benchmarked to these results.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released August 2020

Introduction

The four largest bank holding companies in the United States: JP Morgan Chase & Co., Bank of America Corporation, Citigroup Inc. and Wells Fargo & Company hold approximately $10 trillion in assets as of June 30, 2020, and their combined financial performance serves as a market indicator for financial institutions in general.

Due to the COVID-19 pandemic, loan loss reserves for these bank holding companies increased markedly as all use required CECL accounting. This white paper analyzes loss reserve and market capitalization changes from yearend 2019 through the 2nd Quarter of 2020 for the big 4 bank holding companies.

For financial institutions which are SEC registrants, which is inclusive of the largest U.S. Bank holding companies, the Current Expected Credit Loss (“CECL”) standard became effective for fiscal years beginning after December 15, 2019. Under the CECL methodology, which was announced to financial institutions in June 2016 with ASU 2016-13, companies must record life-of-loan estimated credit losses for debt instruments, leases and loan commitments. The Coronavirus Aid, Relief, and Economic Security (“CARES”) Act signed into law on March 27, 2020 included over $2 trillion of relief to individuals and businesses also included a provision that allowed banks the temporary option to delay compliance with CECL until the end of the year or the end of the coronavirus national emergency, whichever comes earlier. For the most recent quarter, the four largest bank holding companies did not avail themselves of this option and were still reporting losses under the CECL standard and their reserve estimates include life-of-loan credit loss estimates.

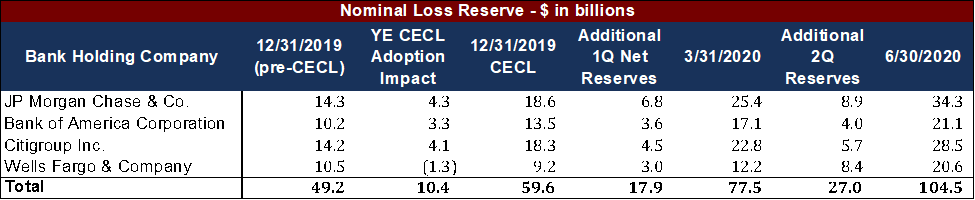

Aggregate Credit Loss Reserves

Not surprisingly, many financial institutions significantly increased credit loss reserve levels subsequently to yearend. The increases specifically relate to future lifetime credit loss estimates attributable to the pandemic. Worth noting is that the four largest bank holding companies increased their credit reserves in aggregate by $17.9 billion in the 1st Quarter and by another $27.0 billion in the 2nd Quarter. The following table reflects aggregate loss reserves for the largest bank holding companies for the last three quarters.

As the table shows, aggregate lifetime credit losses reserves under CECL increased from $59.6 billion at December 31, 2019 to $77.5 billion as of March 31, 2020 and the to $104.5 billion as of June 30, 2020. Overall, the big four bank holding companies increased loss reserve estimates by $44.9 billion so far in 2020. The aggregate loss estimates are 1.75 times higher as of 2nd Quarter 2020 in comparison to yearend, which is an increase from 1.30 times higher as of 1st Quarter 2020.

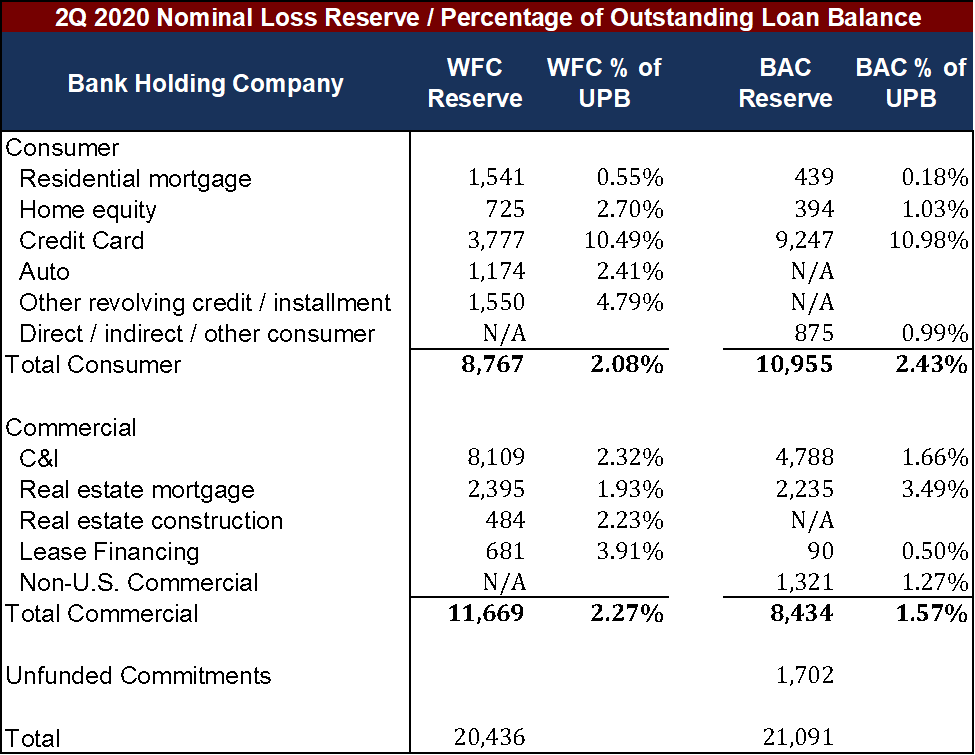

Credit Loss Reserve Detail

In addition to providing aggregate credit loss reserve information to their shareholders, Wells Fargo and Bank of America also disclosed their loss reserve broken out between various consumer and commercial loan categories. The format of their releases was similar. The following table reflects consumer and commercial loss reserves as of June 30, 2020 for Wells Fargo and Bank of America. Differences in the disclosures between the two organizations appear as “N/A”.

As shown by the previous table, Wells Fargo and Bank of America have similar loss reserves as a percentage of outstanding balance for credit cards. With respect to all other loan consumer categories, Wells Fargo has a higher reserve percentage for anticipated lifetime credit losses.

Stock Prices and Capitalization

The COVID-19 pandemic has also adversely affected the stock share price for the big four bank holding companies. In addition to increased credit loss exposure, the accommodative Fed Policy of extremely low interest rates and a flat yield curve greatly reduces the funding advantages provided by deposits and further compresses interest spread margins. The following table reflects the end of day stock price for the last 3 quarters along with the stock price as of July 17, 2020, chosen because 2nd Quarter 2020 results for all four bank holding companies were disclosed that day.

As the table shows, all four bank holding companies reflect the same basic trend – a greatly reduced stock price since yearend. Three of the four reflect higher share prices at June 30, 2020 in comparison to March 31, 2020 with Wells Fargo & Company being the exception. Worth noting is that JP Morgan Chase’s stock increase post 2Q release (comparing July 17, 2020 to June 30, 2020) is mainly due to stronger than expected performance from the investment banking part of their business which was a pleasant upside surprise for their investors.

The following table shows the effect of stock price changes to overall market capitalization levels since yearend for the four largest bank holding companies.

The erosion of market capitalization for the big four U.S. bank holding companies has been sizeable. As shown by the previous table, the capitalization reduction as of June 30, 2020 since yearend has been $431.4 billion representing a 38.1% decline. This is only slightly improved from the 41.4% reduction as of March 31, 2020. While the major stock indices indicate a near full recovery of U.S. stocks as of August 2020, the stocks of financial institutions are have significantly lagged behind the broader market largely due to increased credit exposure.

Conclusion

Under CECL, the financial disclosures of the four largest U.S. bank holding companies include valuable insights as to their life-of-loan credit loss expectations. Projecting losses in the current environment is challenging as the detriments associated with high unemployment need to be balanced with the benefits provided by unprecedented fiscal stimulus. Wilary Winn will continue to monitor the quarterly projections of credit loss estimates as they serve as a vital benchmarking source for our loss estimates.