Recent Trends in the Performance of Pooled Trust Preferred Collateralized Debt Obligations [White Paper]

Key Takeaway

This white paper is an example of our commitment to the community banking industry.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Updated and Revised February 2014

Introduction

While no longer an area of major concern, potential credit losses on TruPs owned by community banks was a potential life-or-death issue for many in 2008, 2009, and 2010. Experts had historically treated a permitted payment deferral as a default. We were the first in the country to argue that this was not necessarily true and that many deferrals would eventually cure. To make this case, we developed sophisticated ways to review the bank issuers in a pool on an institution-by-institution basis. Our willingness to take on this thorny issue resulted in community banks not being forced to record hundreds of millions of dollars of OTTI losses. Moreover, other valuation experts eventually followed our lead, recognizing that our approach was far fairer and more predictive.

Wilary Winn is one of the leading providers of valuations of pooled trust preferred collateralized debt obligations (TruP CDOs) in the country. As of December 2013, we analyzed 62 TruP CDOs containing $24.4 billion of collateral. This represents 55 percent of the 113 total TruP CDO deals issued globally. This white paper summarizes the recent trends we have observed regarding the performance of these securities. As background, Appendix A provides a general description of TruP CDOs.

Collateral Input Assumptions That Determine TruP CDO Value

The performance of the CDO is dependent on the performance of the trust preferred securities underlying the deal. The key inputs used to estimate the performance of the trust preferred securities supporting the CDO are:

- The rate of expected defaults – conditional default rate (“CDR”)

- The loss arising from a default – loss severity

- The rate of expected prepayment – conditional repayment rate (“CRR”)

In addition, TruP CDO default assumptions and cash flows are influenced by:

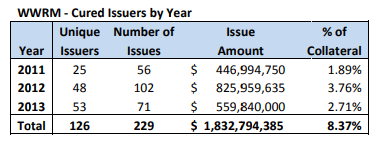

- The rate of deferrals and cures – an issuer of a trust preferred security generally has the right to defer interest payments for up to five years. Historically deferrals ultimately defaulted, thus causing many to equate a deferral with a default. However, even during the rapidly increasing rate of bank failures during the financial crisis that began in 2008, Wilary Winn believed many deferrals would eventually cure. This forecast has proven itself to be true, as evidenced by the following chart showing the rate of cures across the deals valued by Wilary Winn.

- The shape of the forward LIBOR curve – many TruP CDOs rely on LIBOR rates to determine the amount of interest being paid into and out of the deals. Due to the long duration of the CDOs, the shape of the forward curve can have a significant effect on the amount of excess spread in the deal, especially in deals with fixed rates flowing in and floating rates paying out.

Trends

Wilary Winn began performing TruP CDO valuations in late 2008. Based on the observations and data we have collected as part of our valuation process, we have noted the following from that time through December 31, 2013.

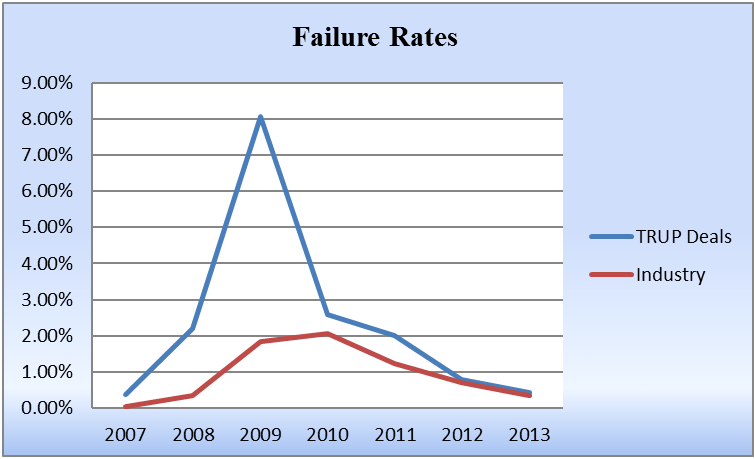

- Risk Characteristics – Defaults on trust preferred securities were once the key driver of TruP CDO performance. The default rates peaked in 2009, and have since declined (please reference the graph on the following page). As the rate of default continues to decrease, Wilary Winn believes the risk of prepayment as well changes in the regulatory treatment of TruPS have become just as important as the risk of default.

- Deferrals – After seeing very few deferrals cure historically, the rate of cures has increased significantly from 2011 through 2013. In 2009 Wilary Winn began modeling many deferrals to cure believing they would recapitalize, merge with another institution, or earn their way out of the deferral given the lifeline provided by TARP and other forms of government intervention. Although this ran contrary to the industry assumption that a “deferral was tantamount to a default”, Wilary Winn has seen 126 issuers cure their deferral from 2011 through 2013 across all the deals we value. Please see Appendix B for more detail.

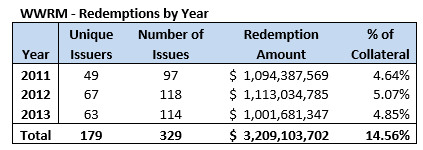

- Prepayments – As predicted in 2010 by Wilary Winn, after seeing very few redemptions from 2008 to 2010, the rate of prepayment has increased significantly from 2011 through 2013. Wilary Winn believes the increase in prepayment activity is due in part to the Dodd-Frank Act which removed trust preferred securities treatment as Tier 1 regulatory capital for depository institution holding companies with more than $15 billion of total assets at December 31, 2009. We began modeling issuer specific prepayment assumptions in 2010 with a focus on banks adversely affected by the Act and have seen 179 issuers redeem their issues from 2011 through 2013 across the deals we value. Please see Appendix C for more detail.

- Profile of FDIC banks – In the majority of the deals we value, the issuers we believe will not default are on average financially stronger than the aggregate average of all FDIC-insured institutions (please reference the included graphs). This creates a “survivor bias” and we believe future default rates for these trust preferred securities will likely be consistent with the long-term default rate for the industry versus the relatively higher default rates we observed in 2008 through 2011 for issuers of trust preferred securities.

- Market Liquidity – The market for trust preferred CDOs continues to remain highly illiquid. In December 2013, the uncertainty invoked between the original release of the Volcker Rule and the final interim rule caused a noticeable increase in bidding and trading activity. However, we believe most of these trades occurred under distress and do not represent trades made in an orderly market.

Analysis of Collateral Input Assumptions

Default Rates

As shown in the chart below, during the early stages of the financial crisis, the failure rates for the issuers of the trust preferred securities underlying the TruP CDOs we value were markedly higher than failure rates for the industry as a whole.

We believe the decrease in the default rate on trust preferred securities is due to the length of the boom, bust, and recovery cycle. Most of the trust preferred securities were issued since 2000 as the banking industry was booming, and therefore were relatively new when we saw the crisis and a wave of early defaults. Prior to late 2010, very few issuers that deferred were able to cure their deferral and subsequently defaulted and many assumed a deferral was a default. Wilary Winn was not convinced this was necessarily so and we began evaluating the collateral supporting the TruP CDO at the issuer level beginning in early 2009 in order to assess the risk of a near-term default. Beginning in 2010, this difference in failure rates began to narrow significantly and we are now seeing many deferring issuers cure their deferral.

Wilary Winn notes that the bank failure rate in 2013 was 35 basis points. This rate is very close to the average default rate from 1934 to 2008 of 36 basis points.

Forecasted Rates of Near-Term Default

Wilary Winn believes we will continue to see a downward trend in bank failures and defaults. One indicator of stabilization is the leveling off and reduction in the number of banks on the FDIC’s “problem banks list.” According to the FDIC1, additions to this list peaked in 2009 when 450 new banks were added followed by another 182 banks in 2010. The number of banks peaked in the first quarter of 2011 at 888, after which a net of 75 banks were removed from the list in the last three quarters of 2011. In 2012 the list had another net drop of 162 banks. As of September 30, 2013, the most recent disclosure of the list, another 136 banks had been removed leaving a total of 515 banks on the list of problem institutions after ten consecutive quarters of decline.

In a recent research report, Moody’s summarized their 2013 ratings changes on TruP CDOs2. In 2013 Moody’s upgraded ratings on 217 tranches in 67 deals and only downgraded ratings on seven tranches in five deals. The upgrades ranged from one to ten notches, with an average of 3.1 notches. They listed five reasons for the upgrades including:

- Continuing deleveraging of senior notes

- Improvements in the over-collateralization ratios

- Increase in the number of cures

- Improvements in the credit quality of underlying collateral

- Declines in TruP CDO exposures to bank failures

These observations affirm the predictive nature of the TruP CDO cash flow models Wilary Winn began to model in 2009 and 2010.

Forecasted Long-term Default Rates for Issuers of Trust Preferred Securities

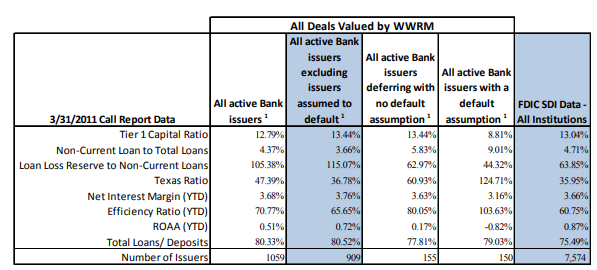

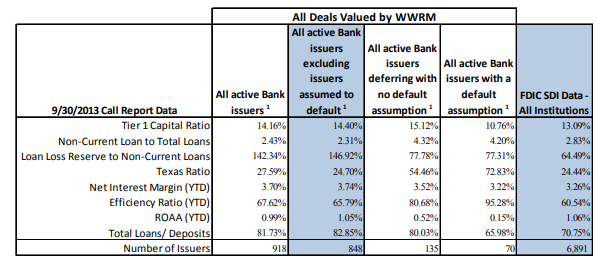

Wilary Winn analysis of the TruP CDO pools we value leads us to believe that the issuers within the pools which we believe will not default are on average financially stronger than the average of all FDIC-insured institutions. As the two shaded columns in the tables on the following page indicate, the key ratios of the active issuers for which we currently do not have a default assumption are relatively stronger than the aggregate for all FDIC-insured institutions. The banks have higher Tier 1 capital, fewer non-current loans, and higher loan loss reserves. On the other hand, they have a slightly higher Texas Ratio than the aggregate. These tables are as of March 31, 2011 and September 30, 2013 respectively.

We note that in order to construct the table we summarized the active issuers by creating a weighted average based on issue size, then divided the issuers into categories based upon their status of deferral and whether or not Wilary Winn assigned a default assumption to the issuer. To ensure an accurate comparison, Wilary Winn calculated the standard deviation across the issuers for each ratio and removed any issuer that fell more than three standard deviations above or below the average for that ratio.

As the tables indicate, the key ratios have drastically improved in the past two years. Wilary Winn believes that the relative strength of the remaining issuers in the deals, excluding those assumed to default, creates a “survivor bias” and we believe future default rates for these trust preferred securities will likely be consistent with the long-term default rate for the industry versus the default rates we observed in 2008 through 2011 for issuers of trust preferred securities. As a result, Wilary Winn believes that there is no need to vector terminal CDRs upwards solely on the basis of high historical TruP failure rates.

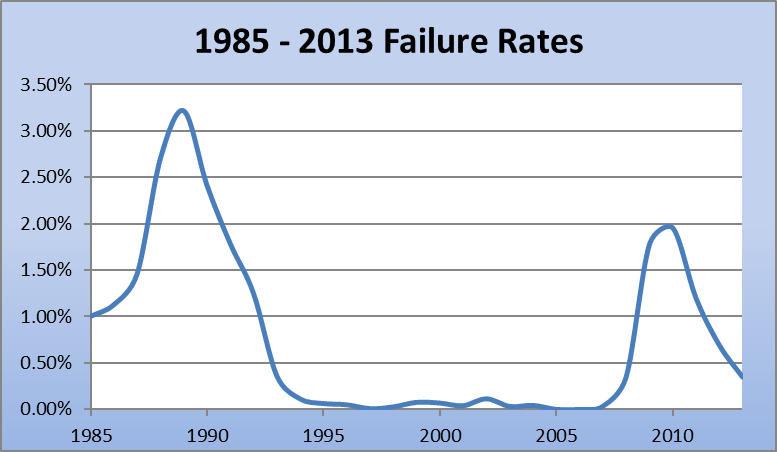

In our experience, most experts are basing their estimates for longer-term rates of deferral and defaults on historical averages. For example, FTN Financial has estimated that the annual average default rate (defined as bank failure) from 1934 to 2008 was 36 basis points which is very close to the 0.35% bank failure rate in 2013. As the following chart shows, the rate of failure increased significantly during the financial crisis but dropped to historical levels in 2013.

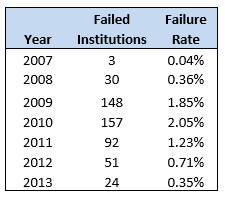

Because of spikes in failure rates in 2009 through 2012, some experts expressed the belief that a long-term failure rate should be based on the most recent 25 years, which approximates 75 basis points versus the 36 basis points calculated in the longer duration FTN study. Wilary Winn notes that the 75 basis point failure rate includes two extremely challenging time periods for the banking industry, which may not be indicative of future long-term trends. As the following table shows, the 25 year failure rate resembles a barbell curve, with failures heavily concentrated in the late 1980s during the savings and loan crisis and in the most recent financial crisis of 2008.

Because of the barbell distribution, we base our long-term default rate on the 0.36% provided in the FTN study which is also close to the 0.35% failure rate in 2013.

Loss Severity

The fact that a trust preferred issuer defaults does not necessarily mean that an investor will lose all of their investment. Thus, it is important to understand not only the default assumption, but also the expected loss given a default, or the loss severity assumption.

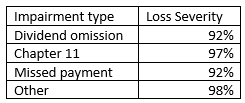

On November 21, 2008, Standard & Poor’s (S&P) published, Global Methodology for Rating Trust Preferred/Hybrid Securities Revised. In that study, S&P indicated that their assumption for recoveries on hybrid securities issued by banks is 15% equating to a loss severity assumption of 85%.

Moody’s Analytics has performed research that confirms that recoveries on defaulted trust preferred securities are low (i.e. less than 20%). Research by Moody’s Analytics shows loss severity based on the type of impairment:

Wilary Winn has observed a large range of loss severities anywhere from 0% to 100%. We recognize TruPS holders of certain defaulted issuers will recover some portion of their investment, as some issuers currently in bankruptcy proceedings are expected to have sufficient assets remaining to repay at least a portion of their TruPS. We have also seen an increase in the number of institutions declaring bankruptcy under U.S. Bankruptcy Code Section 363. Under this structure, the bank holding company files for Chapter 11 bankruptcy protection while another entity recapitalizes and purchases the bank subsidiary. According to SNL Financial, this can provide for a quick and cost-effective way to complete the sale while protecting the acquiring group from liability and potentially preventing holders of TruPS from blocking a recapitalization3. We believe the appeal of structuring a sale under this code has increased due to the increase in the number of TruP CDO issuers in which the health of the bank subsidiary has improved substantially while the holding company, which is responsible for repaying the issuance in the CDO, has continued to struggle. However, in certain recent cases the holders of the TruPS have been successful in arguing against the original terms set forth in the 363 sale and thereby increasing the payout to the TruP CDO holders.

Prepayments

Trust preferred securities generally allow for prepayment without a prepayment penalty any time after five years. Prepayments affect the securities in three ways. First, prepayments lower the absolute amount of excess spread, an important credit enhancement. Second, the prepayments are directed to the senior tranches, the effect of which is to increase the overcollateralization of the mezzanine layer. However, the prepayments can lead to adverse selection in which the strongest institutions have prepaid, leaving the weaker institutions in the pool, thus mitigating the effect of the increased overcollateralization. Third, prepayments can limit the numeric and geographic diversity of the pool, leading to concentration risks.

Prior to August 2007, the spread to the benchmark on trust preferred securities narrowed. Because of the narrowing of spreads, many financial institutions prepaid their outstanding trust preferred securities at the five year mark (when the lockout expired) and refinanced. However, as a result of the financial crisis in 2008, prepayment of trust preferred securities virtually ceased until 2011. Wilary Winn believes the resumption in prepayment activity is due in part to the Dodd-Frank Act. Under the Act, depository institution holding companies with more than $15 billion of total assets at December 31, 2009, were no longer be able to count trust preferred securities as Tier 1 regulatory capital beginning January 1, 2013 with a three year phase in period. Similarly, U.S. bank holding company subsidiaries of foreign banking organizations with more than $15 billion in total assets will no longer be able to count trust preferred securities as Tier 1 capital beginning July 1, 2015 with a three year phase in period.

Since the beginning of 2011, we have seen 179 issuers fully redeem their TruPS across the range of deals we value (additional detail is shown in Appendix C). Many of these prepayments have come from larger banks that have prepaid either because they can find less expensive funding elsewhere or because of the restrictions imposed by the Dodd-Frank Act. We have also seen a number of partial prepayments.

Recent Events

Regulatory Change

On December 10, 2013, Federal Banking Regulators issued final rules regarding implementation of Section 619 of the Dodd-Frank Act (“the Volker rule”), more specifically “Prohibitions and Restrictions on Proprietary Trading and Certain Interests In, and Relationships with, Hedge Funds and Private Equity Funds”. The Volcker Rule stated that “a banking entity may not, as principal, directly or indirectly, acquire or retain any ownership interest in or sponsor a covered fund”. The final rules took the community banking marketplace by surprise because it appeared that a very high percentage of TruP and Insurance CDOs would be considered “covered funds”. The rules further provide that banks must dispose of their covered funds by July 21, 2015, subject to a regulatory extension of up to five years. The accounting implications related to TruP CDOs were dire. Under the accounting standards, a bank must record only the credit portion of other-than-temporary-impairment (“OTTI”) provided the bank does not intend to sell the debt security, or it is more likely than not that a bank will not be required to sell a debt security prior to its anticipated recovery. The July 21, 2015 required sale date tripped the more likely than not threshold and the banks would therefore have to mark their TruP CDOs to fair value through the income statement. The accounting implications created an uproar including the filing of a suit by the American Bankers Association against the Federal Banking regulators.

On January 14, 2014, Regulators released a final interim rule authorizing retention of TruP CDOs backed primarily by bank-issued trust preferred securities. The Regulators provided a non-exclusive list of the TruP CDO funds that are deemed to be “not covered” and therefore not subject to the Volker Rule restrictions on ownership. Unfortunately, not all Pooled Trust Preferred CDOs made the list, specifically CDOs backed by collateral issued by Insurers. Nevertheless, the ABA dropped its suit on February 13, 2014.

Due to the uncertainty invoked between the original release of the Volcker Rule and the final interim rule, there was a noticeable increase in trading activity. However, we believe most of these trades occurred under distress and did not represent trades made in an orderly market.

Endnotes

- FDIC Speeches and Testimony – Chairman Gruenberg Press Conference Opening Statement on the Third Quarter 2013 Quarterly Banking Profile – November 26, 2013 ↩︎

- Moody’s 2013 Year-in-Review: Global Structured Credit – February 19, 2014 ↩︎

- SNL Blogs – Bankruptcy opens the door for bank recaps – Nathan Stovall – February 15, 2011 ↩︎