SBA 7(a) Loans and Secondary Market Accounting Implications [White Paper]

Table of Contents

Skip to table of contents- Introduction

- Standard SBA 7(a) Loans and the Servicing Agreement

- SBA 7(a) Loan Sale Premiums

- Accounting & Regulatory Guidance for SBA 7(a) Servicing Rights

- SBA 7(a) Servicing Rights Valuation Components

- Discount on the Retained Portion

- Gain on Sale Accounting and Day 1 Journal Entries

- Ongoing Journal Entries

- Call Report References

Key Takeaway

Wilary Winn is an expert in the SBA 7(a) secondary market and provides valuations of SBA 7(a) loan servicing rights as well as turnkey advice on how to properly account for them.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Updated May 2025

Introduction

This white paper provides insight into the SBA 7(a) loan program and the servicing rights arising from the sale of the guaranteed portion. This includes the key assumptions used to value the servicing rights asset as well as the accounting and regulatory reporting requirements. The topics addressed are complex and are based on general examples. Readers are strongly encouraged to review the recommendations set forth with their independent accountants and primary regulators to obtain their input and comments before implementing these procedures, because the specific facts and circumstances for a particular institution may lead to different accounting and regulatory interpretations than those described herein.

Standard SBA 7(a) Loans and the Servicing Agreement

According to the U.S. Small Business Administration (“SBA”), the SBA 7(a) loan program is the “SBA’s most common loan program, which includes financial help for businesses with special requirements.” In fiscal year 2024, the 7(a) loan program approved 70,242 federal loan guarantees on approximately $31.1 billion of privately originated small business loans through 1,472 lenders. The average approved 7(a) loan amount was $443,097. The 7(a) loan is commonly used when real estate is involved in the purchase. However, it is also used for working capital requirements, equipment, inventory purchases, and to refinance existing debt. The loan guaranty program is intended to incentivize financial institutions to provide lending to small businesses that might not otherwise be able to obtain financing. These small businesses generally have adequate repayment capacity based on reasonable cash flow projections but may have weak collateral or a lack of established credit or cash flow history. The primary risks associated with SBA lending are credit, operational, compliance, liquidity, price, and strategic, with many of these risks interrelated. The lender and the SBA share risk in the transactions, and both have a mutual interest in good underwriting and strong loan performance.

The SBA requires the lender to certify or otherwise show that the desired credit is unavailable to the applicant on reasonable terms and conditions from private, commercial sources without SBA assistance. The SBA also requires that lenders take into consideration factors associated with conventional lending practices, including the applicant’s business industry, the operating history of the business, available collateral, a reasonable loan term based on actual or projected business cash flow, and other factors unique to the applicant that cannot be overcome except through obtaining a federal loan guaranty under prudent lending standards. The limit on loan terms is set to the shortest appropriate term, depending on the borrower’s ability to repay and the loan use. Real estate loans can have up to a 25-year term, machinery and equipment loan maturities cannot exceed the average life expectancy of the equipment, and the maximum term for all other loans is typically 10 years.

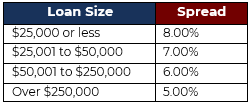

The SBA is responsible for setting the interest rates for their 7(a) loans and does so to keep the borrowing costs for small-business owners relatively low. Interest rates can be fixed or variable and are tied to the Prime rate with an additional spread component based on the term of the loan as well as the total loan amount borrowed. More specifically, the longer the term of the loan, the higher the spread. At the same time, the larger the borrowed amount, the lower the spread. We note that loans with higher spreads receive higher premiums. Furthermore, adjustable-rate loans that reset quarterly or monthly receive higher premiums as compared to loans that adjust annually or fixed-rate loans.

The maximum allowable fixed interest rate is equal to the Prime rate in effect on the first business day of the month plus the spread shown in the following table:

With the Prime rate at 7.50% as of December 19, 2024, maximum interest rates for SBA 7(a) loans currently range from 12.50% to 15.50%.

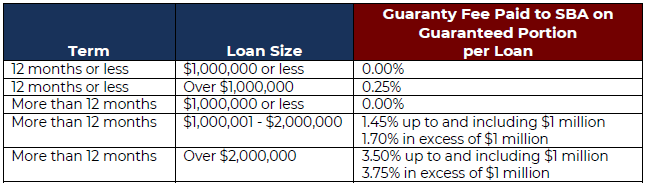

The SBA 7(a) loan program provides a partial guaranty in the event of a default to reimburse the lender’s loss, provided the lender meets the SBA’s underwriting and credit administration requirements. A financial institution may lend up to $5 million to small businesses. The SBA can guarantee up to 85% of the loan for loan amounts up to $150,000. The maximum guarantee for loans over $150,000 is 75%. On December 27, 2020, the Economic Aid Act was signed into law in response to the COVID-19 pandemic and its impact on the economy. The Economic Aid Act included a modification to the standard SBA 7(a) loan program such that loans funded between December 27, 2020, and September 30, 2021, could be guaranteed up to 90%. When two or more loans with maturities exceeding 12 months are made and approved to an applicant (including its affiliates) within 90 days of each other, the loans are considered as one loan for the purpose of determining the percentage of guaranty. Lenders are not permitted to split loans for the purpose of avoiding fees. These rules apply regardless of whether the loans were approved by the same or different 7(a) lenders. The guaranty covers any remaining unpaid principal and eligible care and preservation of collateral expenses up to the guaranteed amount, after liquidation of the collateral. In exchange for the guarantee, a lender must pay a guaranty fee (also known as the Upfront Fee) to the SBA for each loan it makes. Fees vary based on term and size of the loan as follows:

In addition to the guaranty fee, each year the SBA reviews the lenders annual service fee payable to the SBA by 7(a) lenders to manage the estimated costs of the program. This fee is set at the time of loan approval and cannot be charged to the borrower. The fee is 0.55% for all loans effective March 27, 2025 through and including September 30, 2025. If the loan is increased, the fee is recalculated based on the revised loan amount and the rules in effect at the time the loan was originally approved. SBA may also institute a late fee charge for delinquent payments of the annual service fee to cover administrative costs associated with collecting delinquent fees. The SBA may also charge a fee for off-site monitoring and on-site examination and reviews of SBA lender performance.

SBA 7(a) Loan Sale Premiums

Similar to residential mortgages, lenders may sell the guaranteed portions of SBA loans in the secondary market at a premium to provide fee income and free up liquidity. SBA estimates that SBA lenders sell the guaranteed portion of almost 50% of the 7(a) loans they make. Lenders that sell into the SBA secondary market are required to meet the SBA’s reporting and servicing requirements through the SBA’s Fiscal and Transfer Agent (“FTA”). SBA 7(a) loans are sold in the secondary market on a servicing retained basis, but usually only the guaranteed portion of the loan is sold. Therefore, the remaining 15% to 25% unguaranteed portion is retained by the institution.

In a secondary market sale, the SBA’s conditional guaranty to a lender converts into an unconditional guaranty to an investor. When a Lender wants to sell the guaranteed portion of a loan, it enters into a Secondary Participation Guarantee Agreement (“SPGA”) with the SBA and the prospective purchaser. The terms of sale between the lender and the purchaser cannot require the lender or SBA to repurchase the guaranteed portion of the loan except in accordance with the terms of the SPGA.

The standard sale structure for a 7(a) loan that is sold on the secondary market at a premium is through a 1086 agreement. The agreement defines in Section 1.5 that there shall be a minimum lender servicing fee of 0.40% required by SBA for all loans. There shall also be a minimum premium protection fee of 0.60% per annum for any guaranteed interest sold at a price greater than par value. Thus, the total minimum lender fees are 1.00% per annum. The 1.00% minimum per annum earned on the sold portion of the loan is to be recognized as a servicing asset such that the benefits of the servicing are expected to exceed “adequate compensation.” In the case of SBA 7(a) loans, the industry standard for “adequate compensation” is the 0.40% minimum servicing fee required by the SBA.

According to data provided by Windsor Advantage in their Mid-Year Lending Report, the most recent data available, premiums in the first half of 2022 ranged between 111.045% to 119.285%. As defined in Section 1.7 of the 1086 sale agreement, if the sale price exceeds 110% of the outstanding principal amount of the guaranteed portion of the loan, the SBA retains a program user fee equal to 50% of the excess amount. This program user fee is not refunded under any circumstances. Historically, institutions would attempt to avoid paying this SBA fee on premiums exceeding 110% by charging servicing fees of over 1.00% to reduce premiums on the loans sold in the secondary market below the 110% threshold. Although the SBA allows service fees in excess of 1.00%, loans sold in the secondary market with service fees exceeding 1.00% would not meet true sale thresholds under GAAP and would be accounted for as a secured borrowing.

Accounting & Regulatory Guidance for SBA 7(a) Servicing Rights

The proper accounting and reporting for servicing assets is set forth in FASB Accounting Standards Codification (“ASC”) 860 – 50. FASB ASC paragraph 860-50-25-1 (Transfers and Servicing – Servicing Assets and Liabilities) provides that an entity shall recognize a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in any of the following situations:

- A servicer’s transfer of any of the following, if that meets the requirements for sale accounting – an entire financial asset, a group of entire financial assets, or a participating interest in an entire financial asset, in which circumstance the transferor shall recognize a servicing asset or a servicing liability only related to the participating interest sold.

- An acquisition or assumption of a servicing obligation that does not relate to financial assets of the servicer or its consolidated affiliates.

A servicing right is the right to service a loan on behalf of an investor and collect a servicing fee. Loan servicing responsibilities consist of billing the borrower, collecting and processing principal and interest payments throughout the life of a loan, forwarding funds to an investor in the secondary market, and accounting for these activities at the loan and investor level. Responsibilities also include monthly 1502 reporting to ensure compliance with SBA regulations. The institution as loan servicer receives the benefits of the servicing, including the contractually specified servicing fees, a portion of the interest from the financial assets, late charges, and ancillary income, and incurs the costs of servicing the assets. Servicing rights are a modified interest-only strip. The expected life of the loan is calculated based on its expected prepayment rate which is a key valuation variable.

The benefits of servicing are expected to exceed “adequate compensation” defined as “the amount of benefits of servicing that would fairly compensate a substitute servicer should one be required, which includes the profit that would be demanded in the marketplace.” Adequate compensation is determined by the marketplace; it does not vary according to the specific servicing costs of the servicer. If benefits of servicing do not exceed adequate compensation, an institution has a servicing liability. Servicing assets and liabilities must be reported separately. A servicing asset may become a servicing liability, or vice versa, if circumstances change, and the initial measure for servicing may be zero if the benefits of servicing are just adequate to compensate the servicer for its servicing responsibilities.

Wilary Winn believes that the fair value of the servicing rights asset is based on Level 2 and Level 3 inputs and is therefore classified as a Level 3 asset. According to FASB ASC paragraph 820-10-35-48 inputs include the following:

- Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. An active market for the asset or liability is a market in which transactions for the asset or liability occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value and shall be used to measure fair value whenever available.

- Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. If the asset or liability has a specified (contractual) term, a Level 2 input must be observable for substantially the full term of the asset or liability. Level 2 inputs would include, for example, quoted prices for similar assets or liabilities.

- Level 3: Unobservable inputs for the asset or liability. Unobservable inputs should be used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at the measurement date. However, the fair value measurement objective should remain the same; that is, an exit price from the perspective of a market participant that holds the asset or owes the liability.

We believe that the inputs used to value servicing rights are either observable (prepayment speeds, servicing costs, forward curves, default rates, and loss severities) or can be corroborated (discount rates).

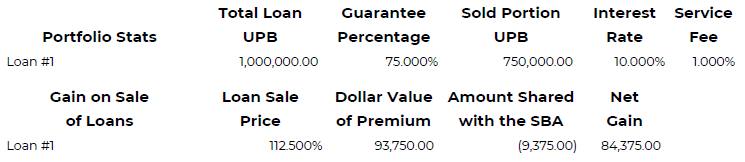

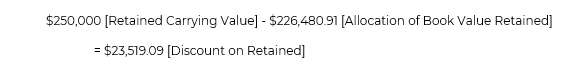

The following table details an example of a $1,000,000 loan of which the 75% guaranteed portion was sold into the secondary market at a premium of 112.50%, with an interest rate of 10.00% and a 1.00% service fee.

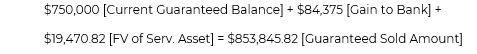

The loan’s guaranteed portion of $750,000 sold at a premium of 112.50% results in a gross premium of $93,750. As the premium above par exceeds 10%, the SBA is entitled to 50% of the 2.5% excess premium. Thus, the SBA will receive $9,375 which results in a gain to the lender of $84,375. The gain is considered gain on sale fee income.

SBA 7(a) Servicing Rights Valuation Components

To determine the fair market value of the servicing asset that is recorded through a loan sale or for an aggregate loan servicing portfolio, Wilary Winn performs a valuation using a proprietary discounted cash flow model. As mentioned previously, Wilary Winn believes that the fair value estimate of the servicing asset is based on Level 2 and Level 3 inputs. We believe that the inputs used to value servicing rights are either observable (prepayment speeds, servicing costs, forward curves, default rates, and loss severities) or can be corroborated (discount rates). The servicing fee is paid monthly based on the outstanding principal balance of the loan and is another significant determinant of value.

Expected Loan Life- Prepayments

The expected life of the loan is derived from the resulting expected cashflows based on the attributes of the loan, including term, and its expected prepayments. Thus, prepayment assumptions are a key valuation variable and are commonly measured relative to a prepayment standard or model. The model used in our valuation is based on an assumed rate of prepayment each month relative to the then outstanding principal balance of the loans for the life of such loans. Wilary Winn notes a borrower may voluntarily prepay 20% of the outstanding balance without notice to the SBA. However, SBA charges a prepayment penalty (subsidy recoupment fee) for prepayments of more than 25% of the outstanding balance on loans with original balances of 15 years or more that prepay within three years from the origination date. The penalty is 5% of the prepayment amount in year one, 3% in year two, and 1% in year three. The effect of these penalties is to slow prepayment activity.

Delinquency, Defaults, & Loss Severity

Wilary Winn’s input assumptions defaults are based on our detailed analysis on default data retrieved from the SBA for loans originated between 2006 and the most recent quarterly update available at the time of the valuation. We segment the loan default data by sector code via the North American Industry Classification System

Delinquency assumptions are in turn based on roll rates calculated using annual default rates.

Because the sold portion of these loans are guaranteed by the SBA, we assume a 0.00% severity (or loss given default). Thus, the combined effect of our default rate and severity is akin to a prepayment.

Servicing Costs

The base servicing cost input assumption is generally based on the marketplace’s assumption of the marginal cost to service a loan. As previously mentioned, the SBA requires a minimum servicing fee of 0.40% per annum. Based on discussions with industry experts and the results of a cost study undertaken by the National Association of Government Guaranteed Lenders (“NAGGL”), Wilary Winn assumes 40 basis points as the base servicing cost per loan per year for the guaranteed portion of loans.

Ancillary Income & Float Earnings

Aside from the servicing fee revenue earned, there are additional revenue streams that Wilary Winn considers in its fair value calculations of the servicing rights asset. Our valuation model incorporates ancillary income as well as income earned on float. More specifically, ancillary income refers to income earned based on the right to collect late charges on delinquent loans whereas income earned on float refers to interest received by the servicing institution while it holds the payments made by the borrower before remitting the payments to the investors. Wilary Winn projects income earned on float using remittance schedules provided by our clients as well as the forward SOFR curve as the implied rate earned for the duration the payment is held. The remittance schedule affects the frequency and timing with which the cash is remitted and the value of future float earnings. For example, a lender may remit payments on the third calendar day of every month or the next business day if the third day is not a business day. We assume payments are received on average by the tenth calendar day of the month. Prepayments are due thirty days from receipt. We therefore assume the lender earns 23 days of float on its principal and interest receipts and 29 days on principal prepayments.

Discount Rate

The previous assumptions detailed are classified as Level 2 inputs in Wilary Winn’s proprietary model. In other words, these are inputs other than quoted prices that are observable in the market. The discount rate used in our model is considered a Level 3 input. According to ASC 820-10-35-37, which establishes the input hierarchy for fair value measurements, a Level 3 input is one that is unobservable in the marketplace. Our discount rates are an estimate of what an investor would require when purchasing an SBA servicing portfolio. Because servicing rights are a modified interest only strip and there is no return of principal in cases of prepayment, the market demands higher discount rates than those used to value fixed income investments such as bonds. Wilary Winn’s discount rate is derived using a 6.00% risk premium over the Prime rate as of the valuation date.

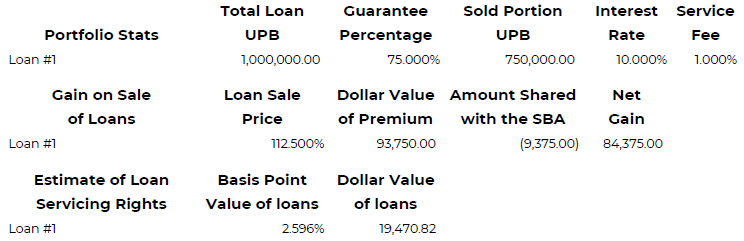

Using the aforementioned inputs, Wilary Winn calculates the fair value of the servicing asset by discounting the net cash flows of the servicing fee revenue, ancillary income, and float income less any costs related to servicing the loans. Below is an extended example of a gain on sale summary with the servicing asset displayed for the sample loan. As shown, the estimated fair value for the right to service the loan is 2.596% of the sold portion UPB, or $19,471.

Discount on the Retained Portion

ASC 860, “Transfers and Servicing,” requires that upon the completion of a transfer of a participating interest that qualifies as a sale, the transferor must:

- Allocate the previous carrying amount of the entire financial asset between the participating interest(s) sold and the participating interest that it continues to hold based on their relative fair values at the date of the transfer.

- Derecognize the participating interest(s) sold.

- Recognize and initially measure at fair value servicing assets, servicing liabilities, and any other assets obtained and liabilities incurred in the sale.

- Recognize in earnings any gain or loss on the sale.

- Report any participating interest(s) that continue to be held by the originating lender as the difference between the previous carrying amount of the entire financial asset and the amount derecognized.

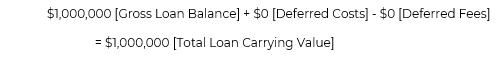

In order to calculate the discount on the retained portion, Wilary Winn begins by determining the carrying value of the entire loan. The carrying value of the loan is equal to the gross loan balance plus any deferred costs less any deferred fees associated with the loan. In the example shown throughout this paper, we have assumed, for simplicity, that there are no deferred fees or costs. Thus, the total carrying value of the example loan is $1,000,000.

The next step is to determine the guaranteed sold amount. This is calculated by summing the current guaranteed balance, the gain to the lender net of the SBA portion, and the fair value of the servicing rights asset.

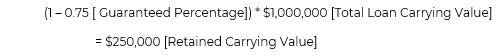

Next, Wilary Winn calculates the retained carrying value which is equal to one less the guaranteed percentage of the sold loan, multiplied by the total loan carrying value.

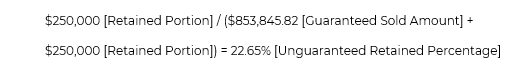

After calculating the retained carrying value, Wilary Winn determines the reallocated unguaranteed retained portion. This is quantified by dividing the retained portion by the sum of guaranteed sold amount and the retained portion.

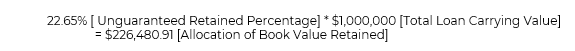

The penultimate step is to multiply the unguaranteed retained percentage by the total loan carrying value to arrive at the reallocated value of the retained portion of the loan sold.

Finally, by taking the difference between the allocation of book value retained and the retained carrying value, we get the discount on the retained portion of the loan sold.

Wilary Winn presents this in our summary example as a percentage of the retained portion of the loan, as shown in the following table. The discount on the retained portion for purposes of this example is 9.408% of the retained portion UPB, or $23,519.

Gain on Sale Accounting and Day 1 Journal Entries

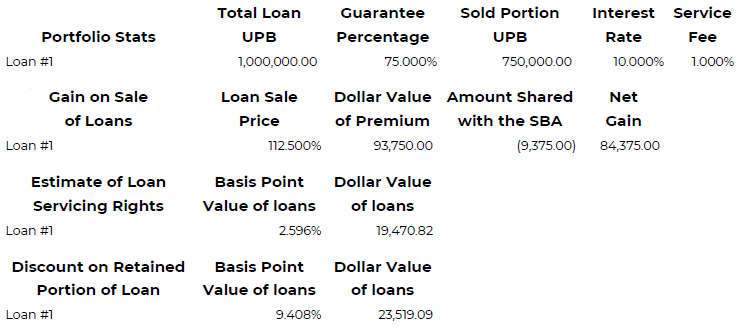

After calculating the gross gain to the lender, the fair value estimate of the servicing rights asset, and the discount on retained portion, Wilary Winn calculates the net gain on sale of the loan. The net gain on sale is quantified as the difference between the guaranteed sold amount and the book value allocation of the sold portion.

Sample journal entries are provided in the following table:

The lender will debit cash for the sold balance plus the gain based on the net sale premium. This is offset with a credit to loans for the sold balance. Initially, the lender must record a debit for the fair value estimate of the servicing rights asset. We advise the lender to credit the discount on the retained portion as a contra asset to the retained loan balance. The net gain on sale in this example is the premium plus the servicing asset less the discount on the retained portion.

Ongoing Journal Entries

The servicing asset is to be subsequently measured according to ASC 860 using one of the following two methods:

- Fair value measurement method: Under U.S. generally accepted accounting principles (GAAP) (i.e., ASC Subtopic 825-10, Financial Instruments – Overall, ASC Subtopic 815-15, Derivatives and Hedging – Embedded Derivatives, and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities), the institution may elect to measure and report certain assets and liabilities at fair value with changes in fair value recognized in earnings. There is no associated allowance for credit loss on the servicing asset.

- Amortization method: Amortize the servicing asset in proportion to and over the period of estimated net servicing income (level yield method) and assess servicing assets for impairment based on fair value at each reporting date. Servicing rights are typically amortized at the group level.

Assuming the institution has elected the amortization method of accounting, we generally see and recommend the amortization expense recorded as an offset against servicing fee income. The reason for this is when the servicing asset is recorded, the offset is to the income statement. The lender has essentially recorded all the income for future servicing revenue. The net amount of the service fee income less amortization expense each month would reflect the yield. By not recording the amortization expense as an offset to servicing fee income, the lender would be overstating revenue. Like the servicing asset, we generally see and recommend the discount on retained portion contra asset be accreted to interest income over the level yield of the loan.

Call Report References

Bank – FFIEC Call Report

While banks with under $5 billion in total assets can file an FFIEC 051 call report in certain circumstances, we believe that engaging in sales of the guaranteed portions of SBA loans and the related creation of servicing assets means they must file under FFIEC 041. We believe such activities would be considered “one or more complex, specialized, or other higher risk activities, such as those for which limited information is reported in the FFIEC 051 as compared to the FFIEC 041 (trading; derivatives; mortgage banking; fair value option usage; servicing, securitization, and asset sales; and variable interest entities).”

The following is a summary of the call report requirements related to the sales of SBA loans.

Report of Condition

RC-C

Loans secured by real estate should be reported on line 1e.

Loans secured by farmland should be reported on line 1b.

Loans for commercial and industrial purposes should be reported on line 4.

Because the discount on the retained portion of loans is a contra asset to the loan portion that is owned by the bank, we advise that it be reported in the bank’s Call Report, consistent with the reporting of all other loans.

The delinquency and nonaccrual status of SBA loans held by the bank should be reported in the bank’s Call Report, consistent with the reporting of all other loans.

SBA lending and sales also affect regulatory capital as reported in Schedule RC-R.

RC-R

The guaranteed portion of loans held for sale should be reported on line 4d Column G, making it subject to a 20% risk weight.

The guaranteed portion of loans held for investment should be reported on line 5d Column G, making it subject to a 20% risk weight.

Statement of Income

The net gain from the sale of the guaranteed portion is reported as non-interest income on Schedule RI as instructed by Schedule RI – Income Statement line 5 I – Net gains (losses) on sales of on Sales of loans and leases.

Servicing

The servicing rights asset is to be reported on Schedule RC-M, item 2, “Intangible assets,” and should be allocated between mortgage (a.) for loans secured by real estate and non-mortgage (c.) for all other loans. Amortization expense of and any impairment losses on servicing assets should be netted against the servicing income reported in Schedule RI, item 5.f.

Amortization Method

For servicing assets and liabilities measured under the amortization method, banks should report servicing income net of the related servicing assets’ amortization expense, include impairments recognized on servicing assets, and also include increases in servicing liabilities recognized when subsequent events have increased the fair value of the liability above its carrying amount.

Fair Value Method

For servicing assets and liabilities remeasured at fair value under the fair value option, include changes in the fair value of these servicing assets and liabilities.

Net gains (losses) recognized in earnings on assets and liabilities that are reported at fair value under a fair value option should be reported on Schedule RI – Memoranda item 13. Report the total amount of pretax gains (losses) from fair value changes included in earnings during the calendar year to date for all assets (a.) and liabilities (b.). Disclosure of such gains (losses) is also required by ASC Subtopic 825-10, Financial Instruments – Overall and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities.

Banks that have elected to report financial instruments or servicing assets and liabilities at fair value on a recurring basis with changes in fair value recognized in earnings or are required to complete Schedule RC-D, “Trading Assets and Liabilities,” must complete Schedule RC-Q, “Assets and Liabilities Measured at Fair Value on a Recurring Basis.”

Credit Union – NCUA Call Report

Upon the completion of a transfer of a participating interest that qualifies as a sale, the net gain is to be reported in the NCUA 5300 Call Report as non-interest income as instructed by the Statement of Income and Expense, page 5, item 19: “Net gains (losses) on Sales of loans and leases.” Additionally, the servicing rights asset is to be reported under Other Assets, page 2, item 22, “Intangible assets,” and can be allocated between Mortgage Servicing Assets (b.) for loans secured by real estate and Other Intangible Assets (c.) for all other loans. Because the discount on the retained portion of loans is a contra asset to the loan portion that is owned by the credit union, we advise that it be reported under Total Loans & Leases, page 2, item 15, which is reported in detail on Schedule A, Section 1. Year-to-date and total outstanding number of loans and amount sold should be reported on Schedule A, Section 6 – Loans purchased and sold under 701.22 and 701.23 “Loans Sold” and should be allocated between Real Estate Loans Sold with Servicing Retained (item 6) for loans secured by real estate and “All Other Loans Sold with Servicing Retained” (item 7) for all other loans.

Amortization Method

For servicing assets and liabilities measured under the amortization method, credit unions should report servicing income net of the related servicing assets’ amortization expense, include impairments recognized on servicing assets, and also include increases in servicing liabilities recognized when subsequent events have increased the fair value of the liability above its carrying amount.

Fair Value Method

For servicing assets and liabilities remeasured at fair value under the fair value option, include changes in the fair value of these servicing assets and liabilities. Disclosure of such gains (losses) is also required by ASC Subtopic 825-10, Financial Instruments – Overall and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities.