SEC Staff Accounting Bulletin 119 – CECL

Table of Contents

Skip to table of contentsKey Takeaway

We provide ALM and CECL solutions that help our clients measure, monitor, and mitigate balance sheet risk on an integrated basis. We consider credit, interest rate, and liquidity risk holistically. We charge a fee for our advice and do not rely on commissions, so we can remain objective. We simply want what is best for our client.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released January 2020

Introduction

On November 19, 2019, the SEC issued Staff Accounting Bulletin No. 119. In the words of the SEC, “the staff accounting bulletin updates portions of the interpretive guidance included in the Staff Accounting Bulletin Series in order to align the staff’s guidance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 326, Financial Instruments – Credit Losses (“Topic 326”).”

In the bulletin, the SEC addresses four major CECL topics:

- Measuring current expected credit losses

- Development, guidance, and documentation of a systematic methodology

- Documenting the results of a systematic methodology

- Validating a systematic methodology

While we found the entire bulletin to be interesting and helpful, we found two items to be particularly thought provoking – the use of external data and methodology validation. A complete copy of the bulletin can be found at https://www.sec.gov/oca/staff-accounting-bulletin-119.

Use of External Data

In Section 3, Documenting the results of a systematic methodology, the staff answers the question of the documentation it would “normally expect a registrant to prepare to support its allowance for credit losses for its loans under FASB ASC Subtopic 326-20”.

Part of their response addresses the use of external data, which is a topic we frequently encounter in our discussions with clients. The SEC indicates that “if a registrant utilizes external data, the staff normally would expect that the registrant would demonstrate in its documentation the relevance and reliability of the external data. The registrant should consider whether the external loss experience data comes from loans with credit attributes similar to those of the loans included in the registrant’s portfolio and is consistent with the registrant’s assumptions regarding current and forecasted economic conditions. The staff normally would expect a registrant to maintain supporting documentation for assumptions and data used to develop its loss rates, including its evaluation of the relevance and reliability of any external data.”

As we undertake CECL reserve calculations, we often supplement client data with external data when the client has experienced losses that are too small or rare to be statistically significant. An example would be if a client had recently begun making less-than-prime quality residential real estate loans when it had in the past focused only on prime loans. While an institution could begin its CECL estimate for the less-than-prime loans by determining its loss rates on prime loans and increasing its estimates through qualitative and environmental factors, we believe better estimates can be made using the losses that the industry has actually incurred on similar loans.

The key here is to ensure the credit attributes are similar and therefore relevant.

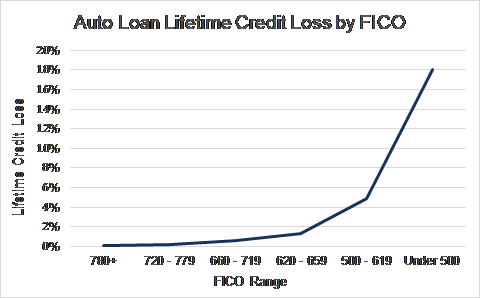

We believe the use of external data to strengthen CECL calculations is a very important issue. As we have documented in our previous white papers – the more granular the inputs, the more predictive the model. Granularity is important because credit losses are non-linear. Historically, we have observed an exponential relationship when tracking credit losses down the FICO spectrum, as demonstrated in the following chart regarding auto loan performance1.

The chart aptly illustrates the reason disaggregated input assumptions improve predictive results.

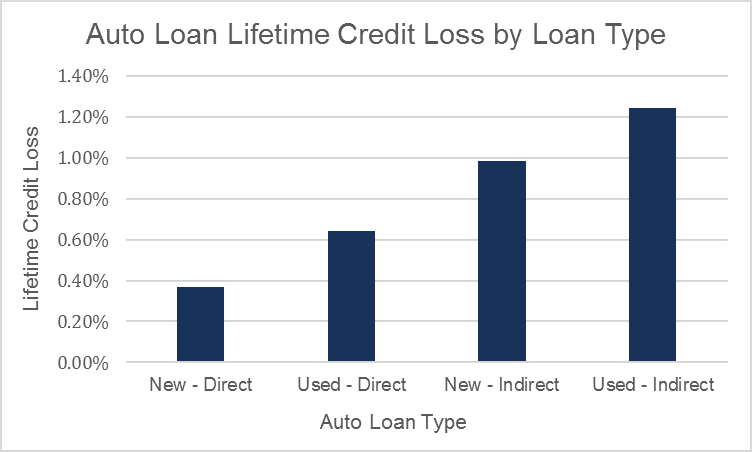

Risk layering can further skew the results. For example, our research has shown that used indirect auto loans default at a much higher rate than new direct auto loans, even for borrowers with the same credit score.

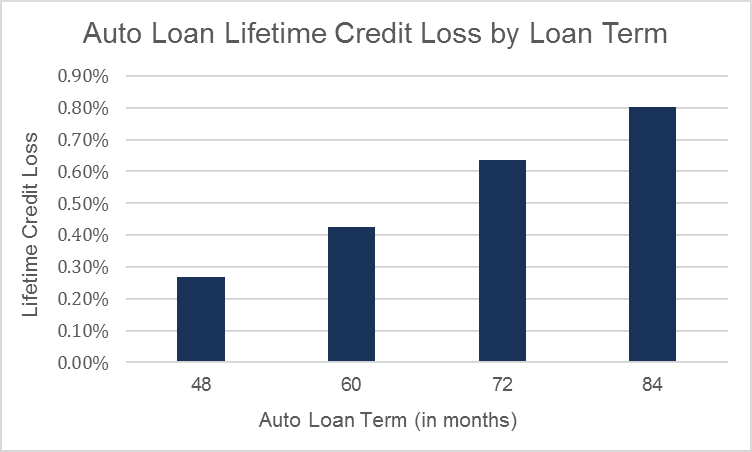

We have recently seen an added form of risk-layering – originating auto loans with longer terms. The extended loan terms result in lower monthly payments for the borrowers and help make the purchase more affordable in the early stages of financing. However, the longer timeframe also creates more time for economic conditions to change and for borrowers to fall into financial trouble. Furthermore, the extension of loan terms slows down the pace of the loans’ principal amortization, increasing the possibility that depreciation may outpace principal payments.

Most community financial institutions do not have statistically significant results at the level of granularity we just discussed (e.g., used auto, indirectly originated, FICO score cohort, 7-year loan term, etc.). In fact, this level of disaggregation results in 160 loan groups. As a result, we supplement their historical performance with industry data.

As another example, to ensure comparability and relevancy, we run our loss estimates for residential real estate loans at the loan level using the combination of FICO score and combined loan-to-value ratio. We are thus considering how loans with very similar loan terms and credit attributes performed over the most recent business cycle as we run our discounted cash flow models.

We believe the granularity of our inputs is relevant because it leads to increased modeling accuracy and a more predictive result.

We believe that great care should be taken in the use of aggregate-level external data. For example, we believe it would be very difficult to supplement input assumptions based on aggregate call report data. The broad categories of new vs. used are simply too broad to strengthen modeling results. While direct versus indirect are also reported items, the user still cannot divide the loans into the four relevant categories of new direct, used direct, new indirect, and used indirect. We thus believe it is very difficult to strengthen simplistic WARM estimates that generally rely on broad call report aggregates. How does a financial institution ensure that the credit scores of its borrowers are consistent with the industry wide results, let alone take into consideration the effects of differing loan terms on risk-layering?

While our call report-level example is an extreme case, we also believe it can be very difficult to show relevancy if the credit loss estimate model is based on vintage analysis or static pools. For example, a financial institution might have experience in direct lending for new vehicles, and decides it wants to enter the indirect used vehicle marketplace. To make CECL estimates for this new class of loans, it plans to use industry data recognizing that its experience in direct lending for new cars is not predictive. For the industry indirect used vehicle pool loan data to be relevant, the loan terms, credit attributes, and underwriting procedures would have to very closely match the loans that the financial institution plans to originate. The level of detail required to make this determination is oftentimes not available. This is another reason we believe disaggregated discounted cash flow models produce more predictive results than static or vintage pools – you are making very direct granular comparisons to ensure the data is relevant.

Methodology Validation

In Section 4, Validating a systematic methodology, the staff provides “guidance to a registrant on validating, and documenting the validation of, its systematic methodology used to estimate allowance for credit losses.”

The SEC indicates – “To verify that the allowance for credit losses methodology is reasonable and conforms to GAAP, the staff believes it would be appropriate for management to establish internal control policies, appropriate for the size of the registrant and the type and complexity of its loan products and modeling methods.”

“These policies may include procedures for a review, by a party who is independent of the allowance for expected credit losses estimation process, of the allowance methodology and its application in order to confirm its effectiveness.”

The SEC went on to say – “While registrants may employ many different procedures when assessing the reasonableness of the design and performance of its allowance for credit losses methodology, as well as the appropriateness of the data and assumptions used, the procedures should allow management to determine whether there may be deficiencies in its overall methodology. Examples of procedures may include:

- A review of how management’s prior assumptions (including expectations regarding loan delinquencies, troubled debt restructurings, write-offs, and recoveries) have compared to actual loan performance;

- A review of the allowance for credit losses process by a party that is independent and possesses competencies on the subject matter. This often involves the independent party reviewing source documents and underlying data and assumptions on a test basis to determine whether or not the established methodology develops reasonable loss estimates;

- A retrospective analysis of whether the models used performed in a manner consistent with the intended purpose of developing an estimate of expected credit losses; and

- When the fair value of collateral is used, an evaluation of the appraisal process of the underlying collateral. This may be accomplished by periodically comparing the appraised value to the actual sales price on selected properties sold.”

We share the commission’s view that model validation can ensure the effectiveness of the institution’s methodology. As in our Asset Liability Management validation work, we believe the best way to do this is to perform an independent calculation using the client’s input assumptions and a second calculation using our own input assumptions. In the first case, we are confirming that when we use our client’s inputs, we obtain their outputs, thus ensuring that the model is operating as intended. We believe the second part of our work is more important. We can build from our client’s approach by undertaking it in accordance with the best practices we see from our other clients and strengthen the calculation by supplementing their experience with industry wide data as appropriate.

We believe our independent estimate can help senior management and the Board of Directors by providing the information they need to make informed decisions regarding the amount of capital they want to put at risk through the institution’s lending and investing activities.

Endnotes

- Results are prospective based on our proprietary database of loan performance over the most recent full business cycle. ↩︎