Secondary Market Agricultural Loan Servicing and Accounting Implications [White Paper]

Key Takeaway

Wilary Winn provides valuations of agricultural loan servicing rights as well as turnkey advice on how to properly account for them.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released November 2024

Introduction

This white paper provides insight into agricultural loan programs and the servicing rights arising from the sale of either whole loans or loan participations. This includes the key assumptions Wilary Winn uses to value agricultural loan servicing rights. We also address the accounting and regulatory reporting requirements related to the sales and the resulting servicing rights.

Agricultural Loans

Agricultural loans support the development and sustainability of the ag sector, which is essential to the nation’s infrastructure. Agricultural loans are often used for various purposes, such as purchasing equipment, seeds, fertilizers, livestock, or land, as well as covering operational costs and farm real estate improvements. Agricultural lending can be complex due to factors such as fluctuating agricultural markets, weather conditions, and government policies affecting farming operations. There are many agricultural loan financing options in the United States, including loans from commercial banks, the Farm Service Agency (“FSA”), and other institutions.

The FSA is an agency of the U.S. Department of Agriculture (“USDA”) and is not in competition with commercial lenders but supports borrowers when they are unable to obtain financing elsewhere. The USDA reduces risk through guarantees for commercial lenders while making credit more accessible to farmers, especially beginning farmers, socially disadvantaged farmers, and those with limited collateral. The FSA operates three programs1:

- The Guaranteed Loan Program offers farm ownership, operating, and conservation loans. Guaranteed loans of up to $2,251,000 (adjusted annually for inflation) are made and serviced by commercial lenders such as banks or credit unions in the Farm Credit System. The lender is the FSA’s customer, and loans are the property and responsibility of the lender. The FSA has the responsibility of approving all eligible loan guarantees up to 95 percent and providing oversight of the lender’s activities.

- The Direct Loan Program offers farm ownership, operating, emergency, and conservation loans. Loans are made directly by the FSA to the farmer using Government money and are serviced by the FSA. The FSA has the responsibility of providing credit counseling and supervision to its direct borrowers by helping applicants evaluate the adequacy of their real estate and facilities, machinery and equipment, financial and production management, and goals. Because it is direct, this program is not relevant to this white paper.

- The Land Contract Guarantee Program is available to the owner of a farm or ranch who wishes to sell real estate through a land contract to a beginning or socially disadvantaged farmer or rancher. The FSA guarantees up to $500,000 with two types of guarantees: a prompt payment guarantee up to the amount of three amortized annual installments plus the cost of any related real estate tax and insurance, or a standard guarantee at 90 percent of the outstanding principal balance under the land contract. In either case, a third-party agent is needed.

Guaranteed loans enable financial institutions to generate additional loan growth while benefiting from the protection offered by the FSA, which provides guarantees to cover potential losses on the loan’s principal and interest. Lenders are required to oversee guaranteed loan borrowers and apply the same standard servicing practices as they do with their other agricultural loan customers. The FSA will review the lender’s oversight and notify the lender if any issues or deficiencies are identified.

The major components of the loan are its term and the interest rate it bears. Loan term is usually dependent on the use of the loan funds and the collateral that secures the loan. Generally, a loan made for or secured by real estate will have a longer term than a loan made to purchase or that is secured by equipment or livestock. Farm ownership loans can have up to a 40-year term whereas operating loans have terms that range from 1 to 7 years.

Guaranteed loans can have either fixed or variable interest rates. The FSA direct loans and land contract guarantees bear fixed interest rates. For loans with variable rates or that are fixed for less than 5 years, the interest rate cannot exceed the prior business day’s SOFR plus 6.75% unless SOFR is less than 1.75%, in which case an additional 1.00% may be added. For loans with rates fixed for 5 years or more, the interest rate cannot exceed the prior business day’s 5-Year Treasury rate plus 5.50%. While SOFR and Treasury are used to establish maximum rates, they are not required to price a loan. For most loans, the FSA charges the lender a guarantee fee of 1.50% of the guaranteed portion of the loan. The lender may pass this fee on to the borrower. The fee is waived under some circumstances.

FSA loan interest rates by program effective as of November 1, 2024, are as follows2:

Due to the seasonal nature of agriculture, payment structures on ag loans are tailored to match the cashflow cycles of farming operations. This reduces the pressure on farmers to make payments during low-income periods but also requires careful cash flow management to ensure sufficient funds are available once the payments are due. Common payment schedules include annual, semi-annual, quarterly, or monthly payments. Borrowers that plan to benefit from a large future income event (e.g., land sale or harvest) or expect to refinance before the principal is due, may also consider an interest-only loan.

Servicing Ag Loans

Selling the guaranteed portion of USDA ag loans while retaining the unguaranteed portion and servicing the loan enhances an institution’s liquidity while maintaining borrower relationships. The institution as loan servicer receives the benefits of the servicing over the life of the loan, including the contractually specified servicing fees, late charges and ancillary income (if so entitled), and incurs the costs of servicing the assets. While not part of the servicing, it also benefits from the interest received from the retained portion of the loan.

Agricultural loan servicing involves managing the administration and repayment of loans given to farmers and agribusinesses. Therefore, lenders and servicers need to have specialized knowledge of the agricultural sector to effectively manage these loans. Key responsibilities of agriculture loan servicing include:

- payment processing

- principal and interest management, including adjusting rates

- payment of taxes and insurance

- status monitoring for delinquencies and defaults

- foreclosure and collateral recovery

- loan modifications

- customer support

- compliance and reporting

- on-site inspections

Contracts between the servicer and the investor will determine the responsibilities of the servicer. Federal Agricultural Mortgage Corporation (“Farmer Mac”) is a government-sponsored enterprise (“GSE”) that provides a secondary market for agricultural mortgages and loans. Farmer Mac buys loans from lenders and sells instruments backed by the loans while the lender retains the servicing. This includes the purchase of Farm & Ranch loans as well as USDA guaranteed loans (e.g., FSA loans)3. Farm & Ranch loans and loan participations are secured by first lien mortgages on eligible agricultural or rural utility assets, which include production agriculture and many agribusinesses. Farmer Mac generally purchases a Farm & Ranch loan at origination, at par.

Farmer Mac divides servicing duties between a central servicer and field servicers. The central servicer is responsible for overall servicing, including billing and collection from borrowers; establishing, maintaining, and monitoring delinquent loans; and directing the field servicers in their duties. The field servicer maintains an ongoing relationship with the borrower; monitors the payment and real estate taxes and hazard insurance; and files UCC continuations. If requested, the field servicer forwards annual financial information, including tax returns, to the central servicer and inspects the property and/or collateral again as requested.

Other major investors in the industry include Agri-access, Zion, Raymond James, AXA, the Rural Finance Authority, and other private investors.

Accounting & Regulatory Guidance for Ag Loan Servicing Rights

The required accounting and reporting for recognizing servicing rights assets is set forth in FASB Accounting Standards Codification (“ASC”) 860-50. FASB ASC paragraph 860-50-25-1 (Transfers and Servicing – Servicing Assets and Liabilities) provides that an entity shall recognize a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in any of the following situations:

A. A servicer’s transfer of any of the following, if that meets the requirements for sale accounting – an entire financial asset, a group of entire financial assets, or a participating interest in an entire financial asset, in which circumstance the transferor shall recognize a servicing asset or a servicing liability only related to the participating interest sold.

B. An acquisition or assumption of a servicing obligation that does not relate to financial assets of the servicer or its consolidated affiliates.

FASB ASC paragraph 86-50-30-1 states that an entity shall initially measure at fair value, a servicing asset or servicing liability that qualifies for separate recognition regardless of whether explicit consideration was exchanged.

The benefits of servicing are expected to exceed “adequate compensation,” defined as “the amount of benefits of servicing that would fairly compensate a substitute servicer should one be required, which includes the profit that would be demanded in the marketplace.” Adequate compensation is determined by the marketplace; it does not vary according to the specific servicing costs of the servicer. If benefits of servicing do not exceed adequate compensation, an institution has a servicing liability. Servicing assets and liabilities must be reported separately. FAS ASC paragraph 860-50-35-1A states that a servicing asset may become a servicing liability, or vice versa, if circumstances change. The initial measure for servicing may be zero if the benefits of servicing are just adequate to compensate the servicer for its servicing responsibilities.

Whether a servicing asset or servicing liability is recorded is a function of the marketplace, not the servicer’s cost of servicing. FAS ASC paragraph 860-50-30-4 states that a loss shall not be recognized if a servicing fee that is equal to or greater than adequate compensation is to be received but the servicer’s anticipated cost of servicing would exceed the fee.

Wilary Winn believes that the fair value of the servicing rights asset is based on Level 2 and Level 3 inputs and is therefore classified as a Level 3 asset. According to FASB ASC paragraph 820-10-35-48 inputs include the following:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. An active market for the asset or liability is a market in which transactions for the asset or liability occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value and shall be used to measure fair value whenever available.

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. If the asset or liability has a specified (contractual) term, a Level 2 input must be observable for substantially the full term of the asset or liability. Level 2 inputs would include, for example, quoted prices for similar assets or liabilities.

Level 3: Unobservable inputs for the asset or liability. Unobservable inputs should be used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at the measurement date. However, the fair value measurement objective should remain the same; that is, an exit price from the perspective of a market participant that holds the asset or owes the liability.

We believe that the inputs used to value servicing rights are either observable (prepayment speeds, servicing costs, forward curves, default rates, and loss severities) or can be corroborated (discount rates).

Ag Loan Servicing Rights Valuation Components

To determine the fair market value of the servicing asset that is recorded through a loan sale or for an aggregate loan servicing portfolio, Wilary Winn performs a valuation using a proprietary discounted cash flow model. As mentioned previously, Wilary Winn believes that the fair value estimate of the servicing asset is based on Level 2 and Level 3 inputs. Servicing rights are a modified interest-only strip. The servicing fee is paid congruent with the borrower’s payment schedule based on the outstanding principal balance of the loan and over the expected life of the loan. For this reason, service fee rate and prepayment rates are key valuation variables.

Servicing Fees

For purposes of the valuation, Wilary Winn uses 450 basis points as the maximum normal servicing fee for USDA guaranteed FSA loans and 162.5 basis points for non-FSA loans. According to FASB Accounting Standards Codification (“FASB ASC”) paragraph 860-50-25-6, a servicer shall account separately for rights to future interest income from the serviced assets that exceed contractually specified servicing fees. Therefore, we have classified fees in excess of 450 basis points for FSA loans and 162.5 basis points for non-FSA loans as interest-only strips. We caution that sales of participation loans with servicing fees in excess of these maximums risk breaking the GAAP true-sale rules.

Expected Loan Life – Prepayments

The expected life of the loan is derived from the resulting expected cashflows based on the attributes of the loan, including term, and its expected prepayments. Thus, prepayment assumptions are a key valuation variable and are commonly measured relative to a prepayment standard or model. The model used in our valuation is based on an assumed rate of prepayment each month relative to the then outstanding principal balance of the loans for the life of such loans. Conditional Prepayment Rate is the annual percent of expected voluntary and involuntary payoffs (defaults). Conditional repayment rate (“CRR”) percent plus conditional default rate (“CDR”) percent equals CPR percent. CPR is also similar to an annualized SMM (Single Monthly Mortality) rate. A CPR of 10% roughly indicates that 10% of the starting Principal Balance will be paid off by the end of a one-year time period.

We run static prepayment scenarios that provide us with a range of values. Scenarios typically project the portfolio prepaying between a 10% conditional repayment rate (“CRR”) for all periods and a 20% CRR for all periods. We benchmark these prepayment speeds to the assumptions that Farmer Mac uses to value their own Farmer Mac bonds as stated in their quarterly 10-Q or annual 10-K. In environments where higher prepayment speeds are observed in the market (e.g., 2020 & 2021), we run additional scenarios to align with Farmer Mac’s reported speeds.

Ag loans may have prepayment restrictions, including a partial lockout prepayment penalty, a make whole prepayment penalty, or a make whole prepayment penalty plus 10%. For loans with prepayment penalties, we assume that fewer or no prepayments will occur until after the expiration period.

Delinquency, Defaults, & Loss Severity

Our delinquency assumptions are based on Farmer Mac’s actual 90-day delinquency rates and cumulative net credit losses from their 10-Q and 10-K and are applied at the loan level by region based on the state where the property is located. Other delinquency assumptions are in turn based on roll rates. Because the sold portion of these loans are guaranteed by the USDA, we assume a 0.00% severity (or loss given default). Thus, the combined effect of our default rate and severity is akin to a prepayment.

Servicing Costs

The base servicing cost input assumption is generally based on the marketplace’s assumption of the marginal cost to service a loan. Wilary Winn does not believe the actual cost to service a loan increases marginally with higher balance loans, which is why we generally use unit dollar costs in our valuations as opposed to a basis point cost assumption. For certain types of loans, the costs used in the marketplace are well-known – for example, residential real estate loans. Wilary Winn uses industry surveys when available to support our unit dollar cost assumptions. Unfortunately, we are not aware of similar studies or surveys for loans in the agricultural industry. We further note that ag loans are diverse with varying purposes, as described previously.

We therefore ask our agricultural loan servicing clients to provide us with cost estimates. The estimates we’ve received vary significantly. We believe most of the differences are due to economies of scale and servicer responsibilities by investor. We also believe that likely purchasers of servicing would be operating at scale and that our assumption for the cost to service a loan should reflect that benefit. The cost to service Farmer Mac loans for our clients where they service more than 500 loans equals approximately $500 per loan per year for field servicing. The cost to service FSA loans is higher at approximately $1,495 per loan per year. We are able to benchmark these costs to what we see in studies for other loan servicing costs (i.e., commercial loans). We continue to monitor this assumption as we accumulate more data.

Ancillary Income & Float Earnings

Aside from the servicing fee revenue earned, there are additional revenue streams that Wilary Winn considers in its fair value calculations of the servicing rights asset. If a servicer is entitled to such revenues based on the servicing agreement and is not required to pass additional revenue onto the investor, our valuation model incorporates ancillary income as well as income earned on float. Ancillary income refers to income earned based on the right to collect late charges on delinquent loans or prepayment penalties, whereas income earned on float refers to interest received by the servicing institution while it holds the payments made by the borrower before remitting the payments to the investors.

Wilary Winn projects income earned on float using remittance schedules provided by our clients as well as the forward SOFR curve as the implied rate earned for the duration the payment is held. The remittance schedule affects the frequency and timing with which the cash is remitted and the value of future float earnings. For example, a lender may remit payments on the 18th calendar day of every month or the next business day if the 18th day is not a business day. If we assume payments are received on average by the fifth calendar day of the month, we therefore assume the lender earns 15 days of float on its principal and interest receipts and on principal prepayments.

Discount Rate

As mentioned previously, the discount rate used in our model is considered a Level 3 input. According to ASC 820-10-35-37, which establishes the input hierarchy for fair value measurements, a Level 3 input is one that is unobservable in the marketplace. Our discount rates are an estimate of what an investor would require when purchasing an ag loan servicing portfolio. Because servicing rights are a modified interest-only strip and there is no return of principal in cases of prepayment, the market demands higher discount rates than those used to value fixed income investments such as bonds. Wilary Winn’s discount rate is benchmarked to industry surveys available on other types of loan servicing which we would expect to have similar yields. We use a risk-free discount rate tied to the two-year treasury for servicing liabilities.

Day 1 Journal Entries

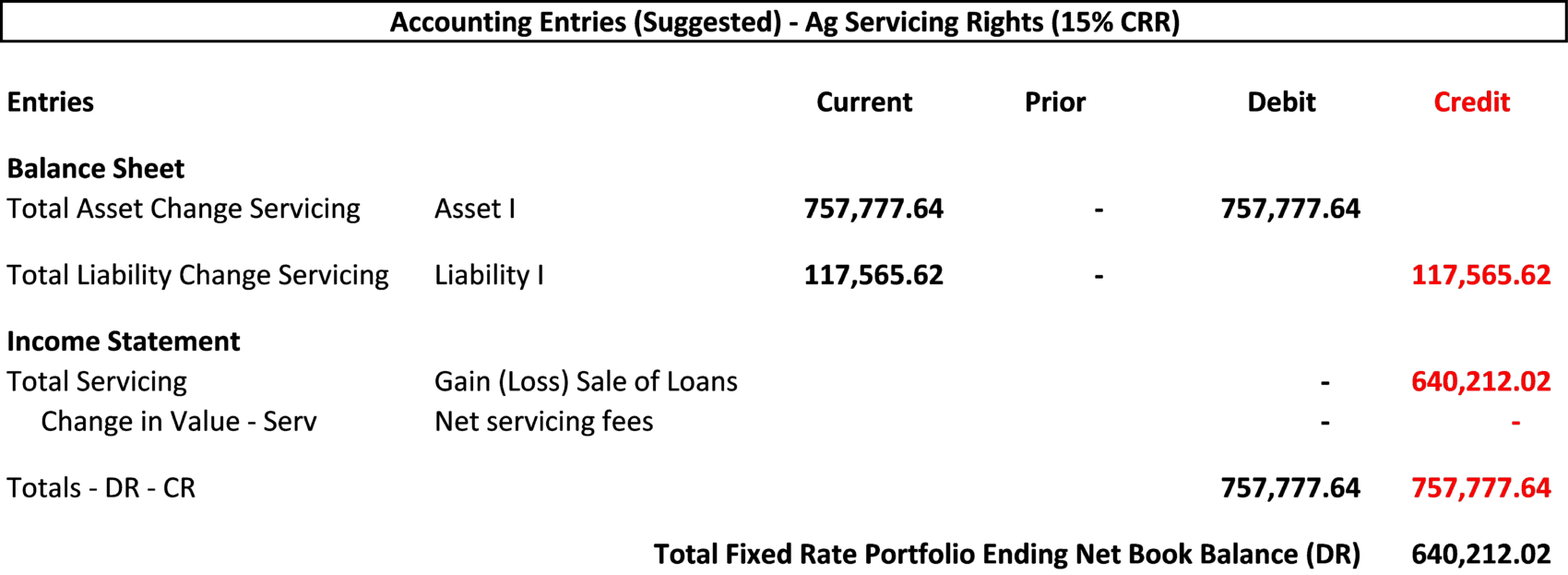

After calculating the fair value estimate of the servicing rights asset, Wilary Winn provides clients with day one and ongoing journal entries. The lender debits cash for the sold balance plus any gain or loss based on the net sale premium or discount (if not sold at par). This is offset with a credit to loans for the sold balance. Initially, the lender must record a debit for the fair value estimate of the servicing rights asset and a credit for the fair value estimate of the servicing rights liability. A sample is provided in the following table:

Ongoing Journal Entries

The servicing rights are to be subsequently measured according to ASC 860 using one of the following two methods:

- Fair value measurement method: Under U.S. generally accepted accounting principles (GAAP) (i.e., ASC Subtopic 825-10, Financial Instruments – Overall, ASC Subtopic 815-15, Derivatives and Hedging – Embedded Derivatives, and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities), the institution may elect to measure and report certain assets and liabilities at fair value with changes in fair value recognized in earnings (net servicing fees). There is no associated allowance for credit loss on the servicing asset.

- Amortization method: Amortize the servicing asset in proportion to and over the period of estimated net servicing income (level yield method) and assess servicing assets for impairment based on fair value at each reporting date. Servicing rights are typically amortized at the group level.

Assuming the institution has elected the amortization method of accounting, we generally see and recommend the amortization expense recorded as an offset against servicing fee income. The reason for this is when the servicing asset is recorded, the offset is to the income statement. The lender has essentially recorded all the income for future servicing revenue. The net amount of the service fee income less amortization expense each month would reflect the yield. By not recording the amortization expense as an offset to servicing fee income, the lender would be overstating revenue. We generally see and recommend the liability be accreted to interest income over the level yield of the loan.

Call Report References

Bank – FFIEC Call Report

While banks with under $5 billion in total assets can file an FFIEC 051 call report in certain circumstances, we believe that engaging in sales of the guaranteed portions of ag loans and the related creation of servicing assets means they must file under FFIEC 041. We believe such activities would be considered “one or more complex, specialized, or other higher risk activities, such as those for which limited information is reported in the FFIEC 051 as compared to the FFIEC 041 (trading; derivatives; mortgage banking; fair value option usage; servicing, securitization, and asset sales; and variable interest entities).”

The following is a summary of the call report requirements related to the sales of ag loans.

Report of Condition

RC-C

Loans secured by farmland, including farm residential and other improvements, should be reported on line 1b.

Loans to finance agricultural production and other loans to farmers should be reported on line 3.

Because the retained portion of loans is owned by the bank, we advise that it be reported in the bank’s Call Report, consistent with the reporting of all other loans.

The delinquency and nonaccrual status of ag loans held by the bank should be reported in the bank’s Call Report, consistent with the reporting of all other loans.

Ag lending and sales also affect regulatory capital as reported in Schedule RC-R.

RC-R Part II

The guaranteed portion of loans held for sale should be reported on line 4d (all other exposures) Column G, making it subject to a 20% risk weight.

The guaranteed portion of loans held for investment should be reported on line 5d (all other exposures) Column G, making it subject to a 20% risk weight.

Statement of Income

The net gain from the sale of the guaranteed portion is reported as non-interest income on Schedule RI as instructed by Schedule RI – Income Statement line 5 I – Net gains (losses) on sales of on sales of loans and leases.

Servicing

The servicing rights asset is to be reported on Schedule RC-M, item 2, “Intangible assets,” and should be allocated between mortgage (a.) for loans secured by real estate and non-mortgage (c.) for all other loans. Amortization expense of and any impairment losses on servicing assets should be netted against the servicing income reported in Schedule RI, item 5.f.

The servicing rights liabilities are to be reported on Schedule RC-G, item 4, “All other liabilities” (including servicing liabilities).

Amortization Method

For servicing assets and liabilities measured under the amortization method, banks should report servicing income net of the related servicing assets’ amortization expense, include impairments recognized on servicing assets, and also include increases in servicing liabilities recognized when subsequent events have increased the fair value of the liability above its carrying amount.

Fair Value Method

For servicing assets and liabilities remeasured at fair value under the fair value option, include changes in the fair value of these servicing assets and liabilities.

Net gains (losses) recognized in earnings on assets and liabilities that are reported at fair value under a fair value option should be reported on Schedule RI – item 5.f “net servicing fees”. Report the total amount of pretax gains (losses) from fair value changes included in earnings during the calendar year to date under memorandum item 13 for all assets (a.) and liabilities (b.). Disclosure of such gains (losses) is also required by ASC Subtopic 825-10, Financial Instruments – Overall and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities.

Banks that have elected to report financial instruments or servicing assets and liabilities at fair value on a recurring basis with changes in fair value recognized in earnings or that are required to complete Schedule RC-D, “Trading Assets and Liabilities,” must complete Schedule RC-Q, “Assets and Liabilities Measured at Fair Value on a Recurring Basis.”

Credit Union – NCUA Call Report

Upon the completion of a transfer of a participating interest that qualifies as a sale, the net gain is to be reported in the NCUA 5300 Call Report as non-interest income as instructed by the Statement of Income and Expense, page 5, item 19: “Net gains (losses) on Sales of loans and leases.” Additionally, the servicing rights asset is to be reported under Other Assets, page 2, item 22, “Intangible assets,” and can be allocated between Mortgage Servicing Assets (b.) for loans secured by real estate and Other Intangible Assets (c.) for all other loans. Because the retained portion of loans is owned by the credit union, we advise that it be reported under Total Loans & Leases, page 2, item 15, which is reported in detail on Schedule A, Section 1. Year-to-date and total outstanding number of loans and amount sold should be reported on Schedule A, Section 6 – Loans purchased and sold under 701.22 and 701.23 “Loans Sold” and should be allocated between Real Estate Loans Sold with Servicing Retained (item 6) for loans secured by real estate and “All Other Loans Sold with Servicing Retained” (item 7) for all other loans.

Amortization Method

For servicing assets and liabilities measured under the amortization method, credit unions should report servicing income net of the related servicing assets’ amortization expense, include impairments recognized on servicing assets, and also include increases in servicing liabilities recognized when subsequent events have increased the fair value of the liability above its carrying amount.

Fair Value Method

For servicing assets and liabilities remeasured at fair value under the fair value option, include changes in the fair value of these servicing assets and liabilities. Disclosure of such gains (losses) is also required by ASC Subtopic 825-10, Financial Instruments – Overall and ASC Subtopic 860-50, Transfers and Servicing – Servicing Assets and Liabilities.

Endnotes

The topics addressed above are complex and are based on general examples. Readers are strongly encouraged to review the recommendations set forth with their independent accountants and primary regulators to obtain their input and comments before implementing these procedures, because the specific facts and circumstances for a particular institution may lead to different accounting and regulatory interpretations than those described herein.