The FHLBank MPF® Program and Credit Enhancement [White Paper]

Key Takeaway

Wilary Winn provides valuations of mortgage servicing rights and mortgage banking derivatives as well as turnkey advice on how to properly account for them. We value more than 400 portfolios annually and are nationally recognized experts of the required financial accounting and regulatory reporting for the MPF® program.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Released March 2020

Introduction

This white paper is an excerpt from our Accounting and Regulatory Guidance for the MPF® program, April 2020, Version 11. It focuses on the required accounting for the credit enhancement fees as well as the credit enhancement obligation, including the effects of CECL.

To account for the MPF® program credit enhancement a PFI must differentiate the accounting for the CE Recourse Obligation amount – the maximum loss amount it could incur versus the Contingent Liability Amount – the actual losses it could likely incur. The CE Recourse Obligation amount is accounted for as a guarantee. The accounting for the Contingent Liability Amount in turn depends on whether the PFI is subject to CECL. PFIs not yet subject to CECL must account for the Contingent Liability in accordance with FAS 450-20 – Accounting for Loss Contingencies. PFIs subject to CECL must account for the CE Recourse Obligation under FAS ASC 326-20 (FAS ASC 460-10-35-5). The CE Recourse Obligation amount is within the scope of CECL because it is an off-balance sheet exposure not accounted for as insurance (FAS ASC 326-20-10-15-2c).

Following is a discussion of the accounting for CE Recourse Obligation Liability – the guarantee followed by an analysis of the Contingent Liability or Recourse Liability Amount – the potential actual losses. Our example is based on the MPF® Original product. We follow with a brief description of the accounting for the other credit enhanced MPF products.

Accounting for the Guarantee

MPF® Original

Under the MPF Original product, the first layer of losses for each Master Commitment (following any PMI coverage) is paid by FHLBank up to the amount of the FLA which accumulates monthly at the rate of 4 basis points per year against the unpaid principal balance of the loans in the Master Commitment. The PFI then provides a second loss CE Recourse Obligation for each Master Commitment. Loan losses beyond the first and second layers are absorbed by FHLBank. The member is paid a fixed CE Fee for providing the CE Recourse Obligation.

The required credit enhancement is determined by using a credit risk model’s assessment of loan, borrower, and property attributes and is calculated for each loan originated under the master commitment. Loan level credit enhancements are accumulated at the pool level to determine maximum credit risk exposure.

The present value of the CE Recourse Obligation is determined by discounting the expected losses at an appropriate discount rate. The primary valuation factors are:

• The loan amount

• The CE Recourse Obligation percentage

• The expected life of the loan

• The expected default rate

• The expected severity of actual foreclosure losses

• The level of credit risk assumed

• The discount rate used to discount the cash flows

• The net amount in the FLA

The severity of the actual losses is dependent on the amount of equity the homeowner has in the loan at the time of the default and the amount of PMI in place, if any. The actual losses flowing through to the PFI are dependent on the percentage level of credit enhancement assumed and the amount of the FLA at the time of default.

The CE Recourse Obligation is a recourse liability that arises from the sale of the loans to FHLBank. The accounting guidance for the recourse liability can be found in FAS ASC 460-10 – Guarantees. FAS ASC 460-10-25-4 requires a guarantor to “recognize at the inception of the guarantee, a liability for that guarantee.” Because the guarantee is issued as a part of a transaction with multiple elements (sale of the loan, recording of the servicing, incurring the liability), the guarantee liability at inception should be recorded at its estimated fair value and will affect the proceeds from the sale (FAS ASC 460-10-30- 2b). The paragraph goes on to state that in estimating fair value, the “guarantor should consider what premium would be required by the guarantor to issue the same guarantee in a standalone arm’s length transaction with an unrelated party as a practical expedient.”

The recognition of the CE Fee income associated with the guarantee is subject to diversity in practice. In the first case, the CE Fee Receivable and CE Obligation Liability are each set to their respective fair values. In the second case, the CE Obligation Liability is set equal to the CE Fees receivable – the practical expedient.

Accounting Practices Example Number One

In this interpretation of FAS ASC 460, the CE Recourse Obligation liability and the CE Fees Receivable are each initially recorded at their estimated fair value, and both are part of the sale proceeds. The fair value of the CE Fees Receivable increases sales proceeds, while the fair value of the CE Recourse Obligation liability reduces sales proceeds.

The value of the CE Fees receivable for the MPF Original product under this accounting practice is based on the outstanding loan amount, the CE Fee percentage, the expected loan life (based on prepayments and defaults) and the rate used to discount the future payments.

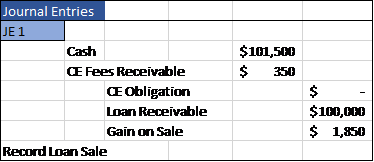

Following is an example of how to record the sale of the loan, the servicing asset at fair value, and the CE Fees receivable and CE Recourse Obligation liability at their fair values (assuming that the value of the CE Recourse Obligation liability at the time of the sale is zero). The basis of the loan is $100,000, its face amount is $100,000 and it can be sold for a price of 101.50. The fair value of the MSR is $1,000 and the estimated fair value of the CE Fees receivable is 35 basis points or $350.

The journal entries to record the sale are as follows:

Because the mortgage loans in the Master Commitment can be contractually prepaid and the Credit Enhancement fees receivable are a function of the principal amount outstanding on the mortgage loans, Wilary Winn believes the CE Fees Receivable should be subsequently measured and accounted for in accordance with the accounting for interest only strips (FAS ASC 860-320-35-2).The receivable is to be measured at its fair market value as an available-for-sale security under FAS ASC 860-20-55-33, with changes in fair value recorded to other comprehensive income.

We further note the CE Fees Receivable amortize as the cash is received.

We note that our Accounting Practices Example Number One is based on our interpretation of guidance regarding accounting for the MPF® program that the FDIC released in its Supervisory Insights News Winter 2004 – Accounting News.

We further note that the analogized interest only strip referenced above in no way affects the fact that transfers of loans to the FHLBanks under the MPF® program are true sales for accounting purposes. See page 10 of our Accounting and Regulatory Guidance for the Mortgage Partnership Finance® Program, March 2020, Version 10.

Accounting Practices Example Number Two

Under this accounting practice (the FAS 460-10 Practical Expedient), the fair value of the CE Recourse Obligation liability at inception is equal to the present value of the CE Fees expected to be received.

Following is an example of how to record the sale of the loan, the servicing asset at fair value, and the CE Fees receivable and CE Recourse Obligation liability at their fair values (assuming that the value of the CE Recourse Obligation liability at the time of the sale is equal to the value of the CE Fees receivable). The basis of the loan is $100,000, its face amount is $100,000 and it can be sold for a price of 101.50. The fair value of the MSR is $1,000 and the estimated fair value of the CE Fees receivable is 35 basis points or $350. The journal entries required to record the sale are as follows.

PFIs can subsequently account for their release from risk over the term of the guarantee using one of the following three methods:

1. Upon expiration or settlement of the CE Obligation;

2. By a systematic and rational amortization method; or

3. As the fair value of the guarantee changes.

We note that the fair value method cannot be used for the CE Recourse Obligation Liability unless it can be justified under GAAP. For example, if the guarantee is accounted for as a derivative (FAS ASC 460-10-35-2).

Wilary Winn recommends the CE Recourse Obligation Liability be amortized in proportion to and over the period of its estimated life. This method results in a “level yield” over the estimated life of the guarantee and the amortization amount would largely offset the fees received.

The reader can see that the reduction in the CE Fees receivable is reduced as cash is collected. However, because the amount recorded at inception is the present value of the CE Fees estimated to be collected, a portion of the cash received represents the value arising from discounting the receivable. The entry for the CE Recourse Obligation is similar in this respect.

We note that many organizations that believe Accounting Practices Example Number Two is the correct interpretation simply account for the CE Fees on a cash basis as received because this methodology closely matches the accounting required under the example.

Accounting for the Contingent Liability (Recourse Liability Amount)

The accounting for the Recourse Liability Amount depends on whether the PFI is subject to CECL.

PFIs Not Subject to CECL

The FDIC in its Supervisory Insights News Winter 2004 – Accounting News states that “we believe that at the inception of the guarantee, it would normally not be probable that an institution would be called on to make payments to FHLBank to cover loan losses in excess of the FLA and the amount to be recorded as a liability at inception is zero. However, for each Master Commitment, an institution should reevaluate this contingent obligation regularly in accordance with FASB Statement #5, Accounting for Contingencies (FAS ASC 450-20). If available information about the performance of these loans indicates that it is probable that the institution will have to reimburse FHLBank for losses in excess of the FLA, and the amount of the loss can be reasonably estimated, the institution must accrue the estimated loss. This loss would be charged to earnings and an offsetting liability would be recorded for the institution’s obligation to FHLBank. As payments are made to FHLBank, the liability would be reduced.”

PFIs Subject to CECL

Wilary Winn believes PFIs that are subject to the CECL standard should calculate potential credit losses using the same methodologies and models used to assess credit risk on residential real estate loans held in portfolio. We believe the CECL calculation is ideally calculated at the loan level and that the pools used to determine losses should be at the master commitment level. This will ensure that a PFI considers the benefit of the funded First Loss Account and the FHLBank covering losses in excess of the Credit Enhancement Obligation Amount.

Other Recourse Products

MPF® 125

Under the MPF 125 product, the first layer of losses for each Master Commitment (following any PMI coverage) is paid by FHLBank up to the amount of the FLA which is 100 basis points of the delivered amount. The PFI then provides a second loss credit enhancement CE Recourse Obligation for each Master Commitment. Loan losses beyond the first and second layers are absorbed by FHLBank. The PFI’s minimum CE Recourse Obligation is 25 basis points based on the amount delivered. The member is paid a performance-based CE Fee for providing the CE Recourse Obligation.

The accounting for the MPF 125 product is similar to the MPF Original product. The differences are primarily related to the underlying economics of the product. The FLA is larger, the maximum potential CE Recourse Obligation is smaller, and the amount of CE Fees to be received is generally less due to the fact that the CE Fees are performance-based.

MPF® 100

Under the MPF 100 Product losses (following any PMI coverage) is paid by FHLBank up to the amount of the FLA which is 100 basis points of the delivered amount. The member then provides a second loss CE Recourse Obligation for each Master Commitment. Loan losses beyond the first and second layers are absorbed by FHLBank. The PFI’s minimum CE Recourse Obligation is 20 basis points based on delivered amount. The PFI is paid a performance-based CE Fee for providing the CE Recourse Obligation which is guaranteed for at least two years.

The accounting for the MPF 100 product is similar to the MPF Original product. The differences are primarily related to the underlying economics of the product. The FLA is larger, the maximum potential CE Recourse Obligation is smaller, and the amount of CE Fees to be received is generally less due to the fact that the CE Fees are performance-based.

MPF® Plus

Under the MPF Plus product, the CE Recourse Obligation for the pool of loans in a Master Commitment is set so as to achieve the equivalent of a “AA” credit rating. Under this product, the PFI procures an SMI policy that insures all or a portion (at the PFI’s option) of the PFI’s CE Recourse Obligation. The FLA is initially set to be equal to the deductible on the SMI policy. Losses on the pool of loans not covered by the FLA and the SMI coverage are paid by the PFI, up to the amount of the member’s uninsured CE Recourse Obligation, if any, under the Master Commitment. The FHLBank absorbs all losses in excess of the SMI coverage and the member’s uninsured CE Recourse Obligation.

Each month, the member is paid a CE Fee for providing a CE Recourse Obligation. The fee is split into fixed and performance fees. The fixed CE Fee is paid beginning with the month after delivery and is designed to cover the cost of the SMI policy. The performance-based CE Fees, which are adjusted for loan losses, accrue and are paid monthly, commencing with the 13th month following each delivery of loans. We believe the accounting for the MPF Plus CE Recourse Obligation is the same as that for the MPF Original, MPF 125 and MPF 35 products.

MPF® 35

Under the MPF 35 product, the first layer of losses for each Master Commitment (following any PMI coverage) is paid by FHLBank up to the amount of the FLA which is a percentage of the delivered amount specified in each Master Commitment. The PFI then provides a second loss CE Recourse Obligation for each Master Commitment. Loan losses beyond the first and second layers are absorbed by FHLBank. The member is paid both a fixed and a performance-based CE Fee for providing the CE Recourse Obligation. The performance-based fee begins accruing in month 1 and is paid to the PFI commencing with the thirteenth month following the delivery of the mortgage loan. Additionally, the PFI may choose to retain the Credit Enhancement obligation or purchase and SMI policy that would reduce its exposure to losses.

The accounting for the MPF 35 product is similar to the MPF 125 products. The differences are primarily related to the underlying economics of the product. The FLA is variable, but most likely smaller, and the amount of CE Fees to be received is generally more due to the fact that the CE Fees are both fixed and performance based.