FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated Credit Quality [White Paper]

Table of Contents

Skip to table of contentsKey Takeaway

Wilary Winn provides complete ASC 310-30 accounting solutions, including scope determinations, expected cash flow estimates and the journal entries to be recorded each reporting period.

How Can We Help You?

Founded in 2003, Wilary Winn LLC and its sister company, Wilary Winn Risk Management LLC, provide independent, objective, fee-based advice to over 600 financial institutions located across the country. We provide services for CECL, ALM, Mergers & Acquisitions, Valuation of Loan Servicing and more.

Updated and Revised May 2013 – Version 2

Introduction

Accounting for purchase loans with deteriorated credit quality is relatively complex, and this paper is for those who want to better understand its requirements and applications. We address the concepts behind FAS ASC 310-30, when it should be applied, how it should be applied, and provide best practices on implementation. Loan and pool level examples, including journal entries, are included to demonstrate the effects of the accounting quarter over quarter.

Accounting for Loans with Deteriorated Credit Quality

In December 2003, the AICPA issued Statement of Position 03-3 (SOP 03-3), Accounting for Certain Loans or Debt Securities Acquired in a Transfer. (The new codification reference is FAS ASC 310-30). Due to the recent downturn in the economy, many institutions have acquired loan portfolios with deteriorated credit quality and FAS ASC 310-30 accounting has thus become more widespread. In addition to being complex, the accounting can be difficult to implement. Most accounting systems cannot handle the required calculations, and therefore, it is common to keep track of these loans outside of the core system.

FAS ASC 310-30 Determination

Let us say your institution has just purchased a pool of loans at fair value through a merger or a bulk sale and you are now wondering what type of accounting rules relate to these loans. For example, how will you accrete any purchase discount back into income or amortize any purchase premium into expense? Loans can either be accounted for under FAS ASC 310-20 Nonrefundable Fees and Other Costs or FAS ASC 310-30 Loans and Debt Securities Acquired with Deteriorated Credit Quality. The determination of whether acquired loans are to be accounted for under FAS ASC 310-30 must be made at acquisition and loans cannot transition between FAS ASC 310-30 and FAS ASC 310-20 subsequent to the acquisition date. The questions to ask are:

- Should I account for the loans based on their contractual cash flows, or

- Should I account for the loans based on their expected cash flows?

Contractual Cash Flows

If your institution expects to receive all of the contractually specified principal and interest payments from an acquired loan, then the loan should be accounted for in accordance with FAS ASC 310-20. Specifically, the purchase discount or premium (interest rate valuation allowance) should be amortized or accreted into income on a level yield over the expected life of the loan. In many cases, an institution can use the “FAS 91” field on its servicing system to calculate the monthly accretion amount.

Wilary Winn believes that the acquiring institution can account for the acquired loans with the highest credit quality (FICOs over 720, reasonable LTVs) under FAS ASC 310-20. We note that our estimated credit losses for these types of loans are generally quite nominal and that we use an adjusted market discount rate to estimate fair value. The acquiring institution first combines the interest rate valuation allowance and the relatively modest credit valuation allowance and then amortizes the total into income over the expected life of the loan.

Because there is no initial credit valuation allowance recorded under this method, the acquiring institution establishes a post-acquisition allowance for loan losses to record credit losses which subsequently arise on the acquired loans.

Expected Cash Flows

On the other hand, loans acquired with “deteriorated credit quality” must be accounted for under FAS ASC 310-30. To be accounted for under FAS ASC 310-30, the acquired loans should meet the following two requirements:

Requirement One – The deterioration in credit quality occurred subsequent to origination.

- At first glance, this determination appears simple. You can review the loan’s performance and underlying attributes to determine whether credit concerns exist. Factors to consider are the borrower’s credit score, sources and uses of cash, payment history, and debt-to-income levels. However, to qualify for accounting under FAS ASC 310-30, this deterioration in credit quality must have occurred subsequent to origination. Accordingly, a loan of lower credit quality from time of its origination may or may not fall into the FAS ASC 310-30 bucket. If the loan has continued to perform based on its contractual terms, then chances are good that deterioration in credit quality did not occur subsequent to origination.

To be eligible for FAS ASC 310-30, the credit conditions would have had to have worsened – the credit score fell, the loan to value ratio increased, etc.

Requirement Two – It is probable that the acquirer will be unable to collect all contractually required payments from the borrower.

- Wilary Winn believes that if the fair value of the loan includes a more than nominal credit valuation allowance, it is clear that the acquirer will not receive all of the contractually required payments from the borrower. We further believe that high FICO/low loan-to-value loans, or loans with low risk ratings, will generally not have a significant credit valuation allowance, would thus fail this requirement and would be accounted for under FAS ASC 310-20.

We believe loans with more than nominal credit valuation allowances clearly meet Requirement Two, but may not meet Requirement One. Fortunately, GAAP permits the acquiring institution to elect to account for the loans at the group level thus avoiding the tedious scope determination required under Requirement One1.

Wilary Winn thus recommends that the acquiring institution make two accounting decision for loans which have more than nominal credit valuation allowances.

- Elect to account for loans that are relatively homogenous (residential first lien, used auto, etc.) at the group level in accordance with FAS ASC 310-30.

- Make the FAS ASC 310-30 determination for commercial loans at the loan level and account for them going forward at the loan level.

We note that GAAP does not allow loans with revolving terms to be accounted for under FAS ASC 310-30 because of the uncertainty of future advances and repayments2. (Loans that have their borrowing privileges eliminated prior to the acquisition date can be included). In our experience, the acquiring institution amortizes the discount rate valuation allowance and the credit valuation allowance of the revolving loans over the remaining term of the loan as of the acquisition date on a straight-line basis. If it becomes apparent over time that the present value of the cash flows are less than the book value of the loan, then the acquiring institution should increase its allowance for loan losses by the amount of the shortfall.

FAS ASC 310-30 Implementation

A loan accounted for under FAS ASC 310-30 is initially recorded at its purchase price (fair value). The amount of expected cash flows that exceed the initial investment in the loan represent the “Accretable Yield,” which is recognized as interest income on a level yield basis over the life of the loan. The excess of total contractual cash flows over the cash flows expected to be received at origination is deemed the “Nonaccretable Difference”. For a complete set of defined terms, refer to the end of the post.

In order to simplify accounting for FAS ASC 310-30 loans, we recommend that an institution record the loan at its principal balance at acquisition and record a corresponding loan “Contra Account” to write down the loan’s balance to its fair value. The institution must then periodically adjust (roll forward) the value of the loan contra account in order to account for interest payments received and the amount of accretion income recognized. Interest received decreases the overall loan carrying value by increasing the contra account. The amount of computed accretable interest income increases the overall loan carrying value by decreasing the contra account. It is important to point out here that the interest collected from the borrower recorded as interest income on the core system must be manually reversed. The only interest income that should be recorded on the loans that fall under FAS ASC 310-30 is the accretable income.

We note that not only is it important to estimate the amount of the future cash flows, it is also important to estimate the timing of the future cash flows. Changes to the actual or expected timing of cash flows can have a material impact on the amount and timing of accretable yield recognized as income. We provide examples of both situations later in this paper.

The required FAS ASC 310-30 accounting has additional complexities.

Nonaccrual

If the timing and amount of future cash flows cannot be reasonably projected, then FAS ASC 310-30 allows for the loan to be placed into a nonaccrual status and the loan can be accounted for under the cost-recovery method. Under this methodology, no accretion income is recognized, and income is only recognized after the carrying amount of the loan has been recovered.

Additional Requirements Related to Pools of Loans

Wilary Winn also notes that loans which are included in a pool of loans under FAS ASC 310-30 cannot be reported in nonaccrual status individually. Instead, these loans must be reported as delinquent in accordance with their contractual terms. When accrual of income on a pool of loans is no longer appropriate due to the institution’s inability to estimate future cash flows, then the entire pool must be placed in nonaccrual status.

As noted earlier, Wilary Winn recommends that acquired loans with deteriorated credit quality which have common risk characteristics be pooled and accounted for at the group level. We note that once a pool of loans is established under FAS ASC 310-30, its integrity should be maintained throughout its life. Loans should not be added to the pool, nor removed absent events such as payoffs, foreclosures, write-offs, or sales of the loans. Furthermore, ASU 2010-18 states that troubled debt restructuring accounting should not be applied to a loan included in pool of loans under FAS ASC 310-30.

When removing a loan from a pool, its relative carrying value should be determined. The accretable yield percentage should not change as a result of the removal. We thus recommend solving for the “correct” carrying amount in order to keep the pool accretion rate the same after removal of the loan. Any gain or loss would be recognized as the difference between the “correct” carrying amount of the loan and the fair value of the collateral received.

Cash Flow Calculation Subtlety

If loans are pooled for accounting purposes, the future cash flows can be calculated at the group level based on weighted average terms or the cash flows can be calculated at the loan level and then aggregated for the pool accounting. We recommend that future cash flows be calculated based on weighted averages only when the underlying loans have very similar terms and payment structures, such as for a group of auto loans. For loans within a pool that have varying lives and payments, such as residential mortgages, we recommend projecting the cash flow for each loan and then aggregating those cash flows into one pooled asset. This way the overall life of the pooled loans will still reflect the characteristics of the underlying loans, and the time period for the accretion will be correct.

Ongoing Accounting

The acquiring institution must periodically compare the actual cash flows received to the previously expected cash flows. In addition, it must re-estimate the remaining cash flows expected to be collected. If the new total expected cash flows exceed the previous estimate, then the acquiring institution should increase the rate of accretion. In essence, the fair value of the loan has increased, but the increase can only be recognized prospectively through an increased yield. If the expected cash flows have decreased, then the acquiring institution should record an allowance for loan losses.

We have prepared the following loan examples to illustrate the Day 1 and ongoing accounting. We begin with Day 1 in order to compare the expected cash flows to the contractual cash flows, and the principal balance of the loans to fair value. The Day 1 valuation summary is attached as Appendix A.

To calculate the expected cash flows, we being with a loan’s scheduled contractual payments. We reduce the contractual payments based on expected prepayments and credit losses. We use CRR (Conditional Repayment Rate) to estimate an annual percentage of expected prepayments. Our initial overall CRR for the loans in our example is 3.5%. We forecast credit losses by estimating the annual rate of default CDR (Conditional Default Rate) and the amount of the loss to be incurred on a default (Loss Severity). We are forecasting $957,100 of principal losses over the life of the loans. In summary, we expect to collect $4,889,305 of the $6,367,359 of total contractual cash flow.

To determine the loan’s initial fair value, we discount the expected cash flows at market adjusted interest rate which, in our example, is equal to 13.5% overall. The present value of the expected cash flows discounted using our 13.5% discount rate equals the fair value of $3,413,210. The amount of income we need to accrete is equal to $1,476,095 (the difference between the total cash flows expected to be collected of $4,889,305 and the carrying value of $3,413,210).

Our Day 1 example shows a principal balance of $5,000,000 and a fair value of $3,413,210. The institution records $5,000,000 of loans receivable and an overall contra account of $1,586,790. As a result, the carrying value equals the fair value.

Appendix B shows a summary of the accounting at the initial valuation and the two quarters thereafter. In Appendices C – F, we show the detailed results if the election is made at the loan level or if the election is made at the pool level. Both examples show the same 19 loans over three time periods: Day 1, Quarter 1, and Quarter 2. We begin with a loan level example because we believe the results are easier to understand.

Quarter 1 Example – Loan Level

(Appendices C-I through C-IV)

The summaries begin with the Day 1 balances we discussed above. We start with the beginning contra account balance of $1,586,790. We increase it by the $63,112 of interest collected during the quarter thus decreasing the carrying amount. We decrease the contra account by the accretion income for the quarter of $115,292, thus increasing the carrying value. We also need to adjust the contra account for loans that paid off or were charged off during the quarter. We did not have any payoffs or charge offs in our Quarter 1 example. Thus, the resulting ending balance of the contra account equals $1,534,611.

Our ending carrying amount is equal to the beginning principal balance of $5,000,000 reduced by the $45,878 of principal received less the new contra account balance of $1,534,611. The ending carrying amount balance is $3,419,512.

Loan-by-loan details are presented in Appendix C-I.

To re-estimate the expected cash flows, we must redo our analysis using updated CRR, CDR and loss given default severity assumptions. In our Quarter 1 example, we have kept the expected lifetime losses and expected probability of prepayment the same as in the Day 1 valuation. The only thing that is different between the two valuations is that the loans have aged 3 months. A comparison of our assumptions at the end of the first quarter compared to the initial valuation is attached as Appendix C-II. Please note that to maintain the overall loss rates, we had to slightly revise our CDR assumptions. In addition, we have disclosed remaining term in months (WAM), the remaining amortization term, the coupon rate (WAC), and the accretion rate used during the quarter.

Appendix C-III shows the result of discounting the re-estimated cash flows at the rate of interest used to accrete income for the quarter – 13.5%. The present value of the new cash flows discounted at the rate of 13.5% is $3,397,266. Since this amount is less than the carrying amount of $3,419,512, we need to record a loan loss reserve of $22,951 to reflect the shortfall.

Many of the loans show a present value less than the carrying value. How did the shortfalls arise when our lifetime loss estimates and discount rates have not changed? What else could cause the decreases in present value?

In general, we know that one or a combination of the following could cause the shortfall.

- We expect to receive less cash flow going forward, either due to increased defaults, increased loss severity or increased prepayments (which we know is not the case for this quarter).

- The actual cash flows were less than the cash flows projected for the quarter.

- We expect not receive cash flows as soon as we originally projected.

Appendix C-IV compares the actual cash flows for the quarter compared to the cash flows expected at the initial valuation. As you can see in column 18, we collected $61,998 less in cash flow than we originally projected. You can also see the actual payments (scheduled loan principal and interest) are similar to the amounts originally forecast for most of the loans. However, we did not receive any payments on loans 9, 18, and 19. The variances are shown in columns 14 and 17. In addition, you can see that we projected $43,804 (col 10) in prepayments for the quarter, whereas no loan actually paid off. Thus, while our loss estimates did not change, the timing of the cash flow slowed and we accreted too much income. We need to record a loan loss reserve on these loans to reflect the shortfall.

The final question is why do some loans require a reserve, but not others? It depends on the amount of cash flows collected and the amount of accretion income recognized. For the loans that required an additional loan loss reserve, the amount of accretion income recognized was, in most cases, greater than the amount of cash flows collected. By way of contrast, loans 6 through 8, and 17 did not require a reserve because the accretion income recognized was less than the amount of cash flows collected.

Finally, we note that in some cases the loan’s present value exceeds the carrying value. This means that the cash flows have improved and we need to consider increasing the rate of accretion.

Quarter 1 Example – Pool Level

(Appendices D-I through D-IV)

We now present the same loans in another example, based on the same input assumptions, except this time we have now grouped the loans by product type. Because the loans are grouped, the initial accretion rate is now calculated based on the Internal Rate of Return (IRR) of the combined cash flows for each group. This results in a slightly different accretion rate than calculating at the loan level and is also slightly different than just the weighted average accretion rate for of all the loans within a group. Overall, we accreted $111,547 of interest income at the pool level compared to $115,292 at the loan level as summarized on Appendix B. Loan level details are shown on Appendix D-I.

All of our input assumptions remain the same as in the loan level example, but we are accreting at an overall rate of 13.1% at the pool level versus 13.5% at the loan level. The lower accretion rate results in a lower required reserve – $20,168 in this case versus $22,951 in our loan level example. See Appendix D-III for more detail.

Quarter 2 Example – Loan Level

(Appendices E-I through E-IV)

We now present activity for the same group of loans for the next quarter. In our Quarter 2 examples, we have changed assumptions and/or actual activity on four loans:

A) Loan #2 – loan pays off early with no loss of principal

B) Loan #9 – forecasted principal loss decreases

C) Loan #12 – loan term is extended

D) Loan #19 – loan is charged off with greater than expected loss

Loan pays off early with no loss

A) Loan #2 paid off in full and no future cash flows are expected. We thus reduce the principal balance of the loan of $99,640 (Appendix E-IV, col 5) and the balance in the contra account of $26,848 (Appendix E-I, col 6) to zero. The offset to the contra account entry is interest income. We also need to release the additional loan loss reserve of $1,044 that we recorded in Quarter 1. To do this, we debit the loss reserve and credit non-interest income (Appendix E-I, col 20). The effect of these adjustments is to reduce the carrying amount to zero. The $27,892 increase in interest income is a result of not incurring the $7,900 loss we forecast, combined with the fact we received the cash flows sooner than we expected.

Forecasted loss decreases

B) On Loan #9, we obtained a new collateral valuation and we determine we can reduce the expected credit mark by $20,000 (Appendix E-II, col 3). Because we still believe the loan has the same chance of default, we reduce the expected credit mark by changing the loss severity percentage (Appendix E-II, col 8). The new assumption drives out higher expected gross future cash flows. As a result, the new present value of $149,183 (Appendix E-I, col 17) is higher than the ending carrying amount of $138,770 (Appendix E-I, col 16) by $10,423. Our first step is to reverse the additional loan loss reserve of $5,980 (Appendix E-I, col 19) that we recorded in Quarter 1 (Appendix E-I, col 23). We are still left with the new present value of the cash flows exceeding the carrying amount by $4,434. Compare the $149,183 (Appendix E-I, col 17) to the net carrying value of $144,749 (Appendix E-I, col 25). In order to bring the carrying amount up to the new present value, we need to accrete additional income. Thus, we increase the accretion rate from 18.0% to 25.0% (Appendix E-II, col 26). This is the rate that will accrete the extra $4,434 back into income over the remaining life of the loan. We note that the rate is relatively high because we expect the loan to have a relatively short average life of 1.1 years. See Appendix E-III.

Loan extended and expected cash flows to be received later than forecast

C) In this example, Loan #12 is reaching the end of its schedule term, and the financial institution elects to extend the loan to 10 years. Prior to the extension, the loan was scheduled to end in 67 months. The loan was originally valued using a discount rate of 12.5%. Based on the actual expected cash flows, we increased the accretion rate to 13.1% at the end of Quarter 1 (Appendix E-II, col 25). The loan has been extended 53 months (Appendix E-II, col 18) and despite the fact that the total amount of cash flows have increased, the present value has decreased. This is because the loan’s interest rate of 5.5% (Appendix E-II, col 23) is less than the present value discount rate of 13.1%. This differential results in a new fair value of $209,818 (Appendix E-I, col 17). The new fair value is less than the carrying value by $27,701 and we must record a loan loss reserve for the shortfall (Appendix E-I, col 23). The loan loss reserve has the effect of lowering the overall carrying value so the loan can continue to earn accretion income at 13.1% over its new expected life.

Wilary Winn highly recommends that financial institutions consider the possibility of extensions when determining the loan’s initial fair value. As you can see, extending a loan, a common loan management practice, can result in a negative effect on the income statement under FAS ASC 310-30.

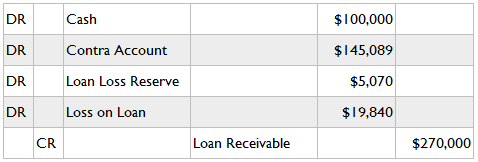

Loss is charged off with higher loss than expected

D) Loan #19 was liquidated and the loss was more than expected. The loan balance was $270,000 and we received $100,000 in principal (Appendix E-IV, col 6). The actual loss is $170,000, whereas we forecast a total loss of $133,800 (Appendix E-II, col 1). The beginning contra account was $150,324 (Appendix E-I, col 1) at the start of the period. We accreted $5,235 (Appendix E-I, col 2) during the period, no interest was collected (Appendix E-I, col 3), and the ending contra balance totaled $145,089. We charge the full amount of the $170,000 to the contra account balance of $145,089, leaving an additional $24,911 of loss. Next, we reduce any loan loss allowance established in prior periods. In this case, we established $5,070 in Quarter 1. After reducing the contra and loan loss accounts to zero (Appendix E-I, col 16), we are left with a remaining $19,840 loss (Appendix E-I, col 15) which runs through the income statement.

The journal entry below reflects all of this activity:

Quarter 2 Example – Pool Level

(Appendices F-I through F-IV)

We again present the results for the four loans listed above, but shows the results when the loans are accounted for at the pool level.

Loan pays off early with no loss

A) Loan #2 paid off in full. As in the loan-level example, the remaining amount in the contra account needs is released by debiting the contra account and crediting interest income (Appendix F-I, col 6). The additional loan loss reserve recorded in Quarter 1 also needs to be released and we accomplish this by debiting the loss reserve and crediting non-interest income (Appendix F-I, col 20).

The difference between the loan level and pool level example is the calculation of the amount to release from each of these accounts. We must calculate the amount to remove from the pool in order for the pool to continue to have an IRR equal to the current accretion rate which is 14.5% is this example. The carrying amount for this loan is $70,823 (Appendix F-I, col 10). The amount of the reserve that we reverse is based on the carrying value of the loan removed to the carrying value of the entire pool before the loan is removed ($70,823 / $320,031 = 22.13%). Applying the 22.13% to the overall reserve for the pool of $3,126 results in an amount of $692. To determine the contra account to be removed for this loan, we take the outstanding principal balance at payoff of $99,640, subtract the carrying value of $70,823, and back off a loan loss reserve of $692. The remainder is $23,894 and we reverse this amount out of the contra account (Appendix F-I, col 6). The new total carrying amount of $245,077 (Appendix F-I, col 16) is allocated out to the remaining three loans in the pool based on their initial fair value percentages.

The overall result of the pool level accounting is that we recorded $24,586 of interest income ($23,894 plus $692) versus $27,892 in our loan level example. This difference allows us to maintain our accretion rate for the pool at 14.5% despite the fact that a loan with an accretion rate of 15.0% paid off early.

Forecasted loss decreases

B) On Loan #9, we obtain a new collateral valuation and we determine we can reduce the expected credit mark by $20,000 (Appendix F-II, cols 1-3). Similar to the loan level example, the new fair value for the group of $224,285 (Appendix F-I, col 17) is higher than the carrying value of $211,934 (Appendix F-I, col 16). Thus, we reverse the full loan loss reserve of $4,705 (Appendix F-I, col 19) for the pool directly into income (Appendix F-I, col 23). We also increase the accretion rate on the pool from 13.8% to 15.9% (Appendix F-II, cols 25-27).

In summary, the differences that arise from the pool accounting method versus loan level are that the amount of loan loss reversal is less ($4,705 compared to $5,980) and we increase the accretion rate for the pool to 15.9% compared to the 25.0% for the individual loan.

Loan extended and expected cash flows to be received later than forecast

C) Loan #12 is reaching the end of its schedule term, and the financial institution elects to extend the loan to 10 years. Prior to the extension, the loan was scheduled to end in 67 months. The result is a lower new fair value for the pool of $373,607, and when compared to the carrying value of the pool, an additional reserve of $23,169 (Appendix F-I, col 23) must be recorded.

The pool level accounting results in a lower reserve of $23,169 versus $27,701 under the loan method because the accretion rate on the pool is 12.4% compared with 13.1% for the loan itself.

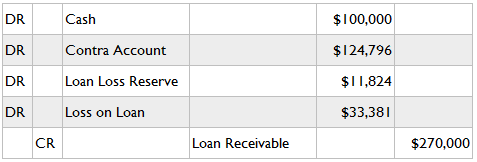

Loss is charged off with higher loss than expected

D) Loan #19 was liquidated and the loss was more than expected. The expected loss was $133,800 while the actual loss was $170,000. As in the loan level example, the contra account and loan loss reserve need to be reversed. Similar to the prepayment example for loan #2, the loan is removed from the pool based on the amount required to keep the accretion rate the same. The amount of contra account that needs to be reversed is $124,796 (Appendix F-I, col 5). The result is that we will record a higher loss at the pool level $33,381 than the $19,480 we recorded at the loan level. Partially offsetting this higher loss is that we can use the full loan loss reserve for the pool of $11,824 (Appendix F-I, col 21) compared with the $5,070 we had available at the loan level.

Below is the journal entry:

Under the pooling method, we remove a higher net carrying value ($133,380 versus $119,840) and record a higher loss ($33,381 versus $19,840) than under the loan method.

Because we removed a net carrying value for the loan under the pooling method our net carrying for the entire remaining pool of $2,331,578 is slightly less when compared with $2,352,063 at the loan level. We, therefore, still have more cushion to absorb future loan losses while maintaining the pool accretion rate of 13.0%.

Conclusion

Accounting for loans under FAS ASC 310-30 can be quite complex. In addition to the initial fair value determination, the loans must be reviewed periodically to account for the differences between actual cash flows versus the cash flows previously forecasted. The remaining expected cash flows must also be reforecast. Most core accounting systems cannot handle the required accounting for FAS ASC 310-30 and most calculations are therefore performed off-line. Any interest income recorded through the core system must be reserved and the calculated accretion income booked through a manual entry.

Fortunately, not all loans acquired in a purchase must be accounted for under FAS ASC 310-30. Acquirers should review all purchased loans to determine which loans are in scope of the accounting guidance. In addition, accounting for relatively homogenous loans at the group level can simplify the required accounting.

Both the timing and the amount of future cash flows can have significant effects on the fair value of the loans, and any changes to the initial valuation assumptions will have an effect on the income statement. If the expected cash flows improve, the positive impact is recognized over the life of the loan through an increase in the accretion rate. However, if the expected cash flows worsen, the negative effect is recognized immediately through booking a loan loss reserve.

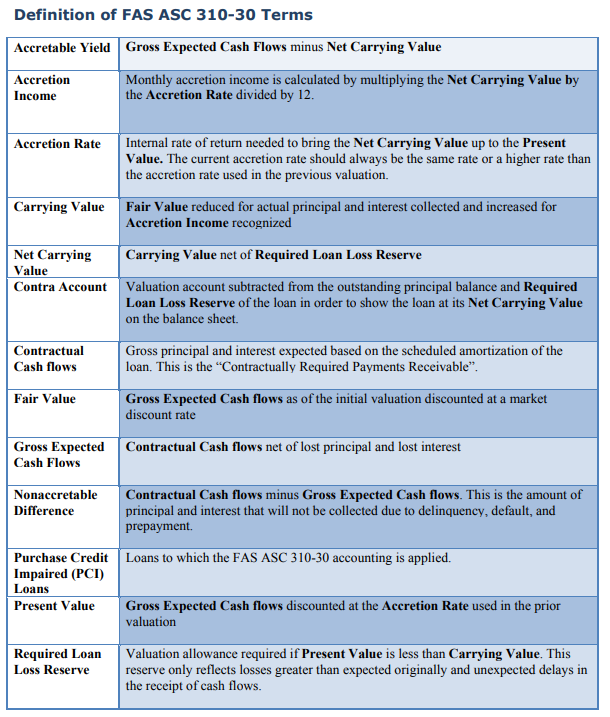

Definition of FAS ASC 310-30 Terms